Power Sector Carbon Dioxide Emissions Fell 10 Percent Between 2019 And 2020: Report

July 27, 2021

by Peter Maloney

APPA News

July 27, 2021

Power sector carbon carbon dioxide (CO2) emissions fell 10 percent between 2019 and 2020, according to a recently issued report.

The report, Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States, was written by M. J. Bradley & Associates, and issued by Ceres, Bank of America, Entergy, Exelon, and the Natural Resources Defense Council (NRDC).

The CO2 emissions decline documented in the report is the largest year-over-year decrease since the report was first released in 1997.

The benchmarking analysis examines and compares key air pollutant emissions from the 100 largest U.S. power producers, including nitrogen oxides (NOx), sulfur dioxide (SO2), CO2, and mercury. The U.S.’ 100 largest power producers accounted for more than 80 percent of the sector’s total generation in 2020. The analysis uses publicly reported generation and emissions data from the Energy Information Administration (EIA) and the Environmental Protection Agency.

The coronavirus pandemic may have been a contributing factor, but the drop in emissions is part of a long-term trend fueled by increased renewables generation and coal-to-gas transitions, according to the Ceres report.

“Industry-wide, the pace of decarbonization is picking up, and as renewables come online to displace fossil fuels, we have the opportunity to accelerate that trend,” Dan Bakal, senior director for electric power at Ceres, said in a statement. “The growth in renewables has allowed us to separate economic growth from emissions, and this year represents one of the most dramatic decoupling points that we have seen.”

Between 2000 and 2020, power sector CO2 emissions decreased 37 percent while gross domestic product (GDP) grew 40 percent and, over the same period, generation from non-hydro renewables more than doubled, the Ceres report noted.

The report also noted that power sector CO2 emissions in 2020 were roughly 40 percent below the industry’s 2007 peak. Power sector emissions of SO2 and NOx emissions have decreased 93 percent and 85 percent from 2000 levels, respectively, the report found. And power plant mercury emissions have decreased 92 percent since 2000.

The Ceres report also noted that the share of power produced by non-hydro renewables jumped 20 percent from 2019 levels, and the share from coal decreased by roughly 17 percent. Meanwhile, natural gas, for the fifth year in a row, was the leading source of electricity generation at 40 percent, followed by nuclear power at 20 percent. Power from non-hydro renewable sources made up 11 percent of total U.S. generation in 2020, of which 20 percent came from solar power, 76 percent from wind, and 4 percent from geothermal sources, the report said.

EIA report

Meanwhile, overall CO2 emissions from energy consumption fell to the lowest level since 1983, according to the Energy Information Administration’s (EIA) Monthly Energy Review, which surveys the consumption of primary energy sources.

The 4.6 billion metric tons (Bmt) of CO2 emitted in 2020 was an 11 percent decrease from 2019, the largest annual decrease on record, the EIA said.

In 2020, natural gas consumption accounted for 1.7 billion metric tons (Bmt) of CO2 emissions, or about 36 percent of the total, the fuel’s largest share on record, the EIA said. About 38 percent of CO2 emissions from natural gas in 2020 came from the electric power sector and 32 percent from the industrial sector, EIA said.

Coal consumption accounted for 0.9 Bmt of CO2 emissions, or about 19 percent of total 2020 CO2 emissions, which is both the lowest total amount and the lowest share since EIA began its annual data series in 1973, the agency said, adding that about 90 percent of CO2 emissions from coal in 2020 were from the electric power sector. Coal accounted for 54 percent of electric power CO2 emissions in 2020, even though the fuel accounted for 19 percent of electricity generation last year, EIA said.

“The power sector continues its march away from fossil fuels, replacing them with clean sources like wind and solar. But there is still a ways to go,” Starla Yeh, director of the policy analysis group in the climate and clean energy program at NRDC, said in a statement. “We’ll need to at least double the share of clean electricity in the generation mix by 2030 to meet the administration’s goals for the sector of 80 percent clean by 2030 and 100 percent by 2035.”

In April, President Joe Biden announced a nationwide goal of 100 percent carbon-free electricity by 2035.

Henderson, Ky., City Commission Rejects Sale of Public Power Utility To Cooperative

July 27, 2021

by Paul Ciampoli

APPA News Director

July 27, 2021

The City Commission of Henderson, Ky., recently voted to reject a proposal by Kentucky electric cooperative Big Rivers Electric Corporation to purchase Henderson Municipal Power & Light (HMP&L), the city’s public power utility.

The vote by the Henderson City Commission took place on July 13 and came after the Henderson Utility Commission in June recommended against selling HMP&L.

At the meeting, Henderson City Commissioner Austin Vowels said that “what our consultant told us was you can expect rates in Henderson to increase if you accept this offer and sell” HMP&L. He noted that Big Rivers offered its own analysis related to the cooperative’s offer.

“My fear and the reason I vote against this transaction happening is that I think it ultimately in the end leads to significant rate increases for the people of Henderson,” Vowels said.

Henderson Mayor Steve Austin said that he sees “no pressing reason for the City of Henderson to sell its municipal utility to an outside agency.”

He noted that HMP&L “offers our citizens the lowest household electric rates in the state, provides excellent service and provides steady financial support for the city.”

Big Rivers, which has made previous offers to buy HMP&L, also attempted to buy another Kentucky public power utility, Owensboro Municipal Utilities. “It is very interesting to me that the City of Owensboro turned down Big Rivers’ offer to buy its municipal utility within about 72 hours after the offer was made,” Austin said at the Commission meeting.

Austin went on to say that “municipal utilities across the state have added value to cities and customers in many, many ways.”

Among the provisions of the Big Rivers offer to buy HMP&L was a payment of $90 million to the City of Henderson.

But Henderson City Commissioner Bradley Staton noted that HMP&L has more than $30 million in its reserves and so “if Big Rivers were to purchase HMP&L they would be using that money to go toward the purchase of HMP&L. So the offer was really for a little less than $60 million, not $90 million.”

Earlier this year, Chris Heimgartner, General Manager of HMP&L, made a presentation before a joint meeting of the City of Henderson, Kentucky Board of Commissions and the Utility Commission regarding Big Rivers Electric’s offer to purchase HMP&L.

Among other things, Heimgartner said in the presentation that the Big Rivers offer was “a very poor proposal” for the City of Henderson and HMP&L’s customers and said it should be declined.

Meanwhile, in early June, PFM Financial Advisors made a presentation before a joint meeting of the City of Henderson, Kentucky Board of Commissions and the Utility Commission regarding Big Rivers Electric’s offer to purchase HMP&L. PFM was hired by the City of Henderson to analyze the offer made by Big Rivers.

The report completed by PFM did not make a recommendation to either sell or retain HMP&L.

In its analysis of impacts on the city as a result of a sale, PFM listed a number of qualitative considerations including, among others, reduced operational and economic synergies with the city and loss of control over an essential service and on its leadership.

Big Rivers is a member-owned, not-for-profit, generation and transmission cooperative (G&T) headquartered in Henderson, Ky., which provides wholesale electric power and services to three distribution cooperative members across 22 counties in western Kentucky.

HMP&L provides electric transmission, distribution, and fiber internet and phone services to the citizens of Henderson.

Fitch Report Shows Strong Financial Trends For Public Power Utilities

July 26, 2021

by Peter Maloney

APPA News

July 26, 2021

Public power utilities in the United States are exhibiting strong financial trends and improving credit quality, according to a new report from Fitch Ratings.

The report, 2021 U.S. Public Power Peer Review, presents a variety of metrics, such as cash on hand, leverage, and debt service coverage, to gauge the financial health of the sector and compare performance across covered utilities as a whole and by classes.

“The latest peer review shows that modest ratios of capital investment to depreciation and improving coverage medians again contributed to low leverage and improving credit quality throughout the public power sector in 2020,” Dennis Pidherny, managing director of U.S. public finance at Fitch, said in a statement.

“These results are particularly surprising given the impact of the coronavirus outbreak and the related economic contraction,” Pidherny said. “They further illustrate the sector’s operating and financial resilience, and its ability to record strong performance even through a very challenging period.”

Among the prominent trends, Pidherny noted that median ratios for coverage of full obligations improved for both wholesale and retail systems, sustaining an upward trend. Wholesale and retail, as well as combined ratios for Fitch entire portfolio of public power utilities continued a gentle upward slope, converging around 1.4 times debt obligations in the 2021 peer review.

Cash on hand medians for retail and wholesale utilities improved again, rising to the highest levels observed in a decade, according to the report. Fitch analysts attributed the build-up of excess cash to modest levels of capital investment, stronger than anticipated demand through the coronavirus pandemic, and disciplined rate setting initiatives.

The median capital expenditure-to-depreciation ratio for wholesale power systems continued a downward trend, falling to 71 percent. The median ratio has been below at or below 100 percent for five of the last seven years, according to the report. The median capex-to-depreciation ratio for retail power systems “improved” to 149 percent, a level last observed in 2010, Fitch said.

Leverage metrics for both wholesale and retail systems were largely unchanged, the report found, with a modest increase in leverage among retail power systems offset by a modest decline in metrics for wholesale systems. Overall, the metric reflects the continuation of a deleveraging trend that began over a decade ago, Fitch said.

Fitch calculated the ratios for each issuer using audited information. More than half the audits used in the report are dated Dec. 31, 2020, but different audit dates were also used and could skew the ratio distribution, Fitch noted. The rating agency also noted that the ratios and metrics in the report may occasionally differ from those reported in new issue and rating reports because of adjustments made during the rating process to reflect additional information received from the issuer.

Two California Community Choice Aggregators Contract For Renewable Energy, Energy Storage

July 23, 2021

by Paul Ciampoli

APPA News Director

July 23, 2021

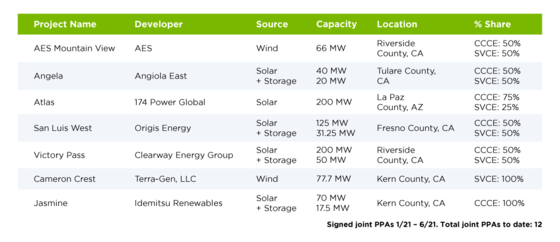

Central Coast Community Energy (CCCE) and Silicon Valley Clean Energy (SVCE) have executed seven power purchase agreements, equating to 778 megawatts (MW) of energy generation between the two community choice aggregators (CCA). The long-term contracts are a result of a request for offers (RFO) jointly issued by the CCAs in 2019 and 2020.

The joint contracts include one wind, one solar, and three solar-plus-storage projects. The solar and solar-plus-storage projects are new builds and will add new generation capacity to the California grid on behalf of the CCAs’ combined 670,000 customers.

In addition to the joint procurement effort, the two agencies signed individual contracts for two separate projects. CCCE signed a power purchase agreement with Idemitsu Renewables for 70 MW of solar and 17.5 MW of battery storage from the Jasmine project in Kern County, Calif., and SVCE signed a contract with Terra-Gen LLC. to receive 77.7 MW of wind energy from three existing wind facilities in Kern County, Calif.

The joint procurement efforts have offered multiple benefits, including shared risk mitigation and greater negotiating power resulting in cost savings that are ultimately passed onto customers. CCCE and SVCE have signed 12 power contracts together, for a total of 1,470 MW and $2.77 billion committed.

Additionally, the newly contracted solar-plus-storage projects are all new facilities and will help meet California’s recent order to build at least 11.5 gigawatts of new resources by 2026. These new resources are needed to integrate existing renewables, ensure reliability, and replace retiring capacity from the Diablo Canyon Nuclear Power Plant in California, the CCAs said.

CCCE and SVCE are also part of a joint effort to procure 500 MW of long-duration storage with seven other CCAs.

The American Public Power Association has initiated a new category of membership for community choice aggregation programs.

APPA supports FERC’s “course correction” in proposal for RTO/ISO participation incentive adders

July 23, 2021

by Paul Ciampoli

APPA News Director

July 23, 2021

The American Public Power Association (APPA) supports a Federal Energy Regulatory Commission’s supplemental notice of proposed rulemaking (NOPR) issued this spring that addresses the return on equity (ROE) incentive adder currently awarded to transmitting utilities that participate in regional transmission organizations and independent system operators, APPA said in a filing at FERC.

In the April 15, 2021 supplemental NOPR (Docket No. RM20-10), FERC proposed changes to its regulations and policies governing incentives for participation in transmission organizations under section 219 of the Federal Power Act (FPA).

APPA has long expressed concern with the Commission’s policy of granting a ROE adder to utilities merely for remaining in transmission organizations and APPA “supports the course correction” proposed in the supplemental NOPR, APPA said in June 25 comments.

In an earlier NOPR in this proceeding issued by FERC in March 2020, FERC proposed to award a 100-basis point ROE adder to transmitting and electric utilities for as long as they participate in a transmission organization, regardless of the voluntariness of such participation. APPA filed comments opposing that proposal.

Citing the comments of APPA and other parties, the supplemental NOPR would revise the March 2020 proposal by adopting a standardized 50-basis point ROE adder for participation in a transmission organization and limiting the availability of this adder to the first three years after a transmitting utility transfers operational control of its facilities to the transmission organization.

Consistent with this framework, the Commission also proposes to require transmitting utilities that have received the transmission organization incentive for three or more years to make compliance filings removing the incentive.

The supplemental NOPR also seeks comment “on whether the transmission organization incentive should be available only to transmitting utilities that join a transmission organization voluntarily,” and, if so, “how the Commission should apply that standard.”

APPA praised FERC for revisiting its regulations governing transmission organization participation incentives under FPA section 219.

The Commission’s proposal to award adders for a three-year period would prevent the transmission organization incentive from persisting as an unjust and unreasonable “bonus for good behavior,” APPA said.

“While eliminating the use of ROE adders altogether would be a reasonable policy choice, removing the adder from the rates of utilities that have been transmission organization members for more than three years will provide immediate transmission rate relief to consumers while leaving in place an incentive framework that may encourage utilities to join Transmission Organizations, consistent with FPA section 219(c),” APPA went on to say.

The use of a short-term ROE adder to encourage utilities to join transmission organizations is a straightforward mechanism that arguably helps address the transitional concerns that some utilities may have about joining a transmission organization, APPA said.

“Providing transmission rate relief from unjustified ROE adders is particularly warranted given the extraordinary increases in transmission costs for many customers in recent years,” the public power trade group said. “In considering comments on the supplemental NOPR, it is essential for the Commission to keep in mind that the increased level of transmission investment in recent years has already led to a significant rise in the transmission costs paid by customers in many regions of the country.”

Perpetuating an ROE adder for ongoing transmission organization participation “needlessly adds an additional cost burden that cannot be justified under the FPA’s just and reasonable standard,” APPA argued.

It said that the Commission’s proposal to restrict the transmission organization incentive to a three-year period is legally sound and a wise public policy choice. The Commission is justified in reconsidering its existing policy that collecting an ROE adder simply for remaining in a transmission organization comports with FPA section 219.

APPA also argued that the transmission organization incentive must be limited to utilities whose participation is voluntary. For example, utilities may be required by state law to participate in RTOs or ISOs, which negates the need for a utility to receive an incentive, according to the comments. Whether a utility’s participation in a transmission organization is voluntary should be decided on a case-by-case basis, APPA said.

“A public utility proposing to collect a transmission organization incentive should be required to identify any federal or state law, regulation, or order, or any private contractual obligation, that bears on the voluntariness of its participation in the transmission organization, and the applicant should be required to demonstrate that its participation in the transmission organization is voluntary notwithstanding any identified legal requirements compelling participation and/or limiting withdrawal,” APPA said.

San Francisco Public Utilities Commission seeks renewable energy, storage proposals

July 21, 2021

by Paul Ciampoli

APPA News Director

July 21, 2021

The San Francisco Public Utilities Commission (SFPUC) is accepting bids for renewable energy supplies and stand-alone energy storage for its CleanPowerSF program, SFPUC said on July 19.

The request for offers (RFO) seeks bids of energy, environmental attributes, capacity attributes, ancillary services and related products from new and existing eligible Renewable Energy Resources (ERRs), co-located ERR and energy storage resources and stand-alone energy storage resources.

Through the RFO, the SFPUC seeks bids for various energy supply product types.

Bids submitted for the respective product types must meet the following criteria:

- ERRs and energy storage resources must be directly connected to the California Independent System Operator Balancing Authority Area, with a preference for resources located in the nine Bay Area counties;

- For ERRs, minimum annual energy delivery of 10,000 megawatt-hours (MWh) per year and a maximum of 200,000 MWh per year;

- Energy storage resources must provide resource adequacy capacity and be at least 1 megawatt AC for at least 4-hour duration;

- Initial delivery date ranging from January 2022-December 2026;

- For ERRs and ERRs co-located with energy storage resources, terms up to 25 years; and

- For stand-alone energy storage resources, terms up to 15 years

A program of the SFPUC, CleanPowerSF is San Francisco’s Community Choice Aggregation program.

The RFO is available here.

Software Companies AutoGrid And Zūm Join To Support School Bus Electrification

July 21, 2021

by Peter Maloney

APPA News

July 21, 2021

Two software companies, AutoGrid and Zūm, have formed a partnership that aims to help electrify the nation’s fleet of school buses.

The partners plan to use AutoGrid’s virtual power plant (VPP) platform to deploy 10,000 electric school buses managed by Zūm in the next four years to create over 1 gigawatt (GW) of flexible capacity when the electricity grid is overloaded. When fully deployed, it would be one of the largest virtual power plants in the world, the companies said.

The nation’s fleet of nearly 500,000 yellow school buses is the country’s largest mass transportation system, transporting more than 27 million students every day, according to the companies.

AutoGrid provides artificial intelligence-powered flexibility management software to the energy industry. In 2018, Colorado Springs Utilities began using AutoGrid’s demand management program for its business customers. The program was designed to allow the public power utility to consolidate management of its demand response resources into a unified system. It also provided the utility the ability to automatically and remotely shift or reduce electricity use of customers participating in the program and to measure and verify energy savings.

In 2016, National Grid began using AutoGrid to unify management of its demand response and distributed energy resource programs in its service North American service territory. At the time, the utility said it expected to enroll more than 400 megawatts (MW) of demand response and distributed energy resources over three years.

Public power utilities are among the leaders in the electrification of public buses. For instance, the Sacramento Municipal Utility District (SMUD), with funding from state agencies such as the California Air Resources Board and the Sacramento Metropolitan Air Quality Management District, has been working with school districts in its territory. At the end of 2020, SMUD had 79 electric school buses in service in its territory with a goal of having 100 buses in service by year-end 2021.

“School buses have predictable daily schedules and are typically used only a few hours each day, making them an ideal resource as part of a virtual power plant,” Rahul Kar, general manager of new energy at AutoGrid, said in a statement. “Virtual power plants play a crucial role in providing stability to a renewable-powered grid and the extra revenues from these grid services enable school districts and [electric vehicle] fleet owners to reduce the total cost of ownership as they strive to meet their sustainability goals.”

Ride share company Zūm offers software that can optimize the routes and vehicles used by school districts.

Earlier this year, the Oakland Unified School District in California signed a 10-year, $100 million contract with Zūm. The contract has resulted in the number of students in the district spending one hour or more on buses getting to and from school to drop from 70% to 3% and, as a result, diesel buses spending less time on streets, Zūm said.

Zūm says it currently works with more than 4,000 schools and school districts, helping them optimize transportation routes and to determine the optimal size of vehicles to help reduce costs, maximize route coverage, and address vehicle underutilization.

Both Zūm and AutoGrid noted that the electrification of school buses could be aided by the infrastructure legislation proposed by the administration of President Joseph Biden that includes plans to electrify at least 20 percent of the nation’s yellow school bus fleet through a new Clean Buses for Kids Program at the Environmental Protection Agency.

FERC Considers Reforms To Transmission Planning And Cost Allocation

July 21, 2021

by Paul Ciampoli

APPA News Director

July 21, 2021

The Federal Energy Regulatory Commission (FERC) on July 15 issued an Advanced Notice of Proposed Rulemaking (ANOPR) to reform its transmission planning, cost allocation, and generator interconnection rules.

At a high level, the potential reforms in the ANOPR “consider the need for more holistic transmission planning and cost allocation and generator interconnection processes, to plan the grid for the future, and to do so in a way that results in rates that are just and reasonable,” FERC staff noted in a presentation made at the Commission’s monthly open meeting.

Comments on the ANOPR will be due 75 days from its publication in the Federal Register, with reply comments due 30 days later (Docket No. RM21-17-000).

The ANOPR seeks comment on potential reforms in three specific areas: (1) reforms for longer-term regional transmission planning and cost-allocation processes that take into account more holistic planning, including planning for anticipated future generation, (2) rethinking cost responsibility for regional transmission facilities and interconnection-related network upgrades, and (3) enhanced transmission oversight over how new transmission facilities are identified and paid for. The ANOPR includes numerous questions for industry comment in connection with each of these three, interrelated topic areas.

Examples of questions raised in the ANOPR include, among others:

- How to plan for future scenarios, including planning for the needs of anticipated future generation, as part of the regional transmission planning and cost allocation processes;

- Whether the Commission should require transmission providers in each transmission planning region to establish a process to identify geographic zones that have the potential for the development of large amounts of renewable generation and plan transmission to facilitate the integration of renewable resources in those zones;

- Whether reforms are needed to improve the coordination between the regional transmission planning and cost allocation and generator interconnection processes;

- How to appropriately identify and allocate the costs of new transmission facilities in a manner that satisfies the Commission’s cost causation principle that costs are allocated to beneficiaries in a manner that is at least roughly commensurate with estimated benefits; and

- Whether participant funding of interconnection-related network upgrades may be proven to be unjust and unreasonable and whether the Commission should eliminate the independent entity variations that allow regional transmission organizations (RTOs) and independent system operators (ISOs) to use participant funding for interconnection-related network upgrades.

The ANOPR also seeks comment regarding whether the current approach to oversight of transmission investment adequately protects customers, and, if customers are not adequately protected from excessive costs, which potential reforms may be required and are legally permissible to ensure just and reasonable rates.

It also seeks comment on several other important related topics including whether FERC action on various matters would be consistent with its legal authority, consideration of consumer protection, coordination between individual transmission provider planning processes and regional transmission planning processes, and interregional planning.

Glick, Clements Issue Joint Concurrence

In a joint concurrence, FERC Chairman Richard Glick and Commissioner Allison Clements noted that the nation’s generation resource mix is changing rapidly. “Due to a myriad of factors — including improving economics, customer and corporate demand for clean energy, public utility commitments and integrated resource plans, as well as federal, state, and local public policies — renewable resources in particular are coming online at an unprecedented rate.”

As a result, the transmission needs of the electricity grid of the future are going to look very different than those of the electricity grid of the past, Glick and Clements said.

They expressed concern that the current approach to transmission planning and cost allocation cannot meet those future transmission needs in a manner that is just and reasonable and not unduly discriminatory or preferential.

“In particular, we believe that the status quo approach to planning and allocating the costs of transmission facilities may lead to an inefficient, piecemeal expansion of the transmission grid that would ultimately be far more expensive for customers than a more forward-looking, holistic approach that proactively plans for the transmission needs of the changing resource mix. A myopic transmission development process that leaves customers paying more than necessary to meet their transmission needs is not just and reasonable,” they wrote.

In that regard, Glick and Clements are pleased to see the Commission “taking a consensus first step toward updating its rules and regulations to ensure that we are meeting the nation’s evolving transmission needs in a cost-effective and efficient fashion.”

Ensuring that transmission rates remain just and reasonable “will require further action, including reforms to interregional transmission planning and cost allocation, as well as other reforms to our regional transmission planning and cost allocation and generator interconnection processes beyond those contemplated herein. Nevertheless, we believe that today’s unanimous Commission action represents a solid foundation for an expeditious inquiry into how we can regulate to achieve the transmission needs of our changing electricity system in a manner consistent with our statutory obligations under the Federal Power Act.”

Glick and Clements also said that they are concerned that, in light of evolving transmission needs, the current regional transmission planning and cost allocation and generator interconnection processes may no longer ensure just and reasonable rates for transmission service.

“In particular, we are concerned that existing regional transmission planning processes may be siloed, fragmented, and not sufficiently forward-looking, such that transmission facilities are being developed through a piecemeal approach that is unlikely to produce the type of transmission solutions that could more efficiently and cost-effectively meet the needs of the changing resource mix,” they wrote.

Glick and Clements argued that regional transmission planning processes “generally do little to proactively plan for the resource mix of the future, including both commercially established resources, such as onshore wind and solar, as well as emerging ones, such as offshore wind. We are also concerned that current regional transmission planning processes are not sufficiently integrated with the generator interconnection processes, and are overwhelmingly focused on relatively near-term transmission needs, and that attempting to meet the needs of the changing resource mix through such a short-term lens will lead to inefficient transmission investments. As a result, under the status quo, customers could end up paying far more to meet their transmission needs than they would under a more forward-looking approach that identifies the more efficient or cost-effective investments in light of the changing resource mix.”

They are also concerned that the current approach to transmission planning and cost allocation is failing to adequately identify the benefits and allocate the costs of new transmission infrastructure.

“In addition, we are concerned that, largely due to the potential shortcomings with the current regional transmission planning and cost allocation processes, transmission infrastructure is increasingly being developed through the generator interconnection process. That means that infrastructure with potentially significant benefits for a broad range of entities may be developed through a process that focuses exclusively on the needs of a comparatively small number of interconnection customers—a dynamic that is almost sure to result in comparatively inefficient investment decisions.”

The participant funding approach to financing interconnection-related network upgrades will often mean that the interconnection customer(s) alone must pay for all—or the vast majority—of the costs of that transmission infrastructure, even where it provides significant benefits to other entities, Glick and Clements said. “That, in turn, may cause those interconnection customers to withdraw projects from the queue, causing considerable uncertainty and delay, and may mean that net beneficial transmission infrastructure is never developed due to a misalignment in how that infrastructure would be paid for.”

Glick and Clements also said that they are concerned that the Commission’s current approach to overseeing transmission investment may not adequately protect consumers. “While transmission infrastructure can provide a broad spectrum of benefits, it is itself a significant investment that represents a major component of customers’ electric bills. The Commission must vigorously oversee the rules governing how transmission projects are planned and paid for if we are to satisfy our responsibility to protect customers from excessive rates and charges. The potential bases for invigorating our oversight of transmission spending contemplated in today’s order have the potential to go a long way toward ensuring that we fulfill that function,” they wrote.

Christie, Danly issue separate concurrences

FERC Commissioners Mark Christie and James Danly issued separate concurrences.

Danly said that the ANOPR poses several questions “where the answer is ‘no.’ Many of the contemplated proposals would exceed or cede our jurisdictional authority, violate cost causation principles, create stifling layers of oversight and ‘coordination,’ trample transmission owners’ rights, force neighboring states’ ratepayers to shoulder the costs of other states’ public policy choices, treat renewables as a new favored class of generation with line-jumping privileges, and perhaps inadvertently lead to much less transmission being built and at much greater all-in cost to ratepayers.”

Danly, who said that there are obviously problems with the existing transmission regime, hopes that commenters “will supply us with a full record on each issue raised in the ANOPR: whether and why the existing rule works or not, and whether and why the possible reform may work or not. With every proposed change, I specifically solicit comments on two subjects. First: is the contemplated reform a proper exercise of the Commission’s authority, i.e., is it within our jurisdiction? That is always the threshold question before we turn to policy. Second: what will be the ultimate effect on ratepayers? I fear that in the enthusiasm to build transmission, many may tout the benefits of new transmission while overlooking the costs that will eventually be borne by ratepayers. No proposed policy, however worthy, can evade our statutory duty to ensure that rates are just and reasonable.”

For his part, Christie said that he concurred with the ANOPR “because approximately ten years after the Commission issued Order No. 1000, it is appropriate to review the implementation of that order, assess the successes and problems that have become evident over the past decade, and consider reforms and revisions to existing regulations governing regional transmission planning and cost allocation. This consideration of potential reforms is especially timely as the transmission system faces the challenge of maintaining reliability through the changing generation mix and efforts to reduce carbon emissions.”

At the same time, he said that his concurrence to issue the ANOPR does not represent an endorsement at this point in the process of any one or more of the proposals included in the order.

Christie said the ANOPR “contains a number of good proposals, some potentially good proposals (depending on how they are fleshed out), and frankly, some proposals that are not — and may never be — ready for prime time, or could potentially cause massive increases in consumers’ bills for little to no commensurate benefit or inappropriately expand the role of federal regulation over local utility regulation. Given the early stage of this process, however, I agree it is worthwhile to submit a broad range of proposals to the public for comment in the hope that the final result will be a more reliable, more efficient, and more cost-effective transmission system.”

Department of Energy Accelerates Release Of Cybersecurity Capability Maturity Model Update

July 21, 2021

by Paul Ciampoli

APPA News Director

July 21, 2021

The Department of Energy (DOE) this week released an update to the Cybersecurity Capability Maturity Model (C2M2), which was originally scheduled for release at the end of this year.

The American Public Power Association (APPA), along with a number of cyber experts from public power, rural electric cooperatives and investor-owned utilities, have been working with the DOE’s Office of Cybersecurity, Energy Security, and Emergency Response (CESER) over the past two years to update the C2M2.

Nathan Mitchell, Senior Director of Operations Programs at APPA, noted that this industry-led effort to update this voluntary cybersecurity model is in response to the continued attacks on information technology/operational technology cyber systems. “APPA wants to thank the public power representatives that have helped in this revision process,” he said.

“APPA recommends that public power utilities review the C2M2 V2.0, conduct a self-assessment of your cybersecurity program, and mitigate any risks you may find to prepare for and prevent cyber-attacks,” he said.

The new model was scheduled to be released at the end of 2021, but DOE-CESER and industry representatives agreed that accelerating the release of the new guidance and recommendations would help the electricity industry assess their cyber systems now.

APPA also recommends that public power utility managers look at the Axio 360 for Public Power platform to help in tracking the progress of cybersecurity capability at their utility. The C2M2 V2.0 is available on the Axio platform. Users can reach out to support@axio.com with any questions.

The testing and validation of the model is ongoing and DOE welcomes any feedback based on experience using the updated model. Email DOE at C2M2@hq.doe.gov to share feedback and lessons learned. If changes are needed to clarify any C2M2 V2.0 model recommendations, an update will be issued at the end of the year.

The C2M2 V2.0 is available for download at: https://www.energy.gov/ceser/cybersecurity-capability-maturity-model-c2m2

Any questions or comments on cybersecurity can be directed to APPA’s Cyber Defense Community email address at: OTCyberDefense@publicpower.org

Rep. DeGette Details Net-Zero Emissions Bill That Includes Elements Supported By APPA

July 20, 2021

by Paul Ciampoli

APPA News Director

July 20, 2021

Rep. Diana DeGette, D-Colo., recently detailed legislation intended to drive the innovation of new technologies that she said will be needed to reduce U.S. power sector emissions to net zero. The bill incorporates several suggestions made by the American Public Power Association (APPA) and its members.

DeGette offered details on the Clean Energy Innovation and Deployment Act in remarks made at APPA’s National Conference Virtual Event on July 14, 2021.

The legislation is comprised of five parts.

The first part focuses on clean energy innovation and uses a range of measures to “bring the many promising clean energy technologies that we have out there to the point of commercial availability as soon as possible,” DeGette told APPA National Conference Virtual Event attendees.

The second part of the bill creates tax incentives for entities that install zero emission electricity generation. Included in this section of the bill are provisions that give extra incentives to companies that deploy the technology sooner and that deploy them in parts of the country where they’ll have the greatest impact, she said. These tax incentives would be available as direct payments including to public power utilities, DeGette said.

The third part of the bill seeks to protect low-income ratepayers by reauthorizing the Low Income Home Energy Assistance Program (LIHEAP) and increasing funding for the weatherization assistance program.

The fourth section “is designed to provide support to the workers who would be displaced by the shift in energy policy,” DeGette said.

The fifth section of the bill would create the nation’s first federal clean energy standard — a zero-emission electricity standard — which is intended to be completely technology neutral. “This technology neutral approach is one of the reasons why this bill is so unique. By taking such an approach we’re able to prioritize climate action rather than any particular electricity generating technology,” DeGette said.

Under the bill, credits for zero emission electricity generation would be issued by the Environmental Protection Agency (EPA) to generators that would in turn sell the credits to retail electricity suppliers. Those suppliers would then submit the credits back to the EPA.

The bill does not place limits on which generators a retail electricity supplier can get credits from. She noted for example that a public power utility in Missouri could buy credits from a generator in Hawaii “or wherever you can get them for the cheapest price.”

DeGette said that creating a national marketplace for credits like this “will help drive down the price and the overall cost of the program and it also helps fuel competition by investors and inventors who will then have an incentive to develop and implement the most cost effective clean energy technology possible.”

In crafting the bill, the lawmaker recognized the fact that many public power utilities don’t have environmental compliance programs, DeGette said. Therefore, she included a provision in the bill that allows a public power utility to enter into an agreement with any generator to manage the credit submission requirements for them.

“Another key part of the bill is the mechanism that’s put in place to automatically tie the nationwide clean energy standard to the availability of new technologies,” DeGette said. “Under the standard, for example, if we still haven’t developed the technology needed to generate affordable, reliable one hundred percent zero emission electricity by 2050, the bill will use offsets to ensure that we’re still able to achieve net zero emissions.”

On the other hand, “if future technological breakthroughs make it possible for us to move much faster and at a lower cost than we think possible today, the requirements that will be put in place under the bill will also advance, moving the target date to achieve nationwide, one hundred percent zero emission electricity up to and as soon as 2030.”

In order to further protect public power utilities and their customers from a high cost of compliance, “we went a step further when we drafted the bill and added three separate off ramps – one that puts a cap on the cost of credits, a second that provides you an exemption if the required technology isn’t available and a third that provides an exemption for generating electricity from a unit that’s deemed essential for maintaining reliability,” she said.

DeGette serves on two committees — the House Committee on Energy and Commerce and the House Committee on Natural Resources. She also serves on several subcommittees and is chair of the Oversight and Investigations panel of the House Committee on Energy and Commerce.