Installed Power Capacity Of Large-Scale Battery Storage In U.S. Continued To Grow: EIA

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

Installed nameplate power capacity of U.S. large-scale battery storage reached 1,650 megawatts (MW) by the end of 2020, the U.S. Energy Information Administration (EIA) reported on July 26.

The 2020 figure represents a 35% (or 428 MW) increase compared with installed battery storage capacity at the end of 2019 (1,222 MW), EIA said in its Electricity Monthly Update.

EIA defines large-scale capacity as those systems with a nameplate capacity of 1 MW or greater. Although the first battery storage system reported to us as of December 2020 began operation in 2003, cumulative battery storage did not surpass 100 MW until 2012, it said.

The federal agency noted that significant battery storage growth began in 2015 when 153 MW of annual operational capacity were added, a 90% increase relative to 2014 levels. Following that growth, battery storage surpassed the 1 gigawatt (GW) mark in 2018.

“As currently reported to us, cumulative planned battery storage power capacity additions for 2021 through 2024 equal 10,904 MW (or 10.9 GW). If all of these projects come online and if no current operating capacity is retired, battery storage power capacity could exceed 12 GW by 2024,” EIA said.

EIA said that battery storage systems are being installed tor a number of reasons including:

- Balancing grid supply and demand

- Reserving energy for times of high demand (referred to as peak shaving)

- Storing energy from intermittent renewable sources, such as wind and solar, to dispatch at a later time

- Providing fast response ancillary services, such as frequency regulation

- Creating opportunities to take advantage of price arbitrage

According to EIA, the most recent increase in new storage capacity is mainly due to the installation of battery energy systems connected to solar projects.

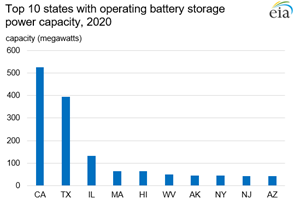

The federal agency reported that the 1,650 MW of operating battery storage power capacity at the end of 2020 were spread out across 33 states, although more than 70% were in 5 states: California, Texas, Illinois, Massachusetts, and Hawaii. Each of these states have over 50 MW of battery storage power capacity. California has the most with 506 MW of battery storage power capacity. Each of these five states have passed legislation in recent years, either to establish requirements for energy storage or to provide financial incentives for new projects, EIA noted.

The 10,904 MW of planned battery storage power capacity additions through the end of 2024 are spread out across 22 states, although over 70% were in 4 states: California, Texas, New York, and Arizona.

California has more than 4 GW of battery storage power capacity planned by 2024, Texas and New York are planning to install over 1 GW each, and Arizona plans to install just under 1 GW.

EIA said that the top 10 states for planned battery storage capacity additions (including Nevada, Florida, New Mexico, Hawaii, Colorado, and Massachusetts) account for 94% of planned additions, or 10.5 GW, by 2024.

EIA said that the concentration of new battery storage capacity additions in the top 10 states may be partly due to one or more of the following factors:

- A high renewable resource base where storage can partner with, or be situated near, projects to take advantage of that resource (for example, very windy or sunny locations)

- State policies that encourage renewable and battery systems

- The presence of local, real-time, capacity-constrained markets that may present economic opportunities for battery storage systems

EIA noted that it will soon publish an update to the report U.S. Battery Storage Market Trends. This report provides further information about battery storage projects including geographic representation, ownership, chemistry, applications, costs, and future trends.

The American Public Power Association’s Public Power Energy Storage Tracker is a resource for association members that summarizes energy storage projects undertaken by members that are currently online.

Infrastructure Bill Excludes Provisions Encouraging Sale Of Public Utilities

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

The Infrastructure Investment and Jobs Act includes a number of provisions of importance to public power utilities including in areas related to cybersecurity and electric vehicle infrastructure. At the same time, it does not incorporate provisions encouraging the sale of public utilities and other revenue generating assets as a way to fund additional infrastructure investments.

The Senate on Aug. 1 began debate on the legislative text, called the Infrastructure Investment and Jobs Act, of an infrastructure framework negotiated over the last several weeks between 22 Democratic and Republican senators.

An initial draft of the senators’ Bipartisan Infrastructure Framework had listed so-called asset recycling as an area of agreement, and opposition to this proposal was a top priority for the American Public Power Association (APPA). Joy Ditto, President and CEO of APPA, on July 14 wrote to President Joseph Biden in opposition to using infrastructure funding legislation to encourage the privatization of public facilities.

The text of the agreement does not incorporate provisions encouraging the sale of public utilities and other revenue generating assets as a way to fund additional infrastructure investments.

Details On Infrastructure Investment and Jobs Act

A section of the bill establishes a grant program at the Department of Transportation to provide grants to eligible entities, including public power, for the deployment of electric, hydrogen, propane, or natural gas vehicle infrastructure along designated Alternative Fuel Corridors. Entities are required to contract with a private entity for the acquisition and installation of fueling infrastructure and may use a portion of grant funds to pay a private entity to operate and maintain the infrastructure for up to five years and/or to enter into a cost-sharing agreement with the private entity.

Fifty percent of the overall funding is set aside for “Community Grants” for which public power would also be eligible. These grants do not require, but allow for, partnerships with private entities and can be used to deploy fueling infrastructure in public locations, including parking facilities, public buildings, public schools, and parks. This section is based on the Clean Corridors Act, which APPA supports.

Another section of the legislation would require the Secretary of Energy, in consultation with state regulatory authorities, industry, the Electric Reliability Organization, and other relevant federal agencies, to carry out a program to promote and advance the physical security and cybersecurity of electric utilities, with priority provided to utilities with fewer resources. This section of the bill also requires a report to Congress on improving the cybersecurity of electricity distribution systems.

APPA is supportive of this provision. It is modeled upon an existing, successful public-private partnership funded by DOE’s Office of Cybersecurity, Energy Security, and Emergency Response Cybersecurity for Energy Delivery Systems program between the department and APPA to bring greater resources, training, and tools for cyber and physical security to small- and medium-sized electric utilities.

The bill would also authorize $500 million for the period of fiscal years 2022 through 2026 for a state energy program for state, local, and Tribal governments to support transmission and distribution planning, including feasibility studies of line routes and alternatives, preparation of necessary project designs and permits, and outreach to affected stakeholders.

The legislation would also increase the borrowing authority made available to the Bonneville Power Administration under the Federal Columbia River Transmission System Act by an additional $10 billion.

In addition, the bill calls for the establishment of a new Treasury account for the purposes of making expenditures to increase bilateral transfers of renewable electric generation between the United States and Canada — $100 million is authorized to be appropriated to carry out the relevant subsection of the bill, which is specified as non-reimbursable.

The bill also directs a study of the potential hydroelectric power value to the Pacific Northwest of increasing the coordination of the operations of hydroelectric and water storage facilities on American and Canadian rivers.

Also, the bill would appropriate $500 million to the Western Area Power Administration for the purchase of power and transmission services.

APPA Weighs In On Interim Final Rule For Coronavirus Relief Funds

July 29, 2021

by Paul Ciampoli

APPA News Director

July 29, 2021

The American Public Power Association (APPA) recently weighed in on an interim final rule (IFR) for coronavirus state and local fiscal relief recovery funds in comments submitted to the U.S. Department of Treasury.

In its July 16 comments, APPA said it strongly supports Treasury’s decision in the IFR to allow coronavirus state and local fiscal relief recovery funds to be used for purposes similar to those of coronavirus relief funds previously authorized.

At the same time, APPA said it disagrees with Treasury’s decision to exclude electric power utilities from the definition of general revenue.

“Historically, public power utilities nationwide on average contribute 5.4 percent of their operating revenues back to the communities they serve. However, the inability of some customers to pay their utility bills due to the COVID-19 pandemic has significantly affected many public power utilities,” APPA said. Treating lost utility revenue as lost general revenue, would allow these communities to use coronavirus state and local fiscal relief recovery funds to offset these losses, the public power group said.

The IFR states that assistance, including utility assistance, to households or populations facing negative economic impacts due to COVID-19 is an eligible use of coronavirus state and local fiscal relief recovery funds. The IRF also allows such assistance to be predicated on the assumption that households or populations experiencing economic harm during the pandemic experienced that harm due to the pandemic, and thus qualify for assistance.

“APPA believes this flexibility is appropriate and will help reduce barriers to relief to those who need it most,” it said.

APPA also strongly supported Treasury’s guidance in the form of Frequently Asked Questions relating to the use of CRF funds Office of the Undersecretary for Domestic Finance and the prohibition of CRF to replace lost revenues.

Specifically, that guidance clarified the parameters under which CRF lost revenue prohibitions would not be violated by a utility payment assistance program benefiting customers of public power utilities. We believe that guidance continues to help communities draft programs of benefit to public power utility customers.

“However, as we understand the rules, households must still attest to their need before relief can be provided,” APPA said. “Because many households are being shielded from the effects of the pandemic by utility shutoff moratoria, there is growing evidence that these households are not seeking relief. In fact, while electric utility customer arrearages are soaring in many communities, we have heard anecdotally that the number of applications for Low Income Home Energy Assistance Program benefits are down.”

Allowing programs supported by coronavirus state and local fiscal relief recovery funds to provide relief directly to customers in arrears without such an attestation would get around this hurdle, APPA said.

Meanwhile, APPA noted in its comments that the statute allows the use of coronavirus state and local fiscal relief recovery funds for the provision of government services to the extent of reduction in revenues.

“As we read the IRF, that includes the provision of electric utility services. However, the IRF specifically excludes utility revenues from the definition of lost general revenue,” APPA said.

As a result, the “pool” of coronavirus state and local fiscal relief recovery funds that could be spent as “lost revenue” funds will be smaller than the actual amount of lost revenue. “While we understand the need for a simple clear methodology for defining this term, it simply does not reflect reality for communities that own or operate their own electric utility. More importantly, it puts at a disadvantage those communities that have suffered significant electric utility arrearages due to the pandemic.”

APPA conducts annually a survey of its members, including an in-depth study of their finances. Consistently these surveys show public power utilities contributing to their communities. For example, the 2020 survey on 2018 financials, showed that, on average nationwide, public power utilities contributed roughly 5.4 percent of operating revenues back to their communities.

However, in February 2021, APPA surveyed its members about the dollar amount of residential arrearages for their electric power utility for January 2020 and then January 2021. Overall, surveyed utilities reported arrearages totaling $375 million as of January 2020 and arrearages totaling $778 million as of January 2021. This is a net increase of $402 million. Measured against residential revenue, arrearages as of January 2021 totaled 5.1 percent of residential income.

Responses to the survey were also quite varied. “Some communities have done relatively well during the pandemic, and so customer payment of bills has not fallen – in fact, in a handful of communities, arrearages have declined. In most communities, however, there has been an increase in arrearages as a result, and in roughly one third of communities, these increases have been quite substantial (with the definition of ‘substantial’ being admittedly subjective),” APPA said.

Many of those communities seeing the highest arrearages are in areas hit particularly hard by the pandemic and where the community has chosen to suspend utility shutoffs or are required to suspend shutoffs by the state.

While coronavirus state and local fiscal relief recovery funds can be used for utility assistance payment relief, that is only helpful if customers are seeking relief and willing to attest to their need for relief, the public power trade group pointed out.

Allowing utility lost revenue to be treated as lost general revenue would ensure that the pool of coronavirus state and local fiscal relief recovery funds that could be spent as “lost revenue” funds is closer to the actual amount of lost revenue. In turn, that would allow public power utilities to seek the use of coronavirus state and local fiscal relief recovery funds for use “for the provision of government services,” APPA said.

“If allowed, our members have indicated that they would most likely seek to use these funds to establish customer assistance programs in which they credit customer accounts for arrearages. Again, as a replacement of lost revenues, this relief could be provided without the heavy hand of the threat of a utility shut off.“

Bipartisan Bills In Congress Allow For Energy Tax Credit Transfer To Public Power Owners

July 29, 2021

by Paul Ciampoli

APPA News Director

July 29, 2021

Bipartisan legislation in Congress calls for a technology-inclusive, flexible investment tax credit (ITC) or production tax credit (PTC) designed to promote innovation across a range of clean energy technologies, including generation, storage, carbon capture, and hydrogen production. The American Public Power Association (APPA) supports the legislation.

The Energy Sector Innovation Credit Act was reintroduced on July 27 by Senate Finance Committee Ranking Member Mike Crapo (R-ID) and Finance Committee member Sheldon Whitehouse (D-RI), along with House Ways and Means Committee members Tom Reed (R-NY) and Jimmy Panetta (D-CA).

The legislation would allow qualifying facility owners to transfer any credits that accrue to project partners, including someone who has an ownership interest in the property, provided equipment for or services in the construction of the property, provides electric transmission or distribution services for such property, purchases electricity from the property pursuant to a contract, or provides financing for the property.

While APPA is primarily pursuing the direct payment of energy tax credits, Crapo and Reed have been leaders in the efforts to obtain comparable incentives for public power and APPA is supportive of their efforts.

In a letter to Crapo and Reed, APPA President and CEO Joy Ditto noted that allowing the transfer of energy-related tax credits to other project partners “would be an important step to removing the financial disincentive for public power utilities to own such facilities, which are needed to transition to cleaner generating technologies.”

Along with APPA, the legislation is supported by a number of other groups and entities including Utah Associated Municipal Power Systems (UAMPS).

Established in 1980, UAMPS is an energy services interlocal agency of the state of Utah. As a project-based consortium, UAMPS provides a variety of power supply, transmission and other services to its 47 members, which include public power utilities in six western states: Utah, California, Idaho, Nevada, New Mexico, and Wyoming.

Schuetz Selected As Energy Northwest’s New CEO

July 29, 2021

by Paul Ciampoli

APPA News Director

July 29, 2021

Richland, Wash.-based Energy Northwest’s Executive Board on July 29 named Robert Schuetz as the agency’s CEO, effective Aug. 7.

Schuetz joined Energy Northwest in 2013. He was promoted to plant general manager for the Columbia Generating Station in 2014 and became site vice president in 2018.

Before joining Energy Northwest, he served as a plant evaluation team leader for the Institute of Nuclear Power Operations (INPO), concluding his INPO tenure on a reverse-loan assignment to Energy Northwest.

Hettel To Continue as chief nuclear officer

Grover Hettel will remain Energy Northwest’s chief nuclear officer with responsibility for the overall performance of the Northwest region’s only nuclear power plant, Columbia Generating Station, which provides approximately 10% of Washington State’s electricity.

During the last decade, Energy Northwest’s Columbia Generating Station set numerous generation records and received industry recognition for performance. The agency has earned multiple safety awards, reduced costs and was named as a utility partner for two Department of Energy’s Advanced Reactor Demonstration Program awards.

Ormat Solicitation Seeks Buyers For Output Of 26-MW, California Geothermal Plant

July 29, 2021

by Peter Maloney

APPA News

July 29, 2021

Ormat Nevada is seeking bids for the purchase of capacity and energy from its repowered 26 megawatt (MW) Heber 2 geothermal project in Heber, Calif.

The winning bidder will receive all available environmental attributes and capacity rights and energy output associated with the geothermal plant as a bundled product that qualifies under California rules for in-state bundled renewable energy credits.

The plant has a 95 percent capacity factor and an existing on-site interconnection within the Imperial Irrigation District’s 92 kilovolt (kV) system and firm transmission service rights to deliver energy at the California Independent System Operator (CAISO) 230-kV Mirage intertie.

Heber 2 is owned and controlled by OrHeber 2 LLC, a subsidiary of Ormat Nevada.

Geothermal energy is well suited to complement intermittent forms of renewable energy such as photovoltaic solar power by supplying energy 24 hours a day regardless of weather conditions, Ormat said. The company noted that, as of June 2021, the California Public Utilities Commission is requiring load serving entities to procure 11,500 MW of new clean electricity by 2026, of which 1,000 MW must be firm power with an 80 percent capacity factor, produces zero on-site emissions, and is weather independent.

The deadline to submit questions regarding the solicitation is Aug. 6. Questions should be addressed to abartosz@ormat.com and will be answered by Aug. 13. Bids are due Aug. 20. Ormat expects to notify the shortlisted buyers by Sept. 10.

The request for bids is available here,

The Heber 2 project is a water-cooled, binary geothermal facility that has been in operation since 1993. It is being repowered to increase its capacity to 26 MW from 12 MW by the replacement of the Ormat Energy Converter units while retaining the existing physical plant footprint. Ormat expects to complete the repowering and have the plant online by Jan. 1, 2023.

The company says the plant will have a 95 percent capacity factor and be able to deliver about 216,000 megawatt hours (MWh) in its first year of operation. Ormat estimates the annual degradation of the facility at 0.05 percent.

Ormat self financed the project and the plant site fully controlled on private land owned by Ormat. The existing facility has all required major permits, and the project has completed a Phase 1 Environmental Site Assessment and has primary local land use permits, Ormat said.

Ormat said preference will be given to bidders who:

- allow for solar power for auxiliary load service, increasing the geothermal output;

- are flexible on the estimated repowering online date;

- offer pricing at P-node or the Mirage 230-kV substation;

- enable Ormat to post a surety for the development and operating securities; and

- are willing to lower the risk of liquidated damages for delays on achieving development period minimums.

A recent report from the National Renewable Energy Laboratory outlined the potential of geothermal energy and the impediments for its deployment.

California Grid Operator Issues Call For Power Conservation

July 28, 2021

by Paul Ciampoli

APPA News Director

July 28, 2021

The California Independent System Operator (CAISO) issued a call for voluntary electricity conservation, for Wednesday, July 28, due to predicted high energy demand and tight supplies across the West.

With higher-than-normal temperatures in the forecast for parts of interior Northern California, the power grid operator on July 27 said it was predicting an increase in electricity demand, primarily from air conditioning use.

CAISO issued the statewide Flex Alert for 4 p.m. to 9 p.m.

A Flex Alert is issued by CAISO when the electricity grid is under stress because of generation or transmission outages, or from persistent hot temperatures.

“Consumers are urged to conserve electricity, especially during the late afternoon and early evening, when the grid is most stressed due to higher demand and solar energy production falling,” the grid operator said. “Consumers are also asked to turn off unnecessary lights, delay using major appliances until after 9 p.m., and set air conditioner thermostats to 78 degrees or higher, if health permits.”

CAISO in a July 28 system conditions bulletin said that several conditions were impacting the grid.

“While the temperature forecast is slightly above normal for parts of California, and demand is projected to be moderately high, there are weather and demand uncertainties, which affects our forecasting data,” it said.

“We are also monitoring several wildfires in and outside of California that could threaten generation and transmission, limiting energy supplies. And there is always the possibility of equipment failure and forced outages on the system,” CAISO said.

“All of these conditions taken alone would normally have minor impacts to the grid, but as the power grid operator, the ISO must plan for unexpected events, such as wildfires or forced line or plant outages, that could whittle into energy supplies and affect grid reliability. To keep the grid stable, the ISO is asking Californians to reduce electricity use from 4 to 9 p.m. today, the critical time of need on the system, when solar production is ramping down and electricity demand can remain high. If everyone makes some small adjustments, the extra supplies can act as a shock absorber in case of unexpected events today,” the July 28 system conditions bulletin said.

“The ISO is not anticipating any rotating power outages at this time. We believe consumer conservation will be key to getting through the most critical period this evening.”

The ISO said it would decide if another Flex Alert is needed for Thursday, July 29, following the close of the market on the afternoon of July 28 and a review of updated weather forecasting.

Earlier this month, a rapidly growing wildfire in Oregon – the Bootleg Wildfire – that threatened transmission lines used to import energy to California and extreme heat throughout California pressured California’s electric grid, prompting CAISO to extend a statewide Flex Alert.

San Francisco Asks CPUC To Determine Value Of PG&E’s Local Electric Assets

July 28, 2021

by Paul Ciampoli

APPA News Director

July 28, 2021

The City and County of San Francisco on July 27 submitted a petition with the California Public Utilities Commission (CPUC) seeking a formal determination of the value of investor-owned Pacific Gas & Electric’s local electric infrastructure, the next step in San Francisco’s efforts to acquire the utility’s city-based electric facilities and complete the city’s transition to public power.

“Owning the grid would allow San Francisco to provide clean, reliable and affordable electricity throughout the City while also taking meaningful climate action, like reaching its set target of using 100% renewable electricity by 2025,” the Office of San Francisco Mayor London Breed noted in a news release.

The move comes after the city made a $2.5 billion offer in 2019 to purchase PG&E’s local electric assets. San Francisco resubmitted its offer when PG&E emerged from bankruptcy in 2020. PG&E rejected both San Francisco purchase offers.

“San Francisco is ready to transition to full public power, and today we are asking the CPUC to determine a fair price that will allow us to move forward with the acquisition of our local power grid,” said Breed in a statement. “It’s been clear for a long time that full public power is the right choice for our city and our residents, and we know we can do this job more safely, more reliably, and more cost effectively than PG&E. It’s time for everyone in the city to have access to clean, reliable, affordable public power.”

“Generally, electric service provided by publicly-owned utilities is more affordable than service from investor-owned utilities,” the petition noted. “This is due to factors such as the absence of large executive bonuses, shareholders, and taxes.”

Transitioning to public power has public support. A 2019 poll found that nearly 70% of San Franciscans support switching to public power.

In the valuation petition filed by City Attorney Dennis Herrera, the city asks the CPUC to determine the just compensation to be paid for PG&E’s electricity distribution assets that serve San Francisco. State law gives the CPUC the authority to set definitive valuations for utility assets. San Francisco’s petition also proposes a process for the Commission to assess the value of PG&E’s electric facilities.

Breed’s office noted that San Francisco has demonstrated its effectiveness as a local power provider for more than 100 years, delivering hydropower from Hetch Hetchy Power to customers like the San Francisco International Airport, the San Francisco Zoo, and Zuckerberg San Francisco General Hospital. The San Francisco Public Utilities Commission’s (SFPUC) CleanPowerSF program also purchases renewable power for over 370,000 homes and businesses. Collectively, the two programs provide more than 70% of the electricity consumed in San Francisco.

San Francisco has also set a goal of shifting to 100% renewable electricity by 2025 and 100% renewable energy by 2040, a target that will be easier to achieve if San Francisco had local control of its power grid.

San Francisco would use bonds secured by future revenues from electricity generation to acquire PG&E’s infrastructure, so no funds for existing city services, like affordable housing, libraries or addressing homelessness, would be affected.

In the valuation request, San Francisco said that PG&E’s “ongoing problems with providing safe and reliable gas and electric service throughout its service territory are well-known.” The city noted that the CPUC has acknowledged that PG&E’s recent history of safety performance “has ranged from dismal to abysmal.”

While San Francisco has not experienced the devastation associated with catastrophic wildfires and other disasters caused by PG&E, “over the years PG&E’s difficulty in maintaining a safe and reliable system has caused multiple incidents resulting in injuries and property damage within the city,” the petition said.

“PG&E customers in San Francisco, like PG&E’s other customers, have also paid substantial costs resulting from PG&E’s physical and financial disasters, including two bankruptcies in as many decades,” the city said.

The city also said that while San Francisco’s acquisition of PG&E assets in San Francisco would benefit the city and its residents, such an acquisition would not materially burden PG&E’s remaining ratepayers and could potentially benefit them as well.

The petition pointed out that San Francisco is a small part of PG&E’s large service territory and PG&E’s revenues per San Francisco customer are smaller than its revenues per PG&E customer outside the city. “The size of PG&E’s remaining service territory would be reduced along with its service obligations. This alone could benefit remaining ratepayers as PG&E would no longer have any expenses or service obligations related to the upkeep — and future capital needs — of the assets purchased by San Francisco.”

Acquisition of PG&E’s property serving San Francisco will provide numerous benefits, the petition said, including enabling the city to provide affordable, safe, and reliable service, and take meaningful environmental and climate action; and improve its programs to ensure workforce development and equity.

“Electric service provided by the city would also be more transparent and accountable to customers,” the city said, noting that bi-weekly meetings of the SFPUC are open to the public.

In addition, rate setting decisions are governed by the city’s charter, which requires independent review, and are subject to rejection by the Board of Supervisors. And SFPUC Commissioners are appointed by the mayor, subject to approval by the Board. “Ultimately, the mayor and board are directly accountable to the voters.”

The petition said that the city developed the two formal offers to PG&E to purchase the assets the city would need to serve San Francisco customers with the advice of experts using standard methods of asset valuation.

“In its responses, PG&E claimed that the city’s offer price was far below the value of the assets. The city seeks to fix the value of the targeted assets using the Commission’s unique expertise under authority granted to the Commission by state law. The city hopes that establishing a definitive value will facilitate negotiation of an acquisition transaction with PG&E.”

Reading Municipal Light Department Awarded Public Access Charging Grant

July 27, 2021

by Paul Ciampoli

APPA News Director

July 27, 2021

The Reading Municipal Light Department (RMLD) has been awarded a Massachusetts Electric Vehicle Incentive Program (MassEVIP) public access charging grant to support the installation of five dual-port level 2 electric vehicle (EV) charging stations in its service territory.

Level 2 EV charging stations provide a charging rate of approximately 10-25 miles of range per hour of charge depending upon vehicle model. Three of the stations will be located in Reading and two of the stations will be located in Wilmington, Mass.

The MassEVIP grant award is just the first of many steps in the process of installing the public charging stations. The RMLD is working with the towns to finalize placement and design, develop a plan for construction, and refine the associated operating policies.

This initial grant totaled just under $80,000.

The MassEVIP public access charging program provides incentive funding to cover a portion of the cost of electric vehicle charging stations that are accessible to the general public. The RMLD will contribute funding and operational support to the installations.

Increasing the adoption of electric vehicles is an important component in RMLD’s ongoing electrification efforts, as well as decarbonization efforts across Massachusetts, the public power utility noted. Increasing the availability of public charging infrastructure will support these efforts.

Updates will be provided as the installations progress.

To learn more about electric vehicles and RMLD’s related rebate programs, visit https://www.rmld.com/electric-vehicle-rebate-programs.

Established in 1894, RMLD serves over 70,000 residents in the towns of Reading, North Reading, Wilmington, and Lynnfield Center. RMLD has over 29,000 meter connections within its service territory. Residential customers account for approximately one-third of RMLD’s electricity sales while commercial, industrial, and municipal customers account for about two-thirds of sales. There are over 3,000 commercial and/or industrial customers in the communities RMLD serves.

The American Public Power Association’s Public Power EV Activities Tracker summarizes key efforts undertaken by members — including incentives, electric vehicle deployment, charging infrastructure investments, rate design, pilot programs, and more. Click here for additional details.

Growth of solar-plus-storage not fully explained by economics: Berkeley Lab report

July 27, 2021

by Peter Maloney

APPA News

July 27, 2021

The pairing of photovoltaic (PV) solar power with battery storage is growing but represents a small portion of the market and cannot be fully explained by economics, according to a new report from the Lawrence Berkeley National Laboratory (LBNL).

The report, Behind-the-Meter Solar+Storage: Market Data and Trends, found that out of the 3,200 megawatts (MW) of battery storage installed in the United States through 2020 about 1,000 MW, or 30 percent, was behind-the-meter and 550 MW of that was paired with solar power. The overwhelming majority, 80 percent, of the combined solar and storage installations were in the residential sector.

Most non-residential energy storage installations were done on a stand alone basis with only about 40 percent paired with solar power. In the utility scale, front-of-the-meter market segment, only 420 MW, or 19 percent, of storage capacity was paired with solar power.

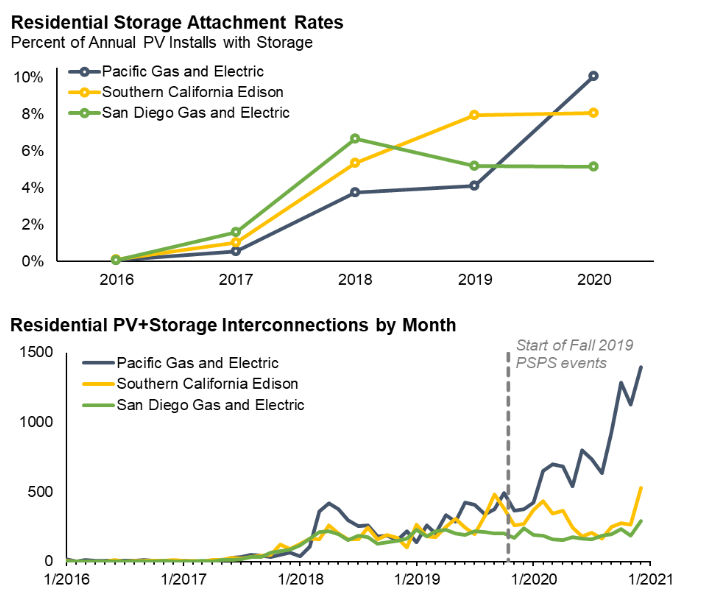

Of all the residential photovoltaic solar systems installed in 2020, about 6 percent included storage and only 2 percent of non-residential solar systems included storage, but there were wide variations in the numbers depending on location, the report found.

Hawaii has, by far, the highest storage attachment rates of any state with 80 percent of residential and 40 percent of non-residential solar systems including storage in 2020. That market, the report says, is driven by net metering reforms that incentivize self-consumption instead of utility payments for excess solar generation.

California was a distant second with 8 percent of residential and 2 percent of non-residential solar systems attaching storage in 2020, driven mostly by incentives and wildfire resilience issues, the report found.

While attachment rates are generally lower outside of California and Hawaii, some utilities, such as Salt River Project in Arizona and Puget Sound Energy in Washington, have attachment rates in the 10 to 20 percent range. In general, however, the report found that residential attachment rates have been rising while non-residential trends are uneven, but in aggregate have been “fairly flat.”

The report also found that residential adopters of solar-plus-storage systems generally have higher incomes than stand-alone PV solar adopters. In California, for instance, solar-plus-storage adopters had median incomes 66 percent higher than their area median income, while stand-alone solar adopter incomes were 41 percent higher.

Within the non-residential sector, for-profit commercial entities comprise about 70 percent of all paired non-residential systems. Schools make up a notably larger share, 25 percent, of paired solar-plus-storage systems than they do for stand-alone solar systems (8%), reflecting “a unique resilience value and relatively large loads,” the report said.

The report also used three different data sources to look at the cost of adding storage to a solar installation and found an incremental cost of adding storage to a residential PV solar system to be about $1,000 per kilowatt hour (kWh) of storage, implying an installed price premium of about $1.20 per watt of solar PV.

In addition to finding that the deployment of solar-plus-storage is locationally specific and driven by rate structures, incentive programs, and natural disaster threats, the report concluded that installed prices for behind-the-meter battery systems have generally risen or remained flat over the past few years. Increasing adoption of battery storage systems cannot, therefore, be attributed to falling retail costs alone, the authors said.

“Deployment trends partly reflect the underlying economics, but there are also some apparent disconnects,” The report’s authors said. Among the disconnects, they noted lower attachment rates in the non-residential sector than in the residential sector, divergent attachment rates across regions with similar payback, and uneconomic adoption in some markets. “Those apparent disconnects may partly reflect other sources of value beyond the direct financial benefits—including potential customer reliability benefits from backup power during outages,” the authors concluded.