Iowa’s Atlantic Municipal Utilities Enters Capacity Agreement With Missouri River Energy Services

February 2, 2022

by Paul Ciampoli

APPA News Dierctor

February 2, 2022

The board of Missouri River Energy Services (MRES) recently approved a new capacity purchase agreement with Iowa’s Atlantic Municipal Utilities (AMU).

The structure of the agreement is similar to the reserved capacity agreements that MRES has in place with 19 other members, MRES noted in the January issue of its MRES Today newsletter.

These agreements offer a win-win solution to a member’s reliability needs and MRES’ capacity needs by utilizing the members’ local generation resources for backup capacity, MRES said.

Through these purchase power agreements, MRES can call upon member generators to run and supply energy to the regional electric grid during times when other resources cannot meet customer needs.

During the 2021 polar vortex, six MRES members within the Southwest Power Pool’s footprint were called on to generate electricity to help keep the lights on in their communities and throughout the region, MRES pointed out.

In addition, reserved capacity agreements allow MRES member utilities to run their generators and supply power to their customers during other times of emergency, including outages caused by severe weather or random accidents that damage powerlines.

As part of the agreement, MRES pays the member a monthly fee in exchange for making the local generating capacity available to MRES for its use.

This mutually beneficial arrangement can help MRES and its members meet their capacity requirements, while helping participating members add local backup generation to increase the reliability of their operations, MRES noted in the newsletter.

Due to transmission limitations, the maximum amount of capacity that a member can install under this program is equal to the member’s peak demand.

MRES is an organization of 61 member municipalities that own and operate their own electric distribution systems. MRES is governed by a 13-member board of directors who are elected by and from the ranks of our member representatives.

Fitch Outlines Public Power Supply Risks Tied to Crypto Currency Mining

February 2, 2022

by Paul Ciampoli

APPA News Dierctor

February 2, 2022

Digital asset or crypto currency mining in the U.S. could present power supply risks to public power utilities unless they are sufficiently mitigated, Fitch Ratings said on Jan 24.

Crypto mining “is energy intensive and requires a considerable amount of power that can significantly increase a utility’s overall electrical load. Utilities must balance the revenue prospect of increased electrical sales with the commitment to procure or generate large amounts of power for crypto mining operations,” Fitch said.

The rating agency noted that crypto mining operations are price-sensitive entities that may be quickly scaled back or shut down if mining becomes uneconomical.

To date, Fitch’s rated public power utilities “have successfully limited their risk by restricting the scope of crypto mining operations in their service area or by defining their power procurement commitments in a way that protects the utility from nonpayment, including due to a sudden closure of the mining facility,” Fitch said.

It noted that utilities that have excess generation capacity may have the ability to meet the power supply requirements of crypto mining operations from existing power supplies. “This is the case in the state of Washington, where energy-intensive aluminum smelting operations have gradually closed over the last two decades and wind energy production has increased available energy supplies over the last decade. This, coupled with abundant low-cost hydroelectric generation, made the region an attractive location for data centers historically and crypto-mining operations in recent years.”

A utility with excess capacity “must evaluate the opportunity costs and benefits of a new large crypto load versus retaining capacity for other economic development opportunities,” according to the rating agency.

Crypto mining operations “typically bring in very little additional economic benefits in the form of jobs or ancillary business to a local economy,” Fitch said. While crypto mining operations have a wide range of sizes, in some instances they can become the largest customer in a rural service territory.

“The volatile and unregulated nature of crypto mining and the large influx of load requests led a number of Washington utilities to adopt new practices beginning in 2014 to mitigate exposure to crypto mining entities, including crypto-currency load moratoriums, evolving rate structures to capture the departure risk of a high-risk industry, and defined customer concentration limits,” the rating agency said.

Much of the recent cryptocurrency mining expansion is occurring in Texas, Fitch noted. “Unlike Washington, Texas utilities generally do not have excess generation capacity, but the structure of the regional energy market offers other perceived business advantages. For utilities with a supply and demand imbalance, utilities may need to invest in new generation facilities, sign new long-term power purchase agreements or procure power via real-time market purchases in order to serve additional crypto mining load.”

Fitch said that the first two of these three options pose the greatest risk to the utility should the crypto mining operation shut down, “as utilities could be left with stranded assets and costs that then must be recovered, typically by customers in the form of rate hikes, although the utility may utilize reserves to recover costs if there is little rate flexibility.”

Increased costs or a reduction in reserves could lead to negative credit pressure if operating margins are compressed; similarly, lower liquidity could lead to a weaker overall financial profile.

To date, Fitch-rated utilities have opted to use short-term market purchases with pass-through cost arrangements to mitigate financial risk to the utility, the rating agency said.

Wis. Utility Customers Save Energy While Helping Charities Under Pilot Program

February 2, 2022

by Paul Ciampoli

APPA News Dierctor

February 2, 2022

The Wisconsin public power communities of New Richmond and Mount Horeb have been selected to participate in the second round of a pilot program under which residents will raise money for local charities while they save money learning new ways to save energy.

Focus on Energy’s “Save to Give Challenge” launched in 2020 exclusively for rural communities. The program’s success in Lodi and Bayfield in Wisconsin last year resulted in its being able to expand this year.

Lodi, New Richmond and Mount Horeb are all members of WPPI Energy, which serves 51 locally owned electric utilities.

Focus on Energy Director of Program Operations Erin Soman noted that Lodi residents taking part in the first challenge were able to help keep one of their community charities open.

In both New Richmond and Mount Horeb, any residential customer of the municipal electric utility will be eligible to participate through the utility’s website.

In the same place residents pay their bills online, they can participate in the “Save to Give Challenge” where they will learn and practice no- and low-cost energy actions, tracking their progress on the website or a mobile phone app.

Each time they record how they saved energy they will earn donation points toward their favorite community nonprofits. When enough residents participate and accrue those points, Focus on Energy will donate up to $25,000 to the charities.

Participants will also have easy access to energy saving tips and information about other Focus on Energy offerings. Through time-limited campaigns — coupled with longer-term strategies — the pilot engages rural households to implement behavior-based energy savings and participate in Focus on Energy programs, Focus on Energy noted.

For Mount Horeb and New Richmond, the “Save to Give Challenge” is also in line with the communities’ goals to save energy and support local organizations. Both communities have robust networks of volunteers, social networks, and treasured nonprofits.

In New Richmond, the “Save to Give Challenge” aligns with the community’s vision, written by its residents, to protect natural resources and maintain the city’s reputation as a prosperous, civically engaged community.

Mt. Horeb Utilities, in partnership with WPPI Energy, will also be providing additional donations to local nonprofits when reaches participation milestones in the “Save to Give Challenge.”

For more information about the challenge, click here.

Additional details on Focus on Energy is available here.

EPA Proposes To Restate The Underpinnings Of Mercury Emission Standards For Power Plants

February 1, 2022

by Paul Ciampoli

APPA News Dierctor

February 1, 2022

The Environmental Protection Agency (EPA) this week finished reviewing the 2020 Reconsideration of the Mercury and Air Toxic Standards (MATS) Supplemental Cost Finding and Residual Risk and Technology Review (RTR) for coal and oil-fired electric generating units (EGUs).

As part of the review EPA is now proposing to revoke the May 2020 finding that it is not appropriate or necessary to regulate coal and oil-fired EGUs under Clean Air Act section 112.

After considering costs, the agency reaffirms its April 2016 finding that it remains appropriate and necessary to regulate hazardous air pollutants (HAP) emissions from EGUs.

EPA is proposing an “alternative formal benefit-cost approach to make the appropriate and necessary determination.”

Under this approach, the agency proposes to conclude that it remains appropriate to regulate HAP emissions from EGUs after considering costs. The benefit-cost analysis issued with the MATS rule “indicated that the total net benefits of MATS were overwhelming; even though EPA was only able to monetize one of many statutorily identified benefits of regulating HAP emissions from EGUs,” EPA said.

EPA is seeking comments on all aspects of the proposal and wants information on the performance and costs of new or improved technologies to control HAPs.

EPA is seeking this information to inform its ongoing review of the RTR. The result of the RTR review will be included in a separate agency action.

According to the EPA, there are no anticipated costs or benefits because no regulatory amendments or impacts are associated with reviewing the appropriate and necessary finding.

A copy of the pre-publication Federal Register notice is available here. The proposal will be open for public comment for 60 days upon publication in the Federal Register. A virtual hearing will be held 15 days after publication.

APPA, Other Groups Urged EPA To Sustain The Mercury Rule

The American Public Power Association in 2019 was joined by other power industry trade groups, labor unions, generators and an affiliate of the U.S. Chamber of Commerce in urging the EPA to sustain the MATS rule given that industry has already fully implemented MATS.

Tuskegee, Alabama Utility Reflects on Past and Present Leadership

January 31, 2022

by APPA News

January 31, 2022

February marks Black History Month. In 1976, President Gerald Ford recognized Black History Month during the nation’s bicentennial celebration, urging Americans to “seize the opportunity to honor the too-often neglected accomplishments of Black Americans in every area of endeavor throughout our history.”

Today the American Public Power Association pays tribute to the Black American leaders who, over a half-century ago, sought to establish the Utilities Board of Tuskegee (UBT). We also celebrate its leaders today.

Tuskegee, Alabama Public Power Utility Formed

The Tuskegee City Council and then-Mayor C.M. Keever unanimously adopted a resolution on January 27, 1970 in support of incorporating a public corporation responsible for utility services.

The effort was spearheaded by Booker T. Conley, Lawyer Edward Reid, and William C. Allen, who are widely recognized as “the fathers of the Utilities Board of the City of Tuskegee.” These three local citizens had undersigned the Certification of Incorporation presented to the Tuskegee City Council. It sought to incorporate a public utility to operate an electric system, a water works system, and a sewage system. The certificate called for, among other issues, that an electrical system be ran in perpetuity by acquiring, operating, maintaining, improving, and extending an electric system in the City of Tuskegee, and in the territory surrounding the city.

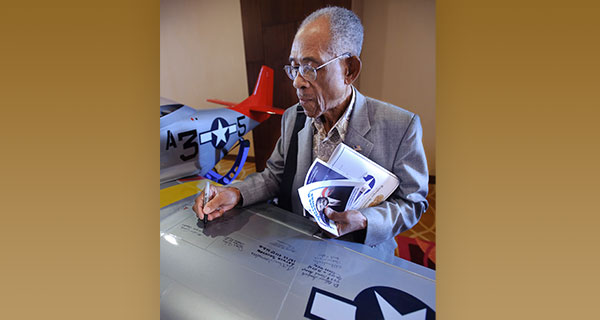

Booker T. Conley (1923-2019)

His family said that Booker Conley embodied the best of Conley family virtues: humble, intelligent, brave, and adventurous. He would surely be proud of the legacy he left for public power today.

Booker Conley greatly admired his older brother, Coleman, and would follow him to Tuskegee University, where Coleman had enrolled in the very first class of Tuskegee Airmen. That first class of U.S. Army Air Corps cadets graduated from Tuskegee Army Air Field on March 7, 1942; the class began with only 13 cadets.

Booker Conley had instead decided to continue a century-long family carpentry tradition by studying architecture at Tuskegee University. He later drafted the plans to build the airplane hangars that housed Tuskegee’s famous “Red Tail” fighter planes.

When his older brother was tragically killed in a combat exercise, Booker took his place and joined the civil pilot training program at the Tuskegee Institute in 1940. Upon graduating from the Army’s Reserve Officers’ Training Corps, he went on to serve with the 92nd “Buffalo Soldiers” infantry division in Italy during World War II, flying P-51 Mustang fighter planes. The Buffalo Soldiers Division was the only Black infantry division that participated in WWII combat, serving in Italy from 1944 to the war’s end.

Booker Conley flew missions over Italy and Northern Africa. He and Coleman Conley are the first known brothers to be documented amongst the 996 Tuskegee Airmen pilots.

Conley returned to Tuskegee after World War II. He lived near the Tuskegee University campus with his wife, Dorothy, where they raised their four children, and he enjoyed a 50-year long career. In his forties, he continued to serve his country by helping advance the formation of a public power utility to improve the utility services in his hometown. It still thrives today.

UBT Today

UBT operates with 72 employees. The 103-square mile service area includes the City of Tuskegee, the towns of Franklin and Shorter, and much of Macon County, Alabama. The utility has approximately 6,714 electric customers – 88% are residential customers. The utility’s two largest customers are Tuskegee University and the Veterans Affairs medical center.

The public power utility is overseen by a five-member board of directors. All five members are Black men, with Black men and women comprising the predominant majority of UBT’s leadership team.

Gerald B. Long, UBT General Manager

Gerald Long, CPA, CGMA, graduated from the University of Alabama, Birmingham in 1983 with a degree in accounting. He joined the Alabama Public Service Commission in 1988 as an advisor concerning the state’s telecommunications issues. He was later promoted to director of the telecommunications division. During his tenure with the Commission, he started his own accounting firm and later left the Commission to operate it full-time in 1996. In 2008 he became the Chief Financial Officer of UBT and, later, its General Manager.

“I love working for UBT because we provide indispensable services to the community, and through the provision of those services, we are able to plot a future for the community that will lead to economic growth and prosperity,” he said.

Alvin Woods, UBT Light & Power Supervisor

Alvin Woods has been with UBT for nearly 35 years. Since 1987, Woods has seen the Lighting Department grow into a well-rounded utility with trained staff and a fleet of work trucks and various equipment necessary to get the job done. When he began, the department thrived from on-the-job training. UBT’s linemen and journeymen are now trained through the Tennessee Valley Public Power Association’s nationally accredited program. Much of the light staff is now substantially certified so the utility no longer needs to subcontract work to outside professionals.

Woods has been the Light & Power Supervisor for over 20 years now and is proud to be part of UBT’s growth and development serving a city with such a rich history.

UBT has won several awards for its reliability. Indeed, UBT’s most recent electric reliability metric percentage stands at 99.9886 percent.

“Outside of serving our community with excellence, we are also proud of being Electric Cities members that go out and assist other cities as well as other states during times of disasters. We love serving the people,” said Woods. The American Public Power Association awarded UBT a Mutual Aid Commendation certificate for supporting electrical restoration efforts to the Vinton Public Power Authority in Louisiana after the utility was hit hard by Hurricane Laura in August 2020.

UBT continues to give back to the community. Most recently, the public power utility donated $10,000 to the Macon County-Tuskegee Public Library to help expand the number of titles the library offers to help further expand learning opportunities for the community. UBT recently donated to the Booker T. Washington High School Boys Basketball team to acquire new equipment and uniforms before the 2022 season began.

Minnesota’s Princeton Public Utilities Launches Rate Study

January 31, 2022

by Paul Ciampoli

APPA News Director

January 31, 2022

Minnesota public power utility Princeton Public Utilities (PPU) has launched an electric rate study that is scheduled to be completed later this year.

In a Q&A with Public Power Current, Keith Butcher, General Manager of PPU, noted that PPU last conducted a rate study in 2015.

“In 2019, PPU implemented a 4% rate reduction in large part due to a reduction in wholesale costs from our supplier, Southern Minnesota Municipal Power Agency (SMMPA),” he noted in an email.

“Like other electric utilities, recent changes at both the wholesale and retail level are challenging the original assumptions from that previous rate study.”

He said that important factors that are changing since 2015 is a growth in customer-owned renewables, increased penetration of electric vehicles and overall changes in the local economy.

In addition, Butcher noted that PPU completed a conversion to AMI metering in the fall of 2021. “The increased data analytics that we can now perform knowing individual customer load shapes will help PPU more accurately track and predict future power delivery costs as well as our own revenue collections,” he said.

In 2021, PPU developed a 10-year capital improvement plan estimated at a cost of $11.7 million. The 10-year plan will be conducted in three phases. Goals of the plan include developing a new SCADA system for added system control and monitoring and completing the upgrade of the distribution network to a 12.47 kV system, among other things.

Financially, PPU has several electric bonds expiring in the next few years and has determined that the next few years will be a good time to invest in the system for the next generation, Butcher noted.

“Developing a better understanding of our changing bond requirements will help ensure fiscal sustainability during the transition from our old financing requirements to our new financing needs,” he said.

PPU is also anticipating load growth due to planned construction activities within its service territory as well as through some service territory acquisitions as city limits expand.

PPU has contracted with DGR Engineering to do a comprehensive rate study analysis that will determine fiscal requirements for the next 10 years, including integration of the impact of planned capital improvements projects and associated financing.

The analysis will also propose appropriate fiscal policy guidelines to serve as targets for rate-setting in the study and to provide future benchmarking metrics on an ongoing basis and develop an estimate of future power supply costs.

In addition, the analysis will project system operating expenses and cash requirements, including capital expenditures, financing obligations, and transfers, determine whether the present level of revenue is adequate or if adjustments are needed. Based on various scenarios, the analysis will develop a multi-year rate adjustment estimate and perform an analysis of customer class definitions, to determine if the current classes are appropriate.

It will also:

- Review the current rate structures, to determine if they align with the current utility cost structures and current industry practices;

- Perform a cost-of-service study, to allocate costs to the appropriate classes, and to the customers within the class;

- Assure fairness and equitability to all customers served;

- Develop proposed retail rates for implementation by PPU based on cost-of-service results;

- Evaluate the impact of the proposed rates on all customer classes; and

- Coordinate with PPU’s financial advisors to support issuance of debt required to fund capital projects.

The agreement with DGR Engineering was signed in December 2021 and work has begun, Butcher said. Results will be available by September for inclusion in PPU’s 2023 budget discussions.

PPU will use the findings to determine what, if any, rate modifications should be made.

“In the interest of transparency, the rationale and impact of any rate modifications will be shared with our customers,” Butcher said. “PPU wants to ensure everyone that we are being deliberative and clear in our work and that PPU is committed to implementing industry best practices in order to preserve and protect the system for current and future ratepayers.”

Having an outside, third-party expert “evaluate our rate structures lends credibility and objectivity to rate determination and will provide assurances to the community at-large that rates are fair and equitable,” he noted.

Court Sides With San Francisco PUC In Dispute With PG&E Over Power Grid Connections

January 31, 2022

by Paul Ciampoli

APPA News Director

January 31, 2022

The U.S. Court of Appeals for the District of Columbia Circuit recently sided with the San Francisco Public Utilities Commission (SFPUC) in a dispute with Pacific Gas & Electric (PG&E) over electricity connections. In its opinion, the appeals court directed the Federal Energy Regulatory Commission (FERC) to conduct further proceedings related to matters addressed in the decision.

The dispute centers on PG&E’s wholesale service to SFPUC under rules approved by FERC. The SFPUC purchases access to PG&E’s distribution system in San Francisco — paying PG&E about $20 million per year — to serve facilities providing city services.

PG&E, “in an attempt to stymie competition from the SFPUC, has been obstructing public projects for years, demanding the installation of unnecessary and expensive equipment before hooking up those projects to the electric grid,” SFPUC said in a news release related to the court’s decision.

The court’s decision covers two separate appeals from San Francisco, challenging a series of FERC orders.

One, a San Francisco complaint in January 2019 about what SFPUC claimed were PG&E’s demands for costly and unnecessary equipment designed for high-voltage primary power connections. San Francisco argued that secondary connections, which carry lower voltages, are the appropriate connection types for these projects. FERC sided with PG&E, and San Francisco appealed to the D.C. Circuit Court, which ruled in the city’s favor.

The appellate court, in a unanimous ruling by a three-judge panel, found that FERC had not justified its decision to uphold PG&E’s refusal to provide SFPUC interconnections at secondary voltage. Focusing on the Commission’s finding that PG&E’s actions were justified by safety and reliability concerns, the court found that FERC’s decision-making was flawed, noting in the ruling that FERC “does not provide sufficient justification for its conclusion,” “does not meet its burden of reasoned decision-making,” and that FERC’s “‘passing reference to relevant factors,’ … is not sufficient to satisfy [FERC]’s obligation to carry out ‘reasoned’ and ‘principled’ decision making.”

The court also said that the orders on review “present a troubling pattern of inattentiveness to potential anti-competitive effects of PG&E’s administration of its open-access tariff.”

The court said that “More than a century ago, Congress authorized the Hetch Hetchy System not only to provide San Francisco with a source of cheap power but also to ensure competition in its retail power market. Faced with claims that PG&E was frustrating that competition by treating its own retail service preferentially and refusing service for customers San Francisco had served for decades, [FERC] fell short of meeting its ‘duty’ to ensure that rules or practices affecting wholesale rates are ‘just and reasonable.’”

The second case addressed by the court started with a San Francisco complaint in 2013 regarding grandfathered customers who were served up until 1992.

The court found that FERC’s orders on grandfathering, which limited the city’s ability to continue to serve many of the customers it was serving in 1992, “are arbitrary and capricious.”

The court’s decision invalidated FERC’s orders on these topics and sent the matters back to FERC for “further proceedings consistent with this opinion.”

The SFPUC is a department of the City and County of San Francisco. It delivers drinking water to 2.7 million people in the San Francisco Bay Area, collects and treats wastewater for the City and County of San Francisco, and generates power for municipal buildings, residents, and businesses.

California Community Choice Aggregators Enter Into Storage Service Agreement

January 30, 2022

by Paul Ciampoli

APPA News Director

January 30, 2022

A group of California community choice aggregators (CCAs) recently voted to enter into an energy storage service agreement with REV Renewables for 69 megawatts/552 megawatt hours of long-duration energy storage.

The REV Renewables Tumbleweed project will be a California Independent System Operator grid-connected, lithium-ion battery storage resource located near Rosamond, in Kern County, California, with an expected online date of 2026.

The CCAs are members of California Community Power, a joint powers agency.

The participating CCAs are: CleanPowerSF, Peninsula Clean Energy, Redwood Coast Energy Authority, San Jose Clean Energy, Silicon Valley Clean Energy, Sonoma Clean Power Authority and Valley Clean Energy. Participating members will follow their own review and approval processes with their local, elected boards.

The California Public Utilities Commission (CPUC) Mid-Term Reliability Procurement order requires all CPUC-jurisdictional load serving entities, including CCAs, to procure from energy storage facilities capable of discharging for a minimum of 8 hours.

The Tumbleweed project satisfies approximately 55% of the long-duration storage compliance requirements of the participating members.

The joint procurement effort by the CCAs for long-duration energy storage began before the CPUC issued the new procurement order when a subset of the CCAs issued a Request for Offers (RFO) in October 2020 seeking to procure cost effective and viable long-duration storage resources.

Participation in the RFO and resulting projects is voluntary for each joint powers agency member.

The American Public Power Association has initiated a new category of membership for community choice aggregation programs.

PJM, N.J. Regulators File Agreement With FERC Tied To Offshore Wind

January 30, 2022

by Paul Ciampoli

APPA News Director

January 30, 2022

The PJM Interconnection and the New Jersey Board of Public Utilities (NJBPU) recently filed a first-of-its-kind joint agreement with the Federal Energy Regulatory Commission (FERC) on Jan. 27 outlining how New Jersey will put PJM’s competitive planning process to work in pursuit of its offshore wind goals.

The agreement details the contractual commitments and responsibilities of the NJBPU and PJM regarding the competitive selection of transmission solutions to enable New Jersey’s goal of delivering 7,500 megawatts (MW) of offshore wind generation to its residents by 2035.

The filing advances the process from a study agreement FERC approved last year. PJM is asking FERC to issue an order no later than April 15.

PJM is in the process of evaluating 80 proposals submitted in a competitive solicitation window for wind that ran from April 15 to Sept. 17, 2021.

PJM anticipates recommending to New Jersey by May the most cost-effective and efficient transmission solutions. The NJBPU expects to decide whether to sponsor selected transmission projects by September. Each proposal offers solutions to deliver offshore wind generation to the existing bulk electric grid.

Typically, PJM’s Regional Transmission Expansion Plan (RTEP) includes projects driven by reliability or market-efficiency criteria. The state agreement approach provides an avenue to incorporate public policy goals into the process, PJM said.

New Jersey is the first state to make use of the state agreement approach, which enables a state, or group of states, to propose a project to assist in realizing public policy requirements as long as the state (or states) agrees to pay all costs of any state-selected buildout included in the RTEP. Those costs would be recovered from customers in those states.

New York Power Authority To Invest $70 Million To Modernize Underground Power Line

January 29, 2022

by Paul Ciampoli

APPA News Director

January 29, 2022

The New York Power Authority (NYPA) is moving forward with a $70 million upgrade and modernization of the Long Island Sound Cable, an underground transmission line that transverses the Long Island Sound from Westchester County to Nassau County, carrying up to 600 megawatts of electricity to Long Island.

The NYPA Board of Trustees on Jan. 25 approved a nearly $38 million contract with Elecnor Hawkeye, an engineering and construction firm, to undertake the project’s design, manufacturing, delivery, assembly, and commissioning.

The transmission project will enable accelerated progress against New York State’s goal for 70 percent of the state’s electricity to come from renewable sources by 2030. It also advances the State’s path to realize a zero-emission grid by 2040 as outlined in the Climate Leadership and Community Protection Act, NYPA noted.

The reconductoring project, which is slated to begin this fall and complete in 2023, will include the replacement and commissioning of the Nassau County section of the cable, in addition to the installation of additional manholes, fiber optic replacements, and instrumentation improvements to bring operational flexibility to the line and alleviate the risk of faults.

The action by the NYPA trustees builds on the October 2021 board approval to purchase the high-pressure fluid-filled cable needed for the reconductoring project from the Okonite Company for $28 million.

The scope of the project will be submitted to the Department of Public Service within the next few months.

The 26-mile, 345-kilovolt transmission line was placed into service in May 1991 and is part of a statewide network of approximately 1,400 circuit-miles of high-voltage transmission lines and associated substations owned by NYPA.

As part of NYPA’s 10-year strategic plan, VISION2030, NYPA is committed to growing transmission throughout New York State.

The modernization of the Long Island Sound Cable is one of several transmission improvement and development projects NYPA is working on independently, or with other industry partners, across the state, including:

- Smart Path, a $484 million project to improve 78 circuit-miles of transmission from Massena in St. Lawrence County to the Town of Croghan in Lewis County;

- Smart Path Connect, a $605 million, multi-faceted project that includes rebuilding more than 50 circuit-miles of transmission between Massena and the Town of Clinton, rebuilding approximately 55 circuit-miles of transmission southward from Croghan to Marcy, and rebuilding and expanding several substations along the impacted transmission corridor;

- Central East Energy Connect, a $276 million project that includes the construction of more than 90 circuit-miles of new 345 kV and 115 kV transmission lines and two substations between Marcy in the Mohawk Valley and New Scotland in the Capital Region; and

- Clean Path NY, an $11 billion clean infrastructure project that includes a new 174-mile underground transmission line that will enable the delivery of more than 7.5 million megawatt-hours of energy into New York City every year.