San Francisco Asks CPUC To Determine Value Of PG&E’s Local Electric Assets

July 28, 2021

by Paul Ciampoli

APPA News Director

July 28, 2021

The City and County of San Francisco on July 27 submitted a petition with the California Public Utilities Commission (CPUC) seeking a formal determination of the value of investor-owned Pacific Gas & Electric’s local electric infrastructure, the next step in San Francisco’s efforts to acquire the utility’s city-based electric facilities and complete the city’s transition to public power.

“Owning the grid would allow San Francisco to provide clean, reliable and affordable electricity throughout the City while also taking meaningful climate action, like reaching its set target of using 100% renewable electricity by 2025,” the Office of San Francisco Mayor London Breed noted in a news release.

The move comes after the city made a $2.5 billion offer in 2019 to purchase PG&E’s local electric assets. San Francisco resubmitted its offer when PG&E emerged from bankruptcy in 2020. PG&E rejected both San Francisco purchase offers.

“San Francisco is ready to transition to full public power, and today we are asking the CPUC to determine a fair price that will allow us to move forward with the acquisition of our local power grid,” said Breed in a statement. “It’s been clear for a long time that full public power is the right choice for our city and our residents, and we know we can do this job more safely, more reliably, and more cost effectively than PG&E. It’s time for everyone in the city to have access to clean, reliable, affordable public power.”

“Generally, electric service provided by publicly-owned utilities is more affordable than service from investor-owned utilities,” the petition noted. “This is due to factors such as the absence of large executive bonuses, shareholders, and taxes.”

Transitioning to public power has public support. A 2019 poll found that nearly 70% of San Franciscans support switching to public power.

In the valuation petition filed by City Attorney Dennis Herrera, the city asks the CPUC to determine the just compensation to be paid for PG&E’s electricity distribution assets that serve San Francisco. State law gives the CPUC the authority to set definitive valuations for utility assets. San Francisco’s petition also proposes a process for the Commission to assess the value of PG&E’s electric facilities.

Breed’s office noted that San Francisco has demonstrated its effectiveness as a local power provider for more than 100 years, delivering hydropower from Hetch Hetchy Power to customers like the San Francisco International Airport, the San Francisco Zoo, and Zuckerberg San Francisco General Hospital. The San Francisco Public Utilities Commission’s (SFPUC) CleanPowerSF program also purchases renewable power for over 370,000 homes and businesses. Collectively, the two programs provide more than 70% of the electricity consumed in San Francisco.

San Francisco has also set a goal of shifting to 100% renewable electricity by 2025 and 100% renewable energy by 2040, a target that will be easier to achieve if San Francisco had local control of its power grid.

San Francisco would use bonds secured by future revenues from electricity generation to acquire PG&E’s infrastructure, so no funds for existing city services, like affordable housing, libraries or addressing homelessness, would be affected.

In the valuation request, San Francisco said that PG&E’s “ongoing problems with providing safe and reliable gas and electric service throughout its service territory are well-known.” The city noted that the CPUC has acknowledged that PG&E’s recent history of safety performance “has ranged from dismal to abysmal.”

While San Francisco has not experienced the devastation associated with catastrophic wildfires and other disasters caused by PG&E, “over the years PG&E’s difficulty in maintaining a safe and reliable system has caused multiple incidents resulting in injuries and property damage within the city,” the petition said.

“PG&E customers in San Francisco, like PG&E’s other customers, have also paid substantial costs resulting from PG&E’s physical and financial disasters, including two bankruptcies in as many decades,” the city said.

The city also said that while San Francisco’s acquisition of PG&E assets in San Francisco would benefit the city and its residents, such an acquisition would not materially burden PG&E’s remaining ratepayers and could potentially benefit them as well.

The petition pointed out that San Francisco is a small part of PG&E’s large service territory and PG&E’s revenues per San Francisco customer are smaller than its revenues per PG&E customer outside the city. “The size of PG&E’s remaining service territory would be reduced along with its service obligations. This alone could benefit remaining ratepayers as PG&E would no longer have any expenses or service obligations related to the upkeep — and future capital needs — of the assets purchased by San Francisco.”

Acquisition of PG&E’s property serving San Francisco will provide numerous benefits, the petition said, including enabling the city to provide affordable, safe, and reliable service, and take meaningful environmental and climate action; and improve its programs to ensure workforce development and equity.

“Electric service provided by the city would also be more transparent and accountable to customers,” the city said, noting that bi-weekly meetings of the SFPUC are open to the public.

In addition, rate setting decisions are governed by the city’s charter, which requires independent review, and are subject to rejection by the Board of Supervisors. And SFPUC Commissioners are appointed by the mayor, subject to approval by the Board. “Ultimately, the mayor and board are directly accountable to the voters.”

The petition said that the city developed the two formal offers to PG&E to purchase the assets the city would need to serve San Francisco customers with the advice of experts using standard methods of asset valuation.

“In its responses, PG&E claimed that the city’s offer price was far below the value of the assets. The city seeks to fix the value of the targeted assets using the Commission’s unique expertise under authority granted to the Commission by state law. The city hopes that establishing a definitive value will facilitate negotiation of an acquisition transaction with PG&E.”

Reading Municipal Light Department Awarded Public Access Charging Grant

July 27, 2021

by Paul Ciampoli

APPA News Director

July 27, 2021

The Reading Municipal Light Department (RMLD) has been awarded a Massachusetts Electric Vehicle Incentive Program (MassEVIP) public access charging grant to support the installation of five dual-port level 2 electric vehicle (EV) charging stations in its service territory.

Level 2 EV charging stations provide a charging rate of approximately 10-25 miles of range per hour of charge depending upon vehicle model. Three of the stations will be located in Reading and two of the stations will be located in Wilmington, Mass.

The MassEVIP grant award is just the first of many steps in the process of installing the public charging stations. The RMLD is working with the towns to finalize placement and design, develop a plan for construction, and refine the associated operating policies.

This initial grant totaled just under $80,000.

The MassEVIP public access charging program provides incentive funding to cover a portion of the cost of electric vehicle charging stations that are accessible to the general public. The RMLD will contribute funding and operational support to the installations.

Increasing the adoption of electric vehicles is an important component in RMLD’s ongoing electrification efforts, as well as decarbonization efforts across Massachusetts, the public power utility noted. Increasing the availability of public charging infrastructure will support these efforts.

Updates will be provided as the installations progress.

To learn more about electric vehicles and RMLD’s related rebate programs, visit https://www.rmld.com/electric-vehicle-rebate-programs.

Established in 1894, RMLD serves over 70,000 residents in the towns of Reading, North Reading, Wilmington, and Lynnfield Center. RMLD has over 29,000 meter connections within its service territory. Residential customers account for approximately one-third of RMLD’s electricity sales while commercial, industrial, and municipal customers account for about two-thirds of sales. There are over 3,000 commercial and/or industrial customers in the communities RMLD serves.

The American Public Power Association’s Public Power EV Activities Tracker summarizes key efforts undertaken by members — including incentives, electric vehicle deployment, charging infrastructure investments, rate design, pilot programs, and more. Click here for additional details.

Growth of solar-plus-storage not fully explained by economics: Berkeley Lab report

July 27, 2021

by Peter Maloney

APPA News

July 27, 2021

The pairing of photovoltaic (PV) solar power with battery storage is growing but represents a small portion of the market and cannot be fully explained by economics, according to a new report from the Lawrence Berkeley National Laboratory (LBNL).

The report, Behind-the-Meter Solar+Storage: Market Data and Trends, found that out of the 3,200 megawatts (MW) of battery storage installed in the United States through 2020 about 1,000 MW, or 30 percent, was behind-the-meter and 550 MW of that was paired with solar power. The overwhelming majority, 80 percent, of the combined solar and storage installations were in the residential sector.

Most non-residential energy storage installations were done on a stand alone basis with only about 40 percent paired with solar power. In the utility scale, front-of-the-meter market segment, only 420 MW, or 19 percent, of storage capacity was paired with solar power.

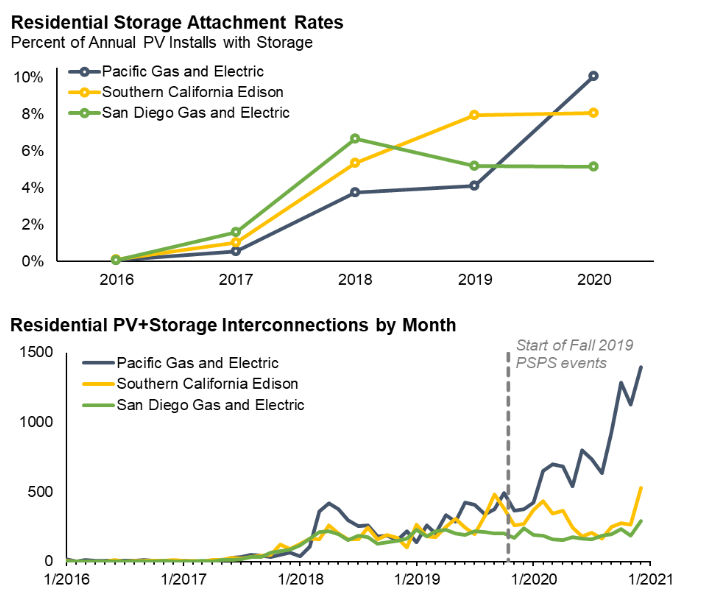

Of all the residential photovoltaic solar systems installed in 2020, about 6 percent included storage and only 2 percent of non-residential solar systems included storage, but there were wide variations in the numbers depending on location, the report found.

Hawaii has, by far, the highest storage attachment rates of any state with 80 percent of residential and 40 percent of non-residential solar systems including storage in 2020. That market, the report says, is driven by net metering reforms that incentivize self-consumption instead of utility payments for excess solar generation.

California was a distant second with 8 percent of residential and 2 percent of non-residential solar systems attaching storage in 2020, driven mostly by incentives and wildfire resilience issues, the report found.

While attachment rates are generally lower outside of California and Hawaii, some utilities, such as Salt River Project in Arizona and Puget Sound Energy in Washington, have attachment rates in the 10 to 20 percent range. In general, however, the report found that residential attachment rates have been rising while non-residential trends are uneven, but in aggregate have been “fairly flat.”

The report also found that residential adopters of solar-plus-storage systems generally have higher incomes than stand-alone PV solar adopters. In California, for instance, solar-plus-storage adopters had median incomes 66 percent higher than their area median income, while stand-alone solar adopter incomes were 41 percent higher.

Within the non-residential sector, for-profit commercial entities comprise about 70 percent of all paired non-residential systems. Schools make up a notably larger share, 25 percent, of paired solar-plus-storage systems than they do for stand-alone solar systems (8%), reflecting “a unique resilience value and relatively large loads,” the report said.

The report also used three different data sources to look at the cost of adding storage to a solar installation and found an incremental cost of adding storage to a residential PV solar system to be about $1,000 per kilowatt hour (kWh) of storage, implying an installed price premium of about $1.20 per watt of solar PV.

In addition to finding that the deployment of solar-plus-storage is locationally specific and driven by rate structures, incentive programs, and natural disaster threats, the report concluded that installed prices for behind-the-meter battery systems have generally risen or remained flat over the past few years. Increasing adoption of battery storage systems cannot, therefore, be attributed to falling retail costs alone, the authors said.

“Deployment trends partly reflect the underlying economics, but there are also some apparent disconnects,” The report’s authors said. Among the disconnects, they noted lower attachment rates in the non-residential sector than in the residential sector, divergent attachment rates across regions with similar payback, and uneconomic adoption in some markets. “Those apparent disconnects may partly reflect other sources of value beyond the direct financial benefits—including potential customer reliability benefits from backup power during outages,” the authors concluded.

Power Sector Carbon Dioxide Emissions Fell 10 Percent Between 2019 And 2020: Report

July 27, 2021

by Peter Maloney

APPA News

July 27, 2021

Power sector carbon carbon dioxide (CO2) emissions fell 10 percent between 2019 and 2020, according to a recently issued report.

The report, Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States, was written by M. J. Bradley & Associates, and issued by Ceres, Bank of America, Entergy, Exelon, and the Natural Resources Defense Council (NRDC).

The CO2 emissions decline documented in the report is the largest year-over-year decrease since the report was first released in 1997.

The benchmarking analysis examines and compares key air pollutant emissions from the 100 largest U.S. power producers, including nitrogen oxides (NOx), sulfur dioxide (SO2), CO2, and mercury. The U.S.’ 100 largest power producers accounted for more than 80 percent of the sector’s total generation in 2020. The analysis uses publicly reported generation and emissions data from the Energy Information Administration (EIA) and the Environmental Protection Agency.

The coronavirus pandemic may have been a contributing factor, but the drop in emissions is part of a long-term trend fueled by increased renewables generation and coal-to-gas transitions, according to the Ceres report.

“Industry-wide, the pace of decarbonization is picking up, and as renewables come online to displace fossil fuels, we have the opportunity to accelerate that trend,” Dan Bakal, senior director for electric power at Ceres, said in a statement. “The growth in renewables has allowed us to separate economic growth from emissions, and this year represents one of the most dramatic decoupling points that we have seen.”

Between 2000 and 2020, power sector CO2 emissions decreased 37 percent while gross domestic product (GDP) grew 40 percent and, over the same period, generation from non-hydro renewables more than doubled, the Ceres report noted.

The report also noted that power sector CO2 emissions in 2020 were roughly 40 percent below the industry’s 2007 peak. Power sector emissions of SO2 and NOx emissions have decreased 93 percent and 85 percent from 2000 levels, respectively, the report found. And power plant mercury emissions have decreased 92 percent since 2000.

The Ceres report also noted that the share of power produced by non-hydro renewables jumped 20 percent from 2019 levels, and the share from coal decreased by roughly 17 percent. Meanwhile, natural gas, for the fifth year in a row, was the leading source of electricity generation at 40 percent, followed by nuclear power at 20 percent. Power from non-hydro renewable sources made up 11 percent of total U.S. generation in 2020, of which 20 percent came from solar power, 76 percent from wind, and 4 percent from geothermal sources, the report said.

EIA report

Meanwhile, overall CO2 emissions from energy consumption fell to the lowest level since 1983, according to the Energy Information Administration’s (EIA) Monthly Energy Review, which surveys the consumption of primary energy sources.

The 4.6 billion metric tons (Bmt) of CO2 emitted in 2020 was an 11 percent decrease from 2019, the largest annual decrease on record, the EIA said.

In 2020, natural gas consumption accounted for 1.7 billion metric tons (Bmt) of CO2 emissions, or about 36 percent of the total, the fuel’s largest share on record, the EIA said. About 38 percent of CO2 emissions from natural gas in 2020 came from the electric power sector and 32 percent from the industrial sector, EIA said.

Coal consumption accounted for 0.9 Bmt of CO2 emissions, or about 19 percent of total 2020 CO2 emissions, which is both the lowest total amount and the lowest share since EIA began its annual data series in 1973, the agency said, adding that about 90 percent of CO2 emissions from coal in 2020 were from the electric power sector. Coal accounted for 54 percent of electric power CO2 emissions in 2020, even though the fuel accounted for 19 percent of electricity generation last year, EIA said.

“The power sector continues its march away from fossil fuels, replacing them with clean sources like wind and solar. But there is still a ways to go,” Starla Yeh, director of the policy analysis group in the climate and clean energy program at NRDC, said in a statement. “We’ll need to at least double the share of clean electricity in the generation mix by 2030 to meet the administration’s goals for the sector of 80 percent clean by 2030 and 100 percent by 2035.”

In April, President Joe Biden announced a nationwide goal of 100 percent carbon-free electricity by 2035.

Henderson, Ky., City Commission Rejects Sale of Public Power Utility To Cooperative

July 27, 2021

by Paul Ciampoli

APPA News Director

July 27, 2021

The City Commission of Henderson, Ky., recently voted to reject a proposal by Kentucky electric cooperative Big Rivers Electric Corporation to purchase Henderson Municipal Power & Light (HMP&L), the city’s public power utility.

The vote by the Henderson City Commission took place on July 13 and came after the Henderson Utility Commission in June recommended against selling HMP&L.

At the meeting, Henderson City Commissioner Austin Vowels said that “what our consultant told us was you can expect rates in Henderson to increase if you accept this offer and sell” HMP&L. He noted that Big Rivers offered its own analysis related to the cooperative’s offer.

“My fear and the reason I vote against this transaction happening is that I think it ultimately in the end leads to significant rate increases for the people of Henderson,” Vowels said.

Henderson Mayor Steve Austin said that he sees “no pressing reason for the City of Henderson to sell its municipal utility to an outside agency.”

He noted that HMP&L “offers our citizens the lowest household electric rates in the state, provides excellent service and provides steady financial support for the city.”

Big Rivers, which has made previous offers to buy HMP&L, also attempted to buy another Kentucky public power utility, Owensboro Municipal Utilities. “It is very interesting to me that the City of Owensboro turned down Big Rivers’ offer to buy its municipal utility within about 72 hours after the offer was made,” Austin said at the Commission meeting.

Austin went on to say that “municipal utilities across the state have added value to cities and customers in many, many ways.”

Among the provisions of the Big Rivers offer to buy HMP&L was a payment of $90 million to the City of Henderson.

But Henderson City Commissioner Bradley Staton noted that HMP&L has more than $30 million in its reserves and so “if Big Rivers were to purchase HMP&L they would be using that money to go toward the purchase of HMP&L. So the offer was really for a little less than $60 million, not $90 million.”

Earlier this year, Chris Heimgartner, General Manager of HMP&L, made a presentation before a joint meeting of the City of Henderson, Kentucky Board of Commissions and the Utility Commission regarding Big Rivers Electric’s offer to purchase HMP&L.

Among other things, Heimgartner said in the presentation that the Big Rivers offer was “a very poor proposal” for the City of Henderson and HMP&L’s customers and said it should be declined.

Meanwhile, in early June, PFM Financial Advisors made a presentation before a joint meeting of the City of Henderson, Kentucky Board of Commissions and the Utility Commission regarding Big Rivers Electric’s offer to purchase HMP&L. PFM was hired by the City of Henderson to analyze the offer made by Big Rivers.

The report completed by PFM did not make a recommendation to either sell or retain HMP&L.

In its analysis of impacts on the city as a result of a sale, PFM listed a number of qualitative considerations including, among others, reduced operational and economic synergies with the city and loss of control over an essential service and on its leadership.

Big Rivers is a member-owned, not-for-profit, generation and transmission cooperative (G&T) headquartered in Henderson, Ky., which provides wholesale electric power and services to three distribution cooperative members across 22 counties in western Kentucky.

HMP&L provides electric transmission, distribution, and fiber internet and phone services to the citizens of Henderson.

Fitch Report Shows Strong Financial Trends For Public Power Utilities

July 26, 2021

by Peter Maloney

APPA News

July 26, 2021

Public power utilities in the United States are exhibiting strong financial trends and improving credit quality, according to a new report from Fitch Ratings.

The report, 2021 U.S. Public Power Peer Review, presents a variety of metrics, such as cash on hand, leverage, and debt service coverage, to gauge the financial health of the sector and compare performance across covered utilities as a whole and by classes.

“The latest peer review shows that modest ratios of capital investment to depreciation and improving coverage medians again contributed to low leverage and improving credit quality throughout the public power sector in 2020,” Dennis Pidherny, managing director of U.S. public finance at Fitch, said in a statement.

“These results are particularly surprising given the impact of the coronavirus outbreak and the related economic contraction,” Pidherny said. “They further illustrate the sector’s operating and financial resilience, and its ability to record strong performance even through a very challenging period.”

Among the prominent trends, Pidherny noted that median ratios for coverage of full obligations improved for both wholesale and retail systems, sustaining an upward trend. Wholesale and retail, as well as combined ratios for Fitch entire portfolio of public power utilities continued a gentle upward slope, converging around 1.4 times debt obligations in the 2021 peer review.

Cash on hand medians for retail and wholesale utilities improved again, rising to the highest levels observed in a decade, according to the report. Fitch analysts attributed the build-up of excess cash to modest levels of capital investment, stronger than anticipated demand through the coronavirus pandemic, and disciplined rate setting initiatives.

The median capital expenditure-to-depreciation ratio for wholesale power systems continued a downward trend, falling to 71 percent. The median ratio has been below at or below 100 percent for five of the last seven years, according to the report. The median capex-to-depreciation ratio for retail power systems “improved” to 149 percent, a level last observed in 2010, Fitch said.

Leverage metrics for both wholesale and retail systems were largely unchanged, the report found, with a modest increase in leverage among retail power systems offset by a modest decline in metrics for wholesale systems. Overall, the metric reflects the continuation of a deleveraging trend that began over a decade ago, Fitch said.

Fitch calculated the ratios for each issuer using audited information. More than half the audits used in the report are dated Dec. 31, 2020, but different audit dates were also used and could skew the ratio distribution, Fitch noted. The rating agency also noted that the ratios and metrics in the report may occasionally differ from those reported in new issue and rating reports because of adjustments made during the rating process to reflect additional information received from the issuer.

Two California Community Choice Aggregators Contract For Renewable Energy, Energy Storage

July 23, 2021

by Paul Ciampoli

APPA News Director

July 23, 2021

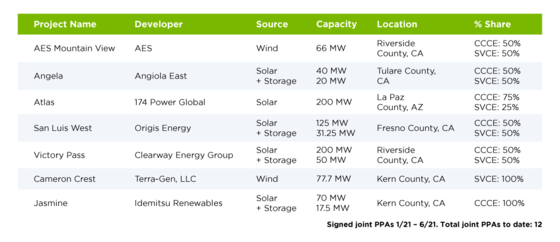

Central Coast Community Energy (CCCE) and Silicon Valley Clean Energy (SVCE) have executed seven power purchase agreements, equating to 778 megawatts (MW) of energy generation between the two community choice aggregators (CCA). The long-term contracts are a result of a request for offers (RFO) jointly issued by the CCAs in 2019 and 2020.

The joint contracts include one wind, one solar, and three solar-plus-storage projects. The solar and solar-plus-storage projects are new builds and will add new generation capacity to the California grid on behalf of the CCAs’ combined 670,000 customers.

In addition to the joint procurement effort, the two agencies signed individual contracts for two separate projects. CCCE signed a power purchase agreement with Idemitsu Renewables for 70 MW of solar and 17.5 MW of battery storage from the Jasmine project in Kern County, Calif., and SVCE signed a contract with Terra-Gen LLC. to receive 77.7 MW of wind energy from three existing wind facilities in Kern County, Calif.

The joint procurement efforts have offered multiple benefits, including shared risk mitigation and greater negotiating power resulting in cost savings that are ultimately passed onto customers. CCCE and SVCE have signed 12 power contracts together, for a total of 1,470 MW and $2.77 billion committed.

Additionally, the newly contracted solar-plus-storage projects are all new facilities and will help meet California’s recent order to build at least 11.5 gigawatts of new resources by 2026. These new resources are needed to integrate existing renewables, ensure reliability, and replace retiring capacity from the Diablo Canyon Nuclear Power Plant in California, the CCAs said.

CCCE and SVCE are also part of a joint effort to procure 500 MW of long-duration storage with seven other CCAs.

The American Public Power Association has initiated a new category of membership for community choice aggregation programs.

APPA supports FERC’s “course correction” in proposal for RTO/ISO participation incentive adders

July 23, 2021

by Paul Ciampoli

APPA News Director

July 23, 2021

The American Public Power Association (APPA) supports a Federal Energy Regulatory Commission’s supplemental notice of proposed rulemaking (NOPR) issued this spring that addresses the return on equity (ROE) incentive adder currently awarded to transmitting utilities that participate in regional transmission organizations and independent system operators, APPA said in a filing at FERC.

In the April 15, 2021 supplemental NOPR (Docket No. RM20-10), FERC proposed changes to its regulations and policies governing incentives for participation in transmission organizations under section 219 of the Federal Power Act (FPA).

APPA has long expressed concern with the Commission’s policy of granting a ROE adder to utilities merely for remaining in transmission organizations and APPA “supports the course correction” proposed in the supplemental NOPR, APPA said in June 25 comments.

In an earlier NOPR in this proceeding issued by FERC in March 2020, FERC proposed to award a 100-basis point ROE adder to transmitting and electric utilities for as long as they participate in a transmission organization, regardless of the voluntariness of such participation. APPA filed comments opposing that proposal.

Citing the comments of APPA and other parties, the supplemental NOPR would revise the March 2020 proposal by adopting a standardized 50-basis point ROE adder for participation in a transmission organization and limiting the availability of this adder to the first three years after a transmitting utility transfers operational control of its facilities to the transmission organization.

Consistent with this framework, the Commission also proposes to require transmitting utilities that have received the transmission organization incentive for three or more years to make compliance filings removing the incentive.

The supplemental NOPR also seeks comment “on whether the transmission organization incentive should be available only to transmitting utilities that join a transmission organization voluntarily,” and, if so, “how the Commission should apply that standard.”

APPA praised FERC for revisiting its regulations governing transmission organization participation incentives under FPA section 219.

The Commission’s proposal to award adders for a three-year period would prevent the transmission organization incentive from persisting as an unjust and unreasonable “bonus for good behavior,” APPA said.

“While eliminating the use of ROE adders altogether would be a reasonable policy choice, removing the adder from the rates of utilities that have been transmission organization members for more than three years will provide immediate transmission rate relief to consumers while leaving in place an incentive framework that may encourage utilities to join Transmission Organizations, consistent with FPA section 219(c),” APPA went on to say.

The use of a short-term ROE adder to encourage utilities to join transmission organizations is a straightforward mechanism that arguably helps address the transitional concerns that some utilities may have about joining a transmission organization, APPA said.

“Providing transmission rate relief from unjustified ROE adders is particularly warranted given the extraordinary increases in transmission costs for many customers in recent years,” the public power trade group said. “In considering comments on the supplemental NOPR, it is essential for the Commission to keep in mind that the increased level of transmission investment in recent years has already led to a significant rise in the transmission costs paid by customers in many regions of the country.”

Perpetuating an ROE adder for ongoing transmission organization participation “needlessly adds an additional cost burden that cannot be justified under the FPA’s just and reasonable standard,” APPA argued.

It said that the Commission’s proposal to restrict the transmission organization incentive to a three-year period is legally sound and a wise public policy choice. The Commission is justified in reconsidering its existing policy that collecting an ROE adder simply for remaining in a transmission organization comports with FPA section 219.

APPA also argued that the transmission organization incentive must be limited to utilities whose participation is voluntary. For example, utilities may be required by state law to participate in RTOs or ISOs, which negates the need for a utility to receive an incentive, according to the comments. Whether a utility’s participation in a transmission organization is voluntary should be decided on a case-by-case basis, APPA said.

“A public utility proposing to collect a transmission organization incentive should be required to identify any federal or state law, regulation, or order, or any private contractual obligation, that bears on the voluntariness of its participation in the transmission organization, and the applicant should be required to demonstrate that its participation in the transmission organization is voluntary notwithstanding any identified legal requirements compelling participation and/or limiting withdrawal,” APPA said.

San Francisco Public Utilities Commission seeks renewable energy, storage proposals

July 21, 2021

by Paul Ciampoli

APPA News Director

July 21, 2021

The San Francisco Public Utilities Commission (SFPUC) is accepting bids for renewable energy supplies and stand-alone energy storage for its CleanPowerSF program, SFPUC said on July 19.

The request for offers (RFO) seeks bids of energy, environmental attributes, capacity attributes, ancillary services and related products from new and existing eligible Renewable Energy Resources (ERRs), co-located ERR and energy storage resources and stand-alone energy storage resources.

Through the RFO, the SFPUC seeks bids for various energy supply product types.

Bids submitted for the respective product types must meet the following criteria:

- ERRs and energy storage resources must be directly connected to the California Independent System Operator Balancing Authority Area, with a preference for resources located in the nine Bay Area counties;

- For ERRs, minimum annual energy delivery of 10,000 megawatt-hours (MWh) per year and a maximum of 200,000 MWh per year;

- Energy storage resources must provide resource adequacy capacity and be at least 1 megawatt AC for at least 4-hour duration;

- Initial delivery date ranging from January 2022-December 2026;

- For ERRs and ERRs co-located with energy storage resources, terms up to 25 years; and

- For stand-alone energy storage resources, terms up to 15 years

A program of the SFPUC, CleanPowerSF is San Francisco’s Community Choice Aggregation program.

The RFO is available here.

Software Companies AutoGrid And Zūm Join To Support School Bus Electrification

July 21, 2021

by Peter Maloney

APPA News

July 21, 2021

Two software companies, AutoGrid and Zūm, have formed a partnership that aims to help electrify the nation’s fleet of school buses.

The partners plan to use AutoGrid’s virtual power plant (VPP) platform to deploy 10,000 electric school buses managed by Zūm in the next four years to create over 1 gigawatt (GW) of flexible capacity when the electricity grid is overloaded. When fully deployed, it would be one of the largest virtual power plants in the world, the companies said.

The nation’s fleet of nearly 500,000 yellow school buses is the country’s largest mass transportation system, transporting more than 27 million students every day, according to the companies.

AutoGrid provides artificial intelligence-powered flexibility management software to the energy industry. In 2018, Colorado Springs Utilities began using AutoGrid’s demand management program for its business customers. The program was designed to allow the public power utility to consolidate management of its demand response resources into a unified system. It also provided the utility the ability to automatically and remotely shift or reduce electricity use of customers participating in the program and to measure and verify energy savings.

In 2016, National Grid began using AutoGrid to unify management of its demand response and distributed energy resource programs in its service North American service territory. At the time, the utility said it expected to enroll more than 400 megawatts (MW) of demand response and distributed energy resources over three years.

Public power utilities are among the leaders in the electrification of public buses. For instance, the Sacramento Municipal Utility District (SMUD), with funding from state agencies such as the California Air Resources Board and the Sacramento Metropolitan Air Quality Management District, has been working with school districts in its territory. At the end of 2020, SMUD had 79 electric school buses in service in its territory with a goal of having 100 buses in service by year-end 2021.

“School buses have predictable daily schedules and are typically used only a few hours each day, making them an ideal resource as part of a virtual power plant,” Rahul Kar, general manager of new energy at AutoGrid, said in a statement. “Virtual power plants play a crucial role in providing stability to a renewable-powered grid and the extra revenues from these grid services enable school districts and [electric vehicle] fleet owners to reduce the total cost of ownership as they strive to meet their sustainability goals.”

Ride share company Zūm offers software that can optimize the routes and vehicles used by school districts.

Earlier this year, the Oakland Unified School District in California signed a 10-year, $100 million contract with Zūm. The contract has resulted in the number of students in the district spending one hour or more on buses getting to and from school to drop from 70% to 3% and, as a result, diesel buses spending less time on streets, Zūm said.

Zūm says it currently works with more than 4,000 schools and school districts, helping them optimize transportation routes and to determine the optimal size of vehicles to help reduce costs, maximize route coverage, and address vehicle underutilization.

Both Zūm and AutoGrid noted that the electrification of school buses could be aided by the infrastructure legislation proposed by the administration of President Joseph Biden that includes plans to electrify at least 20 percent of the nation’s yellow school bus fleet through a new Clean Buses for Kids Program at the Environmental Protection Agency.