Offshore Wind Energy $4.37 Billion Lease Sale Is Highest Grossing Offshore Sale In History

February 25, 2022

by Paul Ciampoli

APPA News Director

February 25, 2022

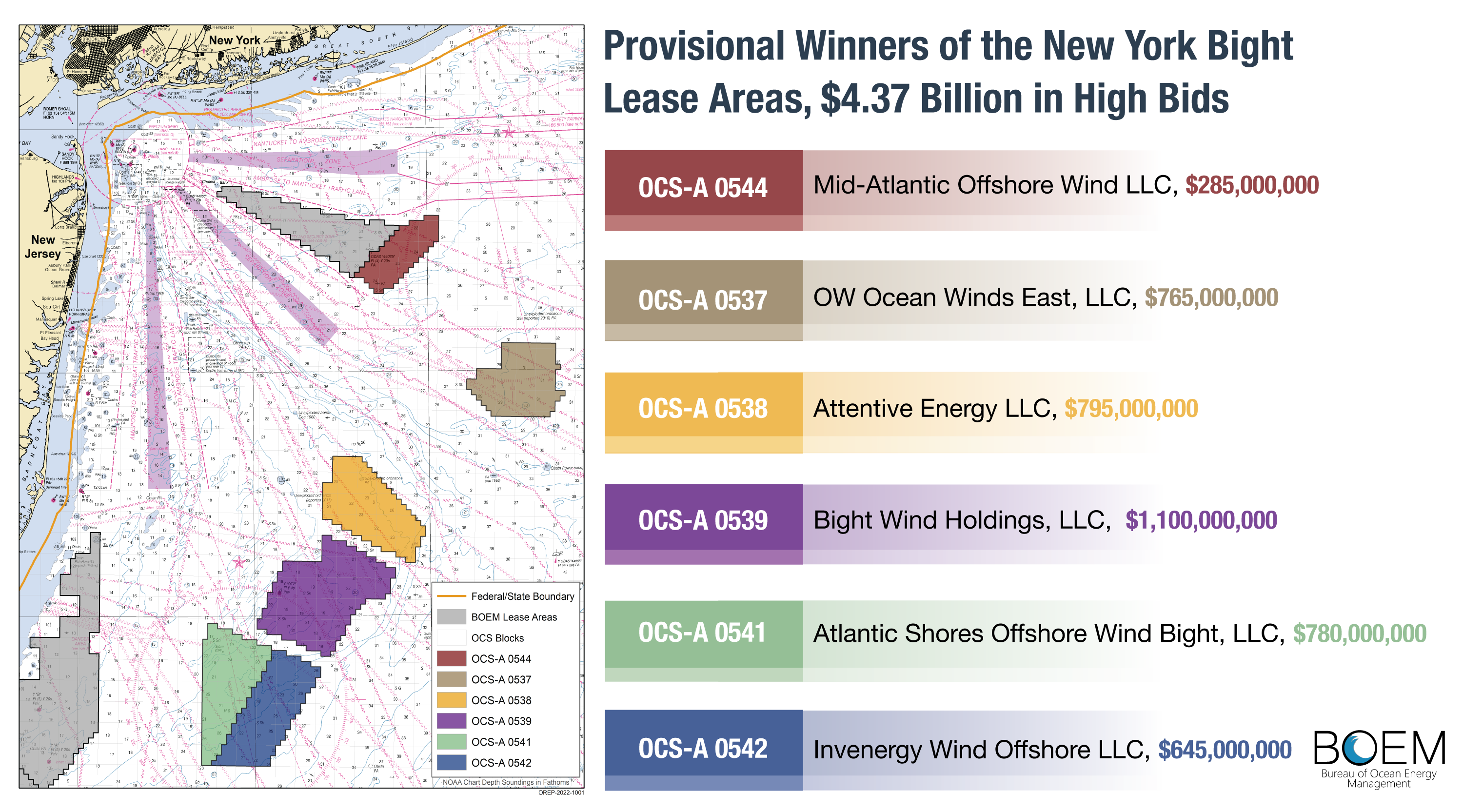

The Department of the Interior (DOI) on Feb. 24 announced the results of the nation’s highest-grossing competitive offshore energy lease sale in history, including oil and gas lease sales, with the New York Bight offshore wind sale.

“These results are a major milestone towards achieving the Biden-Harris administration’s goal of reaching 30 gigawatts of offshore wind energy by 2030,” DOI said.

The lease sale offered six lease areas totaling over 488,000 acres in the New York Bight for potential wind energy development and drew competitive winning bids from six companies totaling approximately $4.37 billion.

Before the leases are finalized, the Department of Justice and Federal Trade Commission will conduct an anti-competitiveness review of the auction, and the provisional winners will be required to pay the winning bids and provide financial assurance to Interior’s Bureau of Ocean Energy Management.

DOI said that the New York Bight offshore wind leases include innovative stipulations designed to promote the development of a robust domestic U.S. supply chain for offshore wind energy and enhance engagement with Tribes, the commercial fishing industry, other ocean users and underserved communities. The stipulations will also advance flexibility in transmission planning, it noted.

BOEM initially asked for information and nominations of commercial interest on 1.7 million acres in the New York Bight. Based on BOEM’s review of scientific data and extensive input from the commercial fishing industry, Tribes, partnering agencies, key stakeholders, and the public, BOEM reduced the acreage offered for lease by 72% to avoid conflicts with ocean users and minimize environmental impacts. BOEM will continue to engage with the public, ocean users, and key stakeholders as the process unfolds.

The Biden Administration has already approved the groundbreaking of the nation’s first two commercial-scale offshore wind projects in federal waters: the 800-megawatt Vineyard Wind project and the 130-megawatt South Fork Wind project.

BOEM expects to review at least 16 plans to construct and operate commercial offshore wind energy facilities by 2025, which would represent more than 22 gigawatts of energy.

In addition, this past fall DOI announced a new leasing path forward, which identified up to seven potential lease sales by 2025, including the New York Bight and offshore the Carolinas and California later this year, to be followed by lease sales for the Central Atlantic, Gulf of Maine, the Gulf of Mexico, and offshore Oregon.

North Carolina Utility Uses APPA Grant To Test Peak Shaving Batteries

February 24, 2022

by Peter Maloney

APPA News

February 24, 2022

Greenville Utilities Commission in North Carolina has added a 1-megawatt (MW) battery energy storage system (BESS) to its grid using a Demonstration of Energy & Efficiency Developments (DEED) grant from the American Public Power Association.

Greenville Utilities was looking for ways to reduce its coincident peak load. Historically the public power utility had used peaking plants, such as a reciprocating engine, for peak shaving. But under an agreement with Duke Energy Progress and North Carolina Eastern Municipal Power Agency (NCEMPA), Greenville Utilities has limits on how much load side generation it can add to its system.

“The allocation was set in the 1990s and was used up; we were looking at other alternatives,” John Worrell, Greenville Utilities’ director of electric systems, said.

Batteries do not count as generation, but Duke has pushed back on that view. In September 2020, the Federal Energy Regulatory Commission (FERC) sided with NCEMPA, allowing the joint action agency to use energy storage devices to reduce demand.

The pilot project was a good way to test the performance and economics of an energy storage system and compare it to the performance of a peak shaving engine, Worrell said. Greenville Utilities received financial assistance from the DEED program, which awarded the utility a $125,000 grant toward the total budgeted $1.6 million cost of the pilot project.

Construction on the project began in June 2020 and the battery came online in November 2020. The energy storage system includes a 1,000-kilowatt (kW), 2,250-kilowatt hour (kWh) lithium iron phosphate batteries.

The project required a year’s worth of data, so the pilot closed out last December. The DEED report was filed at the end of last month. The battery system, however, continues to operate and perform peak shaving duties for Greenville Utilities.

Overall, the project was a success, Worrell said, though there were some issues with batteries overheating, which in some instances restricted their availability during some peak periods. Those issues are being worked out with Powin, the manufacturer of the batteries, Worrell said.

The 12 months of data collected on the battery energy storage system showed that it consumed 106,191 kWh comprised of 33,921 kWh of auxiliary load and 72,207 kWh from charging events. The battery system discharged an average monthly peak supply of 965 kW with a max of 999 kW. A 1,000-kW discharge was recorded at 15-minute intervals but was not sustainable during a full hour as preferred.

Greenville Utilities serves about 71,000 electric customers with an average non-coincident peak demand of 301,500 kW and a coincident peak demand of 255,900 kW, consuming approximately 150 gigawatt hours monthly.

In terms of load management, the battery system operated 54 times for a total duration of 94.5 hours. The average duration per operation was approximately 1.76 hours with a maximum of 2.13 hours.

During the coincident peak hour, the battery system was able to discharge during 11 of 12 hours, resulting in an average monthly coincident peak load reduction of 779 kW with a maximum load reduction of 999 kW. The overheating issue affected total potential peak shaving capability for the months of May, June, August, and September.

Nonetheless, because it reduced monthly coincident peak demand, the battery system was able to avoid $218,743 in demand charges. The total expenses incurred operating the battery system were $43,414, resulting in an annual net savings of $175,328 with the ability to save approximately 62.4 percent of the total potential avoided demand charges.

The performance of the battery system ranked third among Greenville Utilities’ 12 peak shaving generators of various sizes in providing a high saving potential, according to the DEED report. The top ranked peak shaving generators were able to achieve 70.3 percent of total potential avoided cost. However, if the battery system’s average coincident peak load reduction of 779 kW were improved and equivalent to the average peak supply of 965 kW, the battery system would have ranked first with a saving potential of 82.2 percent, according to the DEED report.

Greenville Utilities said it plans to continue operating the energy storage pilot project for peak shaving applications because of the benefits it has provided in avoiding monthly coincident peak demand costs.

The utility also plans to continue to analyze the project to prepare for future projects as they arise. So far, Greenville Utilities is not considering installing another battery storage system. It is considering and has under discussion an energy storage tolling agreement.

Greenville Utilities did very well with the cost of its battery system, but that could be more difficult to replicate in the future because of rising costs, Worrell said. In addition, the cost of off-peak power to charge the batteries could go up as natural gas prices rise.

Alternatively, under a tolling agreement, a third party installs and owns the battery and the utility pays a set fee for peak shaving services. The agreements are usually based on coincident peak charges.

“If the toller takes the risk and we get a locked-in demand charge, we can hedge our peak demand over time, as long as the coincident peak from our supplier does not drop,” Worrell said. The agreement avoids the capital costs of installing a battery storage system while providing certainty of savings on coincident peak demand charges, he said.

Overall, Worrell said he would recommend using battery energy storage to reduce demand charges. Thanks to the pilot program, “we now know battery storage is a viable option with the same risks as a generator and just as reliable,” he said.

Members of APPA’s DEED Program can visit the Greenville project’s DEED Project Library page for access a useful Excel-based calculator which compares the financial feasibility of installing future BESS and RICE for peak-shaving applications, useful datasets containing hourly- and quarter-hourly performance data for Greenville’s BESS, photos, a spec sheet, and the full final report.

Greenville Utilities is a publicly owned utility in Pitt County that provides electric, water, sewer, and natural gas services to the City of Greenville and 75 percent of Pitt County. It is also the largest member of NCEMPA.

Massachusetts Municipal Wholesale Electric Company Launches Energy Efficiency Program

February 23, 2022

by Paul Ciampoli

APPA News Director

February 23, 2022

Massachusetts Municipal Wholesale Electric Company (MMWEC) recently launched a program that will replace residential, commercial and industrial energy efficiency programs in alignment with a shift in focus to a carbon-free future.

MMWEC’s energy efficiency programs, previously known as Home Energy Loss Prevention Services and Green Opportunity, have served MMWEC and its participating municipal light plants (MLPs) for more than three decades.

The driving purpose of the new NextZero brand is to help Massachusetts reach net zero carbon emissions by 2050.

MMWEC said that the new brand and its mission were developed through a rigorous strategic planning process with a subcommittee consisting of representatives of participating MLPs. The new mission emphasizes the critical role that community owned electric systems play in developing the clean energy future.

Municipal light departments participating in MMWEC’s residential energy efficiency programs through NextZero offer programs such as the “Connected Homes” demand response program, electric vehicle scheduled charging program, energy audits and rebates for energy-efficient appliances, electrification technologies and weatherization.

Several light departments also participate in commercial and industrial energy efficiency programs, including energy efficient lighting retrofits and customized efficiency upgrades.

Additional information about NextZero is available here.

MMWEC is a non-profit, public corporation and political subdivision of the Commonwealth of Massachusetts created by an act of the Massachusetts General Assembly in 1975 and authorized to issue debt to finance a wide range of energy facilities.

MMWEC provides a variety of power supply, financial, risk management and other services to the state’s consumer-owned, municipal utilities.

Legislation In Nebraska Proposes Nuclear Reactor Feasibility Study

February 22, 2022

by Paul Ciampoli

APPA News Director

February 22, 2022

Nebraska would use pandemic relief funds to conduct a feasibility study on siting options for nuclear reactors under a bill considered Feb. 16 by a Nebraska Senate Committee.

The bill, LB1100, would appropriate $1 million of the American Rescue Plan Act funds allocated to Nebraska to the state Department of Economic Development for use by a political subdivision that owns or operates a nuclear plant in the state to conduct a feasibility study.

The study would assess siting options for new, advanced nuclear reactors throughout Nebraska and existing electric generation facilities based on key compatibility assets for such reactors, according to the Nebraska Legislature’s Unicameral Update.

Daniel Buman, director of nuclear oversight and strategic asset management at Nebraska Public Power District (NPPD), testified in support of the proposal on behalf of NPPD and the Nebraska Power Association, which represents all of Nebraska’s public power utilities.

Calling a siting study the “next logical step” for meeting the state’s energy needs, he said a new generation of nuclear facilities could provide reliable, baseload carbon-free energy for the state.

Cooper Nuclear Station currently provides approximately 65 percent of the electricity for Nebraska customers over a rolling two-year average, he said.

“Siting studies are needed to identify the best combination of features and locations to maximize the value [of new nuclear sites] for Nebraska,” Buman said.

No one testified in opposition to the bill, which was introduced by Nebraska Sen. Bruce Bostelman, and the committee took no immediate action on LB1100.

Federal Energy Regulators Seek Answers Tied To Dynamic Line Ratings

February 22, 2022

by Paul Ciampoli

APPA News Director

February 22, 2022

The Federal Energy Regulatory Commission (FERC) has launched an inquiry that seeks to answer a wide range of questions related to the use of dynamic line ratings (DLRs) on electric transmission lines.

Transmission line ratings represent the maximum transfer capability of each transmission line. These ratings can change based on weather conditions. The use of DLRs allows the capacity of a line to be updated regularly based on a wide range of weather and line-specific factors affecting the operation of electric transmission lines.

FERC’s Notice of Inquiry (NOI), which was issued on Feb. 17, builds on Order No. 881, which FERC approved in December of last year.

Order No. 881 directs transmission providers to use ambient-adjusted ratings (AARs) as the basis for evaluating near-term transmission service as well as for the determination of the necessity of certain curtailment, interruption or redispatch of near-term transmission service. AARs set transfer capability for transmission lines taking into account the effects of forecasted ambient air temperatures and the presence of solar heating.

Order No. 881 found that line ratings based on conservative assumptions about worst-case, long-term air temperature and other weather conditions can lead to underutilization of the transmission grid. Therefore, requiring all transmission providers to use AARs will better utilize the grid and help lower costs for consumers, FERC concluded.

Order No. 881 also acknowledged that transmission line ratings could be based on factors beyond forecasted ambient air temperatures and the presence of solar heating.

Applying these factors to reflect other weather conditions like wind, cloud cover, solar heating intensity and precipitation, as well as transmission line conditions such as tension or sag, could lead to greater accuracy and enable greater power flows, FERC said.

In addition, the Commission explained that the use of dynamic line ratings can detect situations where flows should be reduced for safe and reliable operation and to avoid unnecessary wear on transmission equipment.

FERC concluded in Order No. 881, however, that the record was insufficient to assess the relative benefits, costs and challenges of dynamic line rating implementation. In issuing the NOI, FERC is attempting to gather additional information on these issues.

The NOI seeks to further explore:

- Whether the lack of DLR requirements renders current wholesale rates unjust and unreasonable;

- Potential criteria for DLR requirements;

- The benefits, costs and challenges of implementing DLRs;

- The nature of potential DLR requirements; and

- Timeframes for implementing potential DLR requirements.

Initial comments in response to the NOI are due 60 days after publication in the Federal Register, with reply comments due 30 days later.

The NOI is available here.

DOE Unveils Organizational Realignment In Response To Infrastructure Law

February 22, 2022

by Paul Ciampoli

APPA News Director

February 22, 2022

The U.S. Department of Energy (DOE) recently announced an organizational realignment to ensure that it has the structure needed to effectively implement the clean energy investments in President Biden’s infrastructure law and the Energy Act of 2020.

The new organizational structure establishes two Under Secretaries: one focused on fundamental science and clean energy innovation and the other focused on deploying clean infrastructure.

The infrastructure law and the Energy Act of 2020 provide over $60 billion primarily for new major clean energy demonstration and deployment programs and more than triples DOE’s annual funding for energy programs, including significantly expanded research and development (R&D) and entirely new demonstration and deployment missions.

The Under Secretary for Infrastructure will focus on deploying clean energy solutions. The new Under Secretary will centralize existing offices focused on major demonstration and deployment with new offices. The existing offices moving to the new Under Secretary include DOE’s Loan Programs Office, Office of Indian Energy, Office of Clean Energy Demonstration, Office of Cybersecurity, Energy Security, and Emergency Response (CESER), and the Federal Energy Management Program.

Accompanying the announcement of the new Under Secretary is the launch of three new offices to support clean energy infrastructure deployment:

- The Grid Infrastructure Office to execute DOE’s Building a Better Grid initiative to modernize and upgrade the nation’s electric transmission lines and deploy cheaper, cleaner electricity across the country;

- The State and Community Energy Program to work more closely with states, localities, and communities to in the planning and deployment of decarbonization solutions;

- The Office of Manufacturing and Energy Supply Chains.

The offices in the Under Secretary for Science and Innovation (formerly the Undersecretary for Science and Energy) will drive research and development of energy technologies, with connected demonstration and deployment activities.

Through the realignment the Office of Science, DOE’s applied energy offices, and DOE’s 17 National Labs will continue their core discovery science and innovation missions including leveraging $12 billion in base appropriations as of fiscal year 2021 and $3.8 billion in funding in the infrastructure law and Energy Act of 2020.

FERC Revises Gas Pipeline Certificate Approach, Adopts New Gas Infrastructure GHG Policy

February 22, 2022

by Paul Ciampoli

APPA News Director

February 22, 2022

The Federal Energy Regulatory Commission (FERC) last week adopted a revised policy statement that significantly modifies its approach for considering new natural gas projects under the Natural Gas Act.

At the same time, FERC adopted an interim policy statement to explain how the Commission will assess the impacts of natural gas infrastructure projects on climate change in its reviews under the Natural Gas Act and the National Environmental Policy Act (NEPA).

The Commission’s actions took place during its Feb. 17 monthly open meeting with a 3-2 vote occurring in both proceedings.

Updated Certificate Policy Statement (Docket No. PL18-1)

In 2018 and again, in 2021, the Commission issued notices of inquiry (NOI) seeking public comment on its 1999 policy statement on the certification of new interstate natural gas transportation facilities.

In particular, the Commission requested information on the consideration of the effects of such projects on affected communities, the treatment of precedent agreements in determining the need for a project, and the scope of the Commission’s environmental review, including an analysis of the impact of a project’s greenhouse gas emissions.

The updated certificate policy statement reaffirms many of the goals and objectives of the Commission’s 1999 policy statement, but further clarifies how the Commission will execute its public interest obligations under the Natural Gas Act.

The updated policy statement explains that, in making such determinations, FERC intends to consider all impacts of a proposed project, including economic and environmental impacts, together. It also calls for a robust consideration of impacts to landowners and environmental justice communities in the Commission’s decision-making process, FERC said.

And where the Commission traditionally has relied on precedent agreements between project applicants and shippers to establish the need for a project, the updated certificate policy statement states that applicants should provide more than just precedent agreements, to help explain why a project is needed, such as the intended end use of the gas.

It also states that the Commission may consider other evidence of need, including demand projections, estimated capacity utilization rates, potential cost savings to customers, regional assessments and statements from state regulators or local utilities.

Interim GHG Policy Statement (PL21-3)

The Commission said that it issued the interim GHG policy statement to explain how it will assess the impacts of natural gas infrastructure projects on climate change in its reviews under the National Environmental Policy Act and the Natural Gas Act.

FERC is seeking comment on all aspects of the interim policy statement, including, in particular, the approach to assessing the significance of the proposed project’s contribution to climate change.

The guidance is subject to revision based on the record developed in this proceeding. However, the Commission will begin applying the framework established in this policy statement in the interim.

This will allow the Commission to evaluate and act on pending applications under section 3 and section 7 of the Natural Gas Act without undue delay and with an eye toward greater certainty and predictability for all stakeholders, it noted.

The interim policy sets a threshold of 100,000 metric tons per year of GHG emissions. Projects under consideration with emissions above that level will require the preparation of Environmental Impact Statements (EIS).

The Commission will consider proposals by project sponsors to mitigate all or part of their projects’ climate change impacts. The Commission may condition its approval on further mitigation of those impacts.

In quantifying GHG emissions, FERC will consider emissions that are reasonably foreseeable and have a reasonably close causal relationship to the proposed action. This will include GHG emissions from construction and operation of the project, and may include GHG emissions resulting from the upstream production and downstream combustion of transported gas.

Applicability

As policy statements, neither document establishes binding rules.

They are intended to explain how the Commission will consider applications for natural gas project construction. They will apply only to pending and new projects; those applicants with projects now pending before the Commission will have the opportunity to supplement their records.

Commissioners Christie And Danly Dissent

Commissioners Mark Christie and James Danly dissented from both items.

In his dissent, Christie said it is a truism that FERC is an economic regulator, not an environmental regulator. “This Commission was not given certification authority in order to advance environmental goals; it was given certification authority to ensure the development of natural gas resources and their availability – this includes pipeline infrastructure – at just and reasonable rates,” Christie said,

“To construe the Commission’s analysis of the public convenience and necessity as a license to prohibit the development of needed natural gas resources using the public interest language in the NGA [Natural Gas Act] would be to negate the very legislative purpose of the statute,” he argued.

“To those who say ‘well, times have changed and Congress was not thinking about climate change when it passed the NGA,’ here’s an inconvenient truth: If Congress wants to change the Commission’s mission under the NGA it has that power; FERC does not,” wrote Christie.

He further argued that FERC’s actions “rely to a remarkable degree on a smattering of statements from a handful of recent orders. Simply put, these authorities are simply ‘too slender a reed’ to support the great weight today’s orders place on them.”

For his part, Danly said in his dissent of the updated policy statement on certification of new interstate natural gas facilities that the Commission’s jurisdiction and the public convenience and necessity standard are not as broad as the updated policy statement suggests. He also said that a number of the changes to the certificate policy statement are misguided.

As for the interim GHG policy statement, Danly said in his dissent of the policy statement that it is “irredeemably flawed.”

He said it is “practically unworkable because it establishes a standardless standard. Its universal application to all projects, both new and pending (some for over two years), is an affront to basic fairness and is unjustifiable, especially in light of the many unnecessary delays already suffered by applicants.”

Moreover, Danly argued the policy statement is unlawful “because it is illogical, it arrogates to the Commission power it does not have, and it violates the NGA, NEPA and the Commission’s and the Council on Environmental Quality’s (CEQ) regulations.”

Louisiana Task Force Approves State’s First-Ever Climate Acton Plan

February 20, 2022

by Peter Maloney

APPA News

February 20, 2022

A Louisiana task force has approved and presented to the state’s governor a Climate Action Plan that would set a goal of achieving zero net greenhouse gas (GHG) emissions by 2050.

The Climate Action Plan recently unanimously approved by Gov. John Bel Edwards’ Climate Initiatives Task Force has three priority policy pillars: renewable electricity generation, industrial electrification, and industrial fuel switching to low- and no-carbon hydrogen.

The policies were tailored to reflect an updated inventory of the state’s greenhouse gas inventory, which was part of the action plan. The inventory showed that 64 percent of Louisiana’s GHG emissions are concentrated in the industrial sector, driven primarily by the state’s refining, chemical manufacturing, and natural gas processing facilities. Another 19 percent of the state’s overall GHG emissions come from the transportation sector, and 13 percent result from electric power generation.

The interim goals of the Climate Action Plan set several goals for renewable resource implementation, including 100 percent renewable or clean energy by 2035 with at least 80 percent from renewable sources, 5 gigawatts (GW) of offshore wind generation by 2035, 100 megawatts (MW) of energy storage by 2030, and a 30 percent increase in transmission infrastructure by 2030 and a 100 percent increase by 2050.

Some elements of the Climate Action Plan would require legislative action, such as the reinstatement of incentives for the installation of renewable resources and energy storage to encourage the purchasing of renewable power.

Other elements of the plan would require action on the part of the state’s Public Service Commission, such as a review of net metering policies and a determination of the best mechanisms for third parties to sell power back to the grid in order to encourage the generation of renewable power.

The industrial emissions reduction aspects of the plan call for “electrification to the extent practicable” and fuel and feedstock switching to alternative sources such as hydrogen and also provides support for research on carbon capture technologies.

The Climate Action Plan also charts a course for addressing the “persistent and complex” challenge of methane emitted from oil and gas infrastructure, particularly orphaned wells.

The transportation and built environment aspects of the plan calls for the installation of 250 electric vehicle charging stations per 100,000 residents by 2050. The plan also calls for legislation for energy efficiency and code upgrades that would require minimum efficiency levels in buildings.

The Climate Action Plan, a first for Louisiana and the first among the state’s neighbors on the Gulf of Mexico, was designed to align Louisiana with pledges made under the United Nation’s 2015 Paris Agreement and with goals set by the federal government, 25 other states, and hundreds of private companies.

Bioenergy, Carbon Capture Are Key To GHG Reduction Strategies: Report

February 20, 2022

by Peter Maloney

APPA News

February 20, 2022

While currently limited, the bioenergy with carbon capture and storage (BECCS) industry has great potential and could play a key role in significant emissions reductions across the economy, according to a new report from the Energy Futures Initiative.

The report, Surveying the BECCS Landscape, analyzes the scientific and research literature on BECCS and its potential to remove greenhouse gas (GHG) emissions from the atmosphere.

BECCS projects can run the gamut from a biomass-fueled power plant to a project that captures carbon dioxide (CO2) and injects it into wells for enhanced oil recovery. The authors of the report, however, say BECCS systems share common features such as a biomass feedstock, biomass-to-energy conversion, carbon capture, and carbon storage or utilization. They noted, however, there is little consensus on precisely which biomass feedstocks, conversion techniques, and carbon capture approaches should be labeled as BECCS and whether a project must be carbon-neutral or carbon-negative to qualify as BECCS.

Definitions aside, the report argues that BECCS has the potential to help with emissions reductions in numerous sectors of the economy, such as agriculture, forestry, electricity, waste, and industry and particularly sectors that are hard to decarbonize, such as heavy industry, aviation, and agriculture.

Nonetheless, there are only a handful of BECCS projects deployed globally, and they are mostly pilot- or demonstration-scale projects that capture less than 400 kilotons (kt) of CO2 a year for enhanced oil recovery or other uses, the report noted.

Without BECCS it will be difficult or even impossible to reach net negative GHG emissions, the report says, noting that the United Nations’ Intergovernmental Panel on Climate Change includes BECCS in its GHG reduction scenarios.

Among the report’s key findings, the authors noted that modeling studies project the need for massive global BECCS deployment, up to 8 gigatons of CO2 per year by 2050. That potential could be hard to achieve, however, because of limited feedstock availability, access to CO2 infrastructure and disposition options, and socioeconomic or environmental limitations, they said.

And while the BECCS industry is currently limited in the United States to only five operating projects, the country has “several characteristics that make it suitable for BECCS deployment including well-established relevant industries (e.g., biofuels, biopower, forestry, agriculture, wood pellet production, and pulp and paper), significant natural resources (e.g., biomass and geologic storage), and growing policy support (e.g., the newly extended 45Q tax credit and the Energy Act of 2020),” the report said.

To reach that potential, expanded biomass supply chains and CO2 infrastructure are needed to support a national BECCS industry, the report said.

And while BECCS pathways face opposition because of environmental justice concerns or because the technologies are often seen as “false solutions” to addressing climate change, the report noted that BECCS pathways can present rural economic development opportunities.

BECCS is beginning to appear more often in legislation, public policies, and federal programs, the report said, but “these efforts are not commensurate with a scale-up to a gigaton-scale industry.”

“Growing the BECCS industry enough to have a meaningful impact on U.S. emissions will require support and expertise from multiple agencies, making federal interagency collaboration paramount,” the report’s authors said.

CMUA Policy Paper Assesses, Advises on California’s 2045 Clean Energy Goal

February 20, 2022

by Peter Maloney

APPA News

February 20, 2022

Reliability and affordability will be key to California’s efforts to greenhouse gas (GHG) emissions, according to a new policy paper by the California Municipal Utilities Association (CMUA).

Reaching California’s target of 100 percent clean energy by 2045 rests on four principles: predictability, reliability, affordability, and flexibility, the paper, Powering California’s Future with Clean, Affordable and Reliable Energy: Four Principles for Success, argues.

“Part of our mission is to be a thought leader,” Barry Moline, executive director of CMUA, said. “We have a responsibility to put good ideas in front of policy makers and to set standards going forward. We are part of the solution and need to be part of the solution in a particular way.”

California’s utilities have already made significant progress toward the state’s goals by reducing electric sector GHG emissions by at least 40 percent since 2006. Much of that progress can be ascribed to collaborating with the state on the many laws and agencies that govern and regulate the state’s energy sector and promote initiatives aimed at mitigating climate change.

In addition to SB 100, also known as the 100 Percent Clean Energy Act of 2018 – a seminal law that put California on the path to 100% clean energy by 2045 – two laws were passed in 2021 that supplement the SB 100 planning process. And, California has a full-time legislature, that annually proposes a continual parade of new bills. Last year, 2,400 bills were introduced in the state’s legislature with about 140 of them related to energy, a “pretty average number,” Patrick Welch, CMUA senior director of energy policy and strategy and author of the paper, said.

“When the laws and regulations driving renewable and clean energy procurement are constantly changing, it can harm the financial stability of utilities, causes project delays, jeopardizes climate progress, and impose costs on California utility customers,” the paper said.

“We have strong foundational clean energy laws in California with a robust planning process to pave the road to 100% clean energy. If legislators want to create new laws, we think they should be looking at removing barriers, and should be cautious about imposing new requirements that change the rules of the game,” Welch said.

“Predictability doesn’t mean just saying, ‘No,’” Moline said. “We want new laws that help achieve goals already established.”

The paper also advises on challenges that the sate’s clean energy goals will present to affordability. Meeting the state’s 2045 target will require more than doubling the energy resources on the grid, including nearly 120 gigawatts (GW) of new clean resources, including utility-scale solar, batteries, and wind farms, and potentially up to 173 GW of new resources.

That “record-breaking” pace of resource expansion over the next 25 years “will come at a cost” of about an additional $4.6 billion annually by 2045 charged to California ratepayers, the paper said, adding that eliminating all fossil-fuel combustion for electricity generation would cost another $8 billion every year.

Citing a Legislative Analyst’s Office report from 2017, the CMUA paper noted that electric rates in California were about 50% higher than the national average. The are multiple factors contributed to those rates, including how fixed costs are recovered, declining energy consumption due to energy efficiency implementation, and state mandates such as the state’s renewable portfolio standard and its carbon dioxide cap-and-trade program.

CMUA also cited a February 2021 paper released by the California Public Utilities Commission that found that rate and bill increases could make other climate policy goals more difficult to achieve.

And a joint agency report to the governor, said that 2021-2030 overall bundled residential rate forecasts for California’s three large investor-owned utilities are expected to grow at a pace that exceeds inflation for many years in the coming decade.

Those concerns could be compounded as the state turns to electrification to address emissions reductions in other parts of the economy, such as the transportation sector, Moline said. “If rates ratchet up too much, people are not going to want to switch to those technologies,” such as adopting electric vehicles. If legislators and regulators are not paying attention to those problems, we want to make sure they are on the marquee,” Moline said.

And while public power utilities such as the Los Angeles Department of Water and Power (LADWP), the Sacramento Municipal Utility District and the Glendale Department of Water & Power have made progress toward reducing GHG emissions, the paper said that they also face more challenges as the level of renewable and clean resources on their systems grow, particularly as they approach the last 10 percent of the 100 percent goal.

“It will be particularly important, as utilities meet their 2030, 60 percent renewable energy goals and continue to plan for 100% clean energy by 2045, for there to be latitude and flexibility in resource selection,” Welch said. “As we approach those thresholds, having a narrow focus doesn’t work from a reliability or cost standpoint.”

“A lot of low hanging fruit has been picked,” Moline said. So, it will be important to have flexibility with respect to the “buckets” that currently specify acceptable types of renewable resources. “Are we stuck in some old school idea or are we open to innovating?” he asked, noting that CMUA is advocating for hydropower to be counted toward meeting emission reduction goals above the 60 percent threshold.

In short, the policy paper should serve as a guideline for lawmakers and regulators, Moline said. The clean energy principles in the paper will move the state toward its goals “faster and with a solid foundation of outstanding service to the people of California,” he said.