Special Series: Potential Alternatives To Managing Insurance Risks – Part Three

August 25, 2021

by Tonya DeRivi

APPA News

August 25, 2021

Historically we have seen the insurance market cycle from either being competitive with few utilities seeing coverage problems, or “tight” as we explained earlier and see now. The American Public Power Association concludes our three-part insurance risk series by exploring ways in which public power utilities have sought, or could seek, alternatives to the increasingly limited availability and expense associated with traditional individualized commercial insurance options.

One model that has been successfully used is “pooling” insurance coverage across multiple entities. This is common practice across state and local governmental entities – but it necessarily covers a broader spectrum of services, from police and fire to libraries and public utilities, and therefore may not offer industry-specific coverage that high-risk enterprises may need. Fortunately, this model can also be tailored to a specific industry – provided there is the capital available and know-how to do so.

Nearly four decades ago, some public power utilities in the Tennessee Valley found themselves in an untenable position: some had no options to buy liability insurance – at any price, according to Anthony Salvatore, an area senior vice president with Gallagher.

The Tennessee Valley Public Power Association (TVPPA) – a regional organization representing public power utilities within the Tennessee Valley Authority’s (TVA) multi-state service area – set out to fix that problem. They formed Distributors Insurance Company (DIC) in 1983 with a small amount of start-up cash and a $1 million letter of credit backed by TVA. Its goal was to make coverage available to all TVPPA members, tailor coverage to exposures unique to public power utilities, and to do so at competitive pricing. In the beginning, DIC had three member accounts with approximately $200,000 in total premium. Their portfolio has grown astronomically since: DIC now has 80 accounts with approximately $40 million in assets and $26 million in surplus. They spend a large amount on safety and loss control efforts, mission-critical endeavors specifically designed to help participating members.

Today’s insurance market issues – especially given what is happening in California – are not easily solved. “California is an incredibly difficult state for insurance companies; it’s not easy to do business in, it’s expensive, and there are problems there that the insurance industry simply cannot fix. These are issues that the state needs to address,” Salvatore said. “The wildfire situation has spooked the entire insurance industry to the point where liability and property insurance capacity has almost entirely dried up. We’ve even seen some of this reactivity from the Western states spread to our area here in the Southeast” he noted. “The market overall is very tight and has been tightening for many years. Then the pandemic pushed everyone over the edge.”

Indeed, one California-based public power utility saw their general liability rate increase 111% with their 2021 policy renewal, further indicative of how wildfire exposure is driving liability coverage and pricing. The insurance carrier has already said they will not offer a renewal in 2022. This utility also saw its total premiums for all lines of coverage nearly double over the last three years, with increasingly restrictive coverages. One of their insurance carriers has already said they may not offer a property insurance renewal in 2022.

What, then, could public power utilities do in this hardening insurance market?

We spoke with Washington, D.C.-based Arnold & Porter lawyers Charles Landgraf and Paul Howard to explore options. Together they have nearly 60 years of pertinent energy and insurance policy experience.

The “pooling” model described above has worked for decades. Forming a model like DIC or the Public Utility Mutual Insurance Company (now a risk retention group) or Aegis (which provides liability and property coverage to mainly investor-owned utilities in the energy industry) would first require conducting a feasibility study, according to Landgraf.

Actuaries would conduct an actuarial study to explore allocations, lawyers would be needed to identify and work through issues, it would have to identify who could serve in the captive manager function – whether for one state, multiple states in a region, or nationally – and then work with brokers and deliver the necessary capital. The more narrowly it is applied, the easier the issues are to work through. Landgraf also noted that while a study exploring only one state’s regulatory law and liability systems would be easier, that also reduces the spread of risk and therefore limits the competitive pricing advantages of the pooling model.

Howard added that the federal Risk Retention Act is relevant because it allows a group captive manager to go national; an entity could be formed in one state to sell insurance to local public power utilities, for example, and then sell or “front” to public power utilities in other states without the added burden of becoming licensed in each state. This offers a nice tool as a multi-state solution – but is limited only to liability lines of business.

They estimated that such a study may cost anywhere from the low six-figures, for a limited regional approach, or high six-figures for a national feasibility study.

Landgraf and Howard suggested there may be intermediate steps public power utilities could take too.

“If this became an acute enough problem for state governments in the West, for example, you could in theory work to develop a multi-state compact,” Howard said. Community-owned utilities may carry a much more sympathetic message to relevant state leaders – namely, their governors and insurance commissioners – seeking regulatory relief through a mini risk retention policy model. Politically like-minded state leaders could work together to reach a mutual agreement allowing public power utilities to pool their capacity for self-insurance and to leverage access to global reinsurance. Landgraf explained that having the backing of state leaders through an interstate agreement to simplify and streamline regulations could, for example, allow a single entity to be domiciled and licensed in one state and serve the other states too.

“This may be something the Pacific Rim states could explore” given their like-minded politics and prior efforts by state leaders to work through climate change policies together, Landgraf said. Similarly, other like-minded states in a region could explore such interstate agreements to help their public power utilities navigate this increasingly difficult insurance market.

Landgraf noted that the insurance industry itself may be inclined to explore such efforts. “They are acutely aware of the different regional impacts climate change is having,” he said. The situation may be acute enough now that a mutual effort to work through region-specific solutions is primed. There is credibility on all sides: the insurance companies would want to help public power utilities create an insurance solution they could support, provided that the states work through existing regulatory problems, like multi-state licensing rules and to simplify regulatory hurdles; state leaders have seen first-hand the resulting damages of a changing climate and that more needs to be done to incentivize preventive measures within their own and nearby states; and publicly-owned utilities need affordable insurance solutions.

Another challenge with seeking multi-state relief is political. One must also consider that agreement across states in this arena involves elected governors and elected or appointed insurance commissioners, Howard added.

The American Public Power Association is the voice of not-for-profit, community-owned utilities that power 2,000 towns and cities nationwide. We celebrate our members that strengthen their communities by providing superior service, engaging citizens, and instilling pride in community-owned power.

Special Series: How Utilities Are Addressing Rising Risks And Insurance Premiums – Part Two

August 24, 2021

by Peter Maloney

and Tonya DeRivi

APPA News

August 24, 2021

Per member requests, the American Public Power Association presents this in-depth Public Power Current newsletter series on managing insurance risks. Thank you to the utility systems and industry experts for their contributions about what is happening in the insurance market that is affecting policy coverage and prices (Part 1); types of “best practices” utilities can utilize to minimize their exposure (Part 2); and what potential alternatives may be available to help in a challenging insurance market (Part 3).

Yesterday we detailed how risks to utility operations are rising and, with them, the cost of insurance.

Several utilities are grappling with this problem, particularly in areas that have recently suffered through disasters.

“Insurance rates have gone up and it’s not just wildfires; everything seems to be elevated,” Russell Mills, director of risk management and treasurer at California’s Sacramento Municipal Utility District (SMUD), said.

Historically, SMUD has not made any wildfire claims, but the utility does have some assets in wildfire areas and, more broadly, operates in a region where wildfires are prevalent, and that proximity can affect perceptions of the risks SMUD faces.

In April 2019, Moody’s Investors Service revised its ratings outlook on SMUD’s outstanding revenue bonds to negative from stable to reflect the more challenging operating environment in California resulting from the impact of wildfires. Moody’s revised its rating on SMUD in May 2020, returning the public power utility’s outlook to stable.

The risks were addressed, but the lesson was clear. The risk environment is changing, and it is best to stay ahead of the problem. In returning the outlook to stable, Moody’s cited SMUD’s “comprehensive actions to shield itself from wildfire risk.”

Mills at SMUD said he is seeing premium increases “across the board.” To address that challenge, he said SMUD tries to differentiate its risk profile from that of other utilities when it makes its annual presentation to underwriters and brokers when it comes time to renew its insurance coverages.

In those meetings, SMUD is able to highlight the steps it has taken with its Upper American River project, a series of 11 dams and eight power houses in a high wildfire risk area on the slopes of the Sierra Nevada Mountains. There, SMUD has focused on vegetation management efforts, undergrounding wires, and hardening assets.

When it returned the utility to a stable outlook, Moody’s cited SMUD’s actions and the utility’s “multi-pronged approach” that included “a sizeable insurance policy and strengthening liquidity.”

Increasing insurance coverage is not the only tool in SMUD’s kit, though. The utility takes proactive steps by conducting probable maximum loss (PML) studies to better understand its risk exposures. SMUD also has been hardening its balance sheet as a precaution against possible disasters.

In 2015-16, SMUD had about $100 million in excess liability wildfire insurance coverage. Over a span of three years, the utility raised its coverage to $300 million and then trimmed it back down to about $250 million.

SMUD also bolstered its commercial paper program by 30 percent to $400 million, raised its operating cash on hand by one month, and is paying down debt to have the capacity to issue bonds if the need arises.

“All three work together – insurance, ratings, and reserves,” Mills said. “It shows our intent and wherewithal.” It also sends a message to the underwriter that the brunt of any liability is not solely on them, he said.

Overall, Mills recommends utilities prepare themselves against natural disasters by taking on mitigation projects, such as grid hardening or undergrounding, that can provide a utility with data they can present to underwriters. For cyber security threats, he recommends utilities take similar steps, such as following the North American Electric Reliability Corp.’s Critical Infrastructure Protection (CIP) standards and conducting in-house training programs and be prepared to show that the procedures are being followed.

So far, Mills said, no insurance company has turned them down or refused to renew a policy. SMUD also has been able to negotiate cuts in proposed premium increases for fire coverage on the order of 10 percentage points.

“At the end of the day, insurance is a means of transferring risk,” Mills said. “You have to own the risk, show that ‘we are part of this.’”

The Northern California Power Agency (NCPA) has worked with their new property insurer to identify further ways the joint action agency could prevent losses and manage their insurance risk exposure, according to Monty Hanks, chief financial officer and assistant general manager of administrative services.

“As many utilities across the nation have experienced, NCPA was faced with a continuation of a hardening property insurance market. Last year was the most challenging one due to some underwriters quoting our program at the last minute,” he said, which left NCPA with little time or negotiating room for better terms or lower premiums. “Despite this, we made a commitment to our members to hit the ‘reset’ button in our approach to procuring property insurance for our facilities,” Hanks said.

NCPA contacted new property insurance market players with expertise in the power generation sector – including FM Global, which insures more than a third of the Fortune 1000 companies. Hanks said that NCPA had traditionally marketed their program about three months prior to the policy’s expiration, but FM Global had never quoted it. “I never understood why – they are a huge player.”

Hanks learned that three months was not enough time for FM Global to perform their own due diligence.

He found that the company’s engineering-first philosophy and approach, which helps clients become more resilient against natural disasters, matched NCPA’s core principles.

“We engaged FM Global in early 2021 to build a plan, and that started with scheduling loss control visits,” he explained. “We learned very quickly that they were not like other property insurance companies. They were guided by the belief that most losses can be prevented, and they will dig deep to understand your business needs to help you reduce your risk,” Hanks said. Indeed, the company has its own research campus where they have studied floods, wind, fire, hail, explosions, etc. that provides them with the data spec sheets to help validate and support their engineering recommendations.

Because NCPA’s members are dependent upon power plants running to provide stable, cost-effective resources, their resiliency is critical.

“One of FM Global’s recommendations was to improve our wildland fire vegetation management around our geothermal plant,” Hanks said. The plant is in a relatively high fire risk area, and although NCPA had always taken a proactive approach to vegetation management, “their studies indicated that we should do more, and recommended we create a clearance zone around the plant that maintains forested areas 330 feet away from plant buildings, especially the cooling towers.” Hanks said.

NCPA agreed and implemented the recommendation. “Now, NCPA feels like we have found a partner in the property insurance business. Working with FM Global to evaluate risk and complete recommended improvements will help us increase the resiliency of our plants against natural disasters – the work that we’ve done as a result will ultimately help us better manage our risks and control operational and maintenance costs,” Hanks said.

Midwest Flooding

In the middle of the country, Nebraska’s Omaha Public Power District (OPPD) is facing similar challenges, though from a different type of natural disaster. In Nebraska, flooding is more of a concern than wildfires, but the effects can be just as devastating.

OPPD filed a claim as a result of the severe flooding that hit Nebraska in 2019. Researchers at the University of Iowa have linked such flood events to warmer weather, particularly higher temperatures in the Gulf of Mexico, a phenomena they say triggers “The Midwest Water Hose.”

For many utilities, rising flood waters have also meant rising premiums. For OPPD, that challenge is made even more difficult because they have coal-fired assets in their generation portfolio.

Insurance coverage for new coal projects is already difficult to find in Europe, but it is a trend that is becoming more widespread and could become prevalent in America in the coming years, Daniel Laskowsky, director of risk management at OPPD, said.

In 2019, Chubb, a major insurer in the U.S., said it would no longer underwrite the construction and operation of new coal-fired plants or companies that generate more than 30 percent of their revenues from coal generation or mining. By one count, 19 major insurance companies now refuse or restrict their coverage of new coal projects.

“We are doing all we can” in the face of rising threats from natural disasters and increasing premiums, Laskowsky said. The insurance environment is “very challenging.” In the renewal process, OPPD has seen “some very large increases, double digit increases,” he said.

The district’s approach to rising insurance rates includes having a solid understanding of the utility’s risk tolerance, using market competition to his favor, and working with underwriters and brokers as partners where he can.

“Understanding your organization’s risk tolerance” is critical, Laskowsky said. “Internally you need to know how much risk you can take.” The usual way to do that is to look at historical risks. The challenge is predicting the future. That is something OPPD is trying to better understand. “It is not a perfect science,” Laskowsky said.

Laskowsky also recommends shopping around to compare insurance coverages and rates. “Competition is good,” he said. “It may not be something you do every year because you don’t want to burn the market,” he said, but if you can find a lower rate, “you have to be willing to fight for it” and “you have to be willing to commit” when that time comes in the negotiating process.

Laskowsky also says OPPD tries to form strong partnerships with its insurance underwriters and brokers. A utility should lean on its insurance brokers and use them as a resource because they have a broader view of the market and know what the rest of the industry is doing, he said. “We know them, and it helps when it comes to negotiations.”

In addition, Laskowsky said the district works with insurance underwriters that are structured as mutual companies that cater to the public power and energy sector. There is more of a partnership approach to doing business and, if a utility participates in the governance process as a member of the organization, “you can have some say in the insurance company’s processes,” he said.

Those are all considerations that public power utilities should consider when shopping for insurance or when they are engaged in coverage renewal process, Weber said. Insurance still remains the top method of risk transference, he said, and most public power utilities buy insurance for at least one line of coverage, but every utility differs in terms of size, location, assets and services offered.

Weber advised that insurance programs should be structured differently to provide proper coverage for a given utility’s risk exposures. A utility with generation assets is much different than a transmission and distribution utility, he said. “It’s not a one size fits all approach.”

Weber also noted that there are a handful of insurers that specialize in the public power space for American Public Power Association members. “Therefore, each insurance carrier has a pretty good idea of the exposures and landscape of the public power sector.” He recommended that members “should make sure their trading partners are financially stable and know what coverages they are getting from their insurance provider.”

Utilities can “differentiate themselves in the market by providing thorough underwriting data and starting the renewal process well in advance,” Weber said. “Underwriters are requiring more data than ever before, and it is important for each utility to be ready to answer and have prepared the underwriting data that might be requested.”

“We recommend also getting to know your underwriter and building the relationship,” Weber said. “At the end of the day, it is a relationship business.”

In Part 3, tomorrow, we will explore ways in which public power utilities have sought, or could seek, alternatives to traditional individualized commercial insurance options.

Ann Arbor, Mich., Council Member To Make Proposal Related To Public Power Feasibility Study

August 24, 2021

August 24, 2021

by Paul Ciampoli

APPA News Director

August 24, 2021

Ann Arbor, Mich., Council Member Elizabeth Nelson plans to introduce a resolution at an upcoming city council meeting that will ask the Ann Arbor Energy Commission to consider and vote on the question of a public power feasibility study for the city.

“The recent multi-day power outage has prompted a lot of conversation in our community about improving the reliability of our electricity and the city’s relationship with DTE, specifically,” wrote Nelson in a recent blog posted on her website.

“For some time now, many local leaders have advocated for a public municipal power utility, similar to what already exists in over forty municipalities in Michigan. Arguments in favor of a public utility include: reliability, sustainability, accountability, and affordability,” she wrote.

The city’s Energy Commission is close to concluding what has been many months of discussion about a public utility. In February, the Commission heard a presentation about public power, as well as advocacy from Michigan State Rep. Yousef Rabhi and State Sen. Jeff Irwin.

In July, the Energy Commission heard another presentation on the topic of a municipal utility, including legal advice about how to achieve it in the state of Michigan. At that meeting, the Commission was asked to recommend funding for a feasibility study.

“Because public utilities exist across Michigan, there is a lot that we know already in terms of how it would function in Ann Arbor,” wrote Nelson. “However, a feasibility study is the appropriate first step in exploring this option. There is significant support in the community for a public power utility, but it is also appropriate that Council receive advice from the Energy Commission regarding this feasibility study.”

Nelson said that she will have a resolution on the agenda for the next city council meeting on Sept. 7, 2021, that asks the Energy Commission to consider and vote on the question of a feasibility study.

She wants the Energy Commission vote to be taken at their next meeting on Sept. 14, so that the Ann Arbor City Council can receive their recommendation in time to vote on it at the council’s next meeting on Sept. 20.

Nelson said that a recommendation for a feasibility study does not bring immediate action, “but does push our efforts in a specific direction: establishing the parameters of the study and identifying the appropriate entity to do that study.”

The American Public Power Association offers a wide range of resources and information related to municipalization on its website.

Special Series: Managing Insurance Risks Takes On Greater Significance With Natural Disasters, Cyber Attacks – Part One

August 23, 2021

by Paul Ciampoli

APPA News Director

and Peter Maloney

August 23, 2021

Per member requests, the American Public Power Association presents this in-depth Public Power Current newsletter series on managing insurance risks. Thank you to the utility systems and industry experts for their contributions about what is happening in the insurance market that is affecting policy coverage and prices (Part 1); types of “best practices” utilities can utilize to minimize their exposure (Part 2); and what potential alternatives may be available to help in a challenging insurance market (Part 3).

Risks to utility operations are rising and with them the cost of insurance is rising too.

In this environment, it can be difficult for a public power utility to retain essential insurance coverage while containing costs. The fact of the matter is that insurance companies have had to make large payouts to customers who have suffered massive losses.

Losses from natural disaster hit $133 billion in 2017, a historic high, according to the Insurance Information Institute. That year saw a deadly combination of hurricanes – Harvey, Maria and Irma – as well as costly California wildfires. Losses due to natural catastrophe fell in 2018 and 2019, but rose again in 2020, hitting $74.4 billion, an 88 percent increase from $39.6 billion of losses in 2019.

In 2020, the most costly losses came from storms and cyclones, which accounted for about 75 percent of the $119 billion in losses, followed by wildfires, accounting for nearly 20 percent of losses, and flooding, which accounted for 4 percent of losses, according to the Insurance Information Institute.

Insurance company SwissRe ranked 2020 as the fifth costliest year on record since 1970 for the insurance industry with global losses totaling $83 billion. The losses were driven by a record number of severe convective storms (thunderstorms with tornadoes, floods and hail) and wildfires in the United States. Those and other secondary events around the world accounted for 70 percent of the $76 billion of insured losses from natural catastrophes, the institute said.

In order to recapitalize after those losses, insurance companies have a few options that are not necessarily exclusive of each other. They can increase the premiums they charge customers, or they can raise the bar in terms of which entities they will insure.

“Insurance carriers have been affected by storms and claim payouts for their insureds, social inflation, and record setting verdicts,” Ryan Weber, vice president at Marsh USA, said. Pricing has increased the past 15 consecutive quarters, he noted.

The good news, Weber said, is that there were signs in the second quarter that the market could be adjusting in insureds’ favor for coverage lines such as property and liability. “Cyber liability pricing appears to be heading in the wrong direction, however, due to the severity and frequency of the recent cyber breaches in 2021,” Weber said.

The cyber ransomware attack on Colonial Pipeline in the U.S. earlier this year, as well as other ransomware attacks, has resulted in increased attention to the risk insurance market. Colonial Pipeline is the largest refined products pipeline in the United States, transporting more than 100 million gallons of fuel daily to meet the energy needs of consumers from Houston, Texas to the New York Harbor.

In May 2021, the Government Accountability Office (GAO) issued a report on cyber insurance. It said that key trends in the current market for cyber insurance include the following:

- Increasing take-up: data from a global insurance broker indicate its clients’ take-up rate (proportion of existing clients electing coverage) for cyber insurance rose from 26 percent in 2016 to 47 percent in 2020.

- Price increases: industry sources said higher prices have coincided with increased demand and higher insurer costs from more frequent and severe cyberattacks. “In a recent survey of insurance brokers, more than half of respondents’ clients saw prices go up 10–30 percent in late 2020,” the report said.

- Lower coverage limits: industry representatives told GAO the growing number of cyberattacks led insurers to reduce coverage limits for some industry sectors, such as healthcare and education.

- Cyber-specific policies: insurers increasingly have offered policies specific to cyber risk, rather than including that risk in packages with other coverage. This shift reflects a desire for more clarity on what is covered and for higher cyber-specific coverage limits.

Meanwhile, in a recent podcast, CAC Specialty’s Adam Lantrip addressed the current cyber insurance market, recent ransomware events, and some tips for coordinating insurance and the technology and legal venders who assist companies in responding to attacks.

CAC Specialty is a specialty insurance brokerage firm.

“Where things are going is clients are going to have to demonstrate a much higher baseline level of security in order to qualify for coverage,” said Lantrip on the podcast. Lantrip is CAC’s senior vice president for professional liability and cyber practice leader.

A year and a half ago, “we could have taken just about any company into the marketplace with whatever their controls were and probably been able to get them a pretty good option from somebody in the insurance marketplace,” Lantrip said.

“Today, we’re seeing clients that we would objectively think are generally pretty good risks but they’re answering ‘no’ to one or two or three very specific questions about their security posture and those ‘no’ responses” are resulting in an automatic refusal “from a huge section of the marketplace.” When that happens, “the ability to get coverage starts to shrink.”

A robust cybersecurity insurance market could help reduce the number of successful cyberattacks by: (1) promoting the adoption of preventative measures in return for more coverage; and (2) encouraging the implementation of best practices by basing premiums on an insured’s level of self-protection, notes the U.S Cybersecurity and Infrastructure Security Agency (CISA), which is part of the Department of Homeland Security.

“Many companies forego available policies, however, citing as rationales the perceived high cost of those policies, confusion about what they cover, and uncertainty that their organizations will suffer a cyberattack,” in recent years CISA says. CISA has engaged key stakeholders to address this emerging cyber risk area.

Since 2012, CISA has engaged academia, infrastructure owners and operators, insurers, chief information security officers (CISOs), risk managers, and others to find ways to expand the cybersecurity insurance market’s ability to address this emerging cyber risk area. More broadly, CISA has sought input from these same stakeholders on the market’s potential to encourage businesses to improve their cybersecurity in return for more coverage at more affordable rates.

CISA is currently facilitating dialogue with CISOs, Chief Security Officers, and insurers about how a cyber incident data repository could foster both the identification of emerging cybersecurity best practices across sectors and the development of new cybersecurity insurance policies that “reward” businesses for adopting and enforcing those best practices.

In Part 2, tomorrow, we will explore some of the “best practices” utilities have undertaken to minimize their exposure to higher insurance rates.

APPA Resources

APPA has numerous member resources available to help risk managers.

- APPA’s September 19-22 Business & Financial Conference will include a dedicated Risk Management & Insurance track – including a newly added presentation on cyber insurance and ransomware attacks.

- APPA hosts an interactive risk management group listserv to obtain and share relevant information.

- APPA will soon be issuing a first-ever member survey to solicit information on risk assessment and insurance coverage. Survey responses will be requested by September 30. Results will be summarized and made available free of charge to APPA members.

- APPA hosts a security topic page on our website with a number of free resources linked in the sidebar for download. Members can also join the Cybersecurity Defense Community and take advantage of APPA’s partnership with Axio360.

Moody’s Says Hydrogen’s Potential As Power Sector Fuel Is Enormous

August 23, 2021

by Paul Ciampoli

APPA News Director

August 23, 2021

Hydrogen’s potential as a fuel in the power sector and the broader economy is enormous, although electric and gas utilities are unlikely to be the primary demand growth driver of the hydrogen market over the next decade, Moody’s Investors Service says in a new report.

“Hydrogen’s growth potential rests in large part on its green appeal – specifically, its potential role in decarbonizing the economy, particularly the transportation, industrial, gas and power sectors,” the rating agency said in the Aug. 11, 2021 report.

Moody’s said that while hydrogen has enormous potential in power and heating applications, electric and gas utilities are unlikely to be the primary demand growth driver of the hydrogen market over the next decade, either in the U.S. or globally.

“In addition to high costs, there are significant efficiency losses associated with its production, which can range anywhere from around 30% to over 70% based on the technology used, making its production more expensive than the electricity or natural gas used to produce it. However, hydrogen is likely to play an important role in US efforts to eliminate carbon emissions from the power sector by 2035,” the report said.

While the U.S. consumes more than 11 million metric tons of hydrogen per year, its use is practically nonexistent in the power sector, Moody’s said.

At the same time, Moody’s said that hydrogen’s potential as a fuel in the power sector and the broader economy is huge.

The report notes that the National Renewable Energy Laboratory (NREL) expects U.S. demand for hydrogen to surge two- to fourfold by 2050, to around 1% to 14% of energy demand. Over the same period, the Department of Energy (DOE) estimates that the hydrogen economy could grow to $750 billion in annual revenue from an estimated $17.5 billion today.

Most of this demand growth is likely to come from the transportation sector, followed by industrial uses (refining, chemical, iron and steel and other), with building heat and power and power generation expected to account for around 19% of the demand by 2050, according to a report coordinated by the Fuel Cell and Hydrogen Energy Association, the rating agency went on to note.

Moody’s points out that hydrogen can already be blended with natural gas for use as a fuel for power generation, albeit with some limitations. Power equipment manufacturers are developing a new generation of gas turbines that can run on 100% hydrogen and there are several pilot projects and at least two larger power plants being developed in the U.S. that will initially burn blends of hydrogen and natural gas, before transitioning to 100% hydrogen, Moody’s said.

“Hydrogen can also be used as an energy carrier for long-term seasonal storage, reducing the need to curtail excess renewable energy production or using nuclear power and providing dispatch flexibility to the grid to help manage peak demand,” the report said.

Moody’s also said that national and state policies and regulations could help increase hydrogen use. It noted that DOE this year unveiled $160 million in federal funding for projects to develop technologies for the production, transport, storage and use of hydrogen. “Wider implementation of carbon instruments, such as allowances and taxes, could help make hydrogen more cost-competitive,” the report said.

Federal and state incentives are also available for the development of carbon capture, utilization and storage technology, an essential component in the production of “blue” hydrogen, which is produced from natural gas, according to Moody’s.

The American Public Power Association (APPA) recently issued a report that provides a perspective on where the emerging hydrogen market is in the U.S. and globally, what is driving the growing interest in hydrogen and what obstacles are preventing hydrogen technology from being able to scale-up.

In a recent blog, Patricia Taylor, Senior Manager, Regulatory Policy and Business Programs at APPA, notes that there are different motivations for the interest in hydrogen in the energy sector these days.

SRP, BPA Meteorologists Detail Steps Smaller Utilities Can Take To Fill Forecasting Gaps

August 18, 2021

by Paul Ciampoli

APPA News Director

August 18, 2021

Arizona’s Salt River Project (SRP) and Oregon-based Bonneville Power Administration (BPA) both have teams that focus on forecasts of temperature and precipitation, among other things.

But what about smaller public power utilities that don’t have a meteorologist on staff? What steps are available to them to help fill the gap in terms of weather forecasting without their having to hire a full-time meteorologist?

“That is a great question because public power utilities vary so much, not only in the number and type of customers, but in the geography they are concerned about,” said Erik Pytlak, who has served as BPA’s Manager of Weather and Streamflow Forecasting since November 2010. “So my advice for a Snohomish PUD is going to be very different than Minidoka, ID, which will be different than the Confederated Salish-Kootenai Tribe.”

He said it may come down to what weather issues the utility is most concerned about and going from there. “Fortunately, there are many weather apps, websites and whole companies that share weather information – some of it for free or at low cost, for utilities of any size and scale to use,” Pytlak said.

“The other suggestion is for the power utilities to talk to each other,” he said. “Even a power marketing agency like BPA gains quite a bit from networking, coordinating and even collaborating with hydropower utilities in the region and even globally, both large and small, on best practices we are finding and developing.”

Bo Svoma, who has been a meteorologist at SRP for over four years, said that staff in a smaller utility company can become familiar with the products issued by the National Weather Service, Climate Prediction Center, and River Basin Forecast Centers. There are also many private companies that offer weather forecast services, he noted.

“At SRP, management has determined a staff of meteorologists and hydrologists is necessary to plan for the dry and wet years that Arizona has always experienced and will continue to see,” he said.

Unique geographic challenges

Svoma noted that SRP meteorologists are responsible for producing both short-term (same day/weather advisory) and longer term (7-10 day to seasonal) forecasts of temperature and precipitation to support both power delivery and water delivery.

They are also responsible for quality control of Salt-Verde watershed precipitation records, monitoring the Salt-Verde watershed to inform streamflow forecasts (flood cameras, snow surveys, etc.) and offering expertise both externally and internally for research projects that help achieve SRP’s short-term and long-term goals (snow hydrology, climate change, etc.).

SRP is the largest provider of electricity in the greater Phoenix metropolitan area, serving more than 1 million customers. SRP is also the metropolitan area’s largest supplier of water, delivering about 800,000 acre-feet annually to municipal, urban and agricultural water users.

When asked to detail some of the unique challenges he faces as a meteorologist at SRP in terms of the utility’s geographic location, Svoma said that the two wet seasons in Arizona pose unique forecasting challenges that are not present in other parts of the country.

During the summer months, the Phoenix metropolitan area experiences a combination of high temperatures and humidity during the North American Monsoon Season that leads to frequent threats of excessive heat, severe thunderstorms, flash flooding and haboobs, which are intense dust storms.

Svoma said that during the winter, high volumes of inflow into the reservoir system from the Salt-Verde rivers can be generated by rainfall, rain-on-snow, and snowmelt, posing forecast challenges that are absent in many higher latitude basins. Currently, the SRP watershed is in its 26th year of drought, he noted. “Thanks to continuous and efficient planning, SRP has remained resilient and will be able to continue to provide water to its more than 2 million customers,” he said.

Pytlak also addressed the question of some of the unique challenges that he faces as a meteorologist at BPA in terms of the utility’s geographic location.

“I am not sure if this is unique among utilities, but the sheer size of our service territory and river basins feeding our hydroelectric projects means we also have very diverse geography,” he said. “Our forecasting area ranges from deserts in southeast Oregon, to rainforests on the Oregon and Washington coasts, to subarctic mountains in southern British Columbia. The Columbia Basin is also right along the path of the jet stream for much of the year, which also drives quite a bit of weather variability.”

BPA earlier this year profiled the work of Pytlak and his team on its website.

BPA is a nonprofit federal power marketing administration based in the Pacific Northwest. BPA markets wholesale electrical power from 31 federal hydroelectric projects in the Northwest, one nonfederal nuclear plant and several small nonfederal power plants.

The dams are operated by the U.S. Army Corps of Engineers and the Bureau of Reclamation. The nonfederal nuclear plant, Columbia Generating Station, is owned and operated by Energy Northwest, a joint operating agency of the state of Washington. BPA provides about 28 percent of the electric power used in the Northwest and its resources — primarily hydroelectric — make BPA power nearly carbon free.

BPA’s territory includes Idaho, Oregon, Washington, western Montana and small parts of eastern Montana, California, Nevada, Utah and Wyoming.

Scorching temperatures this summer

Meanwhile, much of the West has experienced scorching temperatures this summer including Arizona. Svoma was asked whether there have been any surprises in terms of weather patterns so far this summer.

“The early start to the North American Monsoon season, while not entirely surprising given the dry winter in the western U.S., was a little unexpected given that many of the long-range weather models did not indicate an early onset,” he said. The Salt River observed a steady increase in streamflow beginning in early July, earlier than normal and suggesting abundant rainfall in the mountains.

Pytlak said that the June 2021 heat wave “was certainly unprecedented for many of us. Perhaps the biggest surprise is that the weather models that we use from U.S., Canadian, and European weather agencies all handled the extreme event quite well, which gave us and the region valuable time to prepare. The fact we came through the event with virtually no service interruptions was testament to the preparations we always make for extreme events, and how everyone in the region worked together to not only keep the lights on, but also keeping life-saving cooling systems running.”

EIA Reports That Per Capita U.S. Residential Electricity Use Was Flat In 2020

August 18, 2021

by Paul Ciampoli

APPA News Director

August 18, 2021

Although many people spent more time at home last year in response to the COVID-19 pandemic, retail sales of electricity to the residential sector in the United States, calculated per capita (per person), averaged 4,437 kilowatt hours (kWh) per person, only 1% more than in 2019, the U.S. Energy Information Administration (EIA) recently reported.

Warmer weather in 2020 — including a significantly warmer winter — increased electricity consumption for air conditioning during the summer but reduced U.S. home electricity consumption for space heating during the winter, EIA said on Aug. 6.

From 1960 to 2010, per capita U.S. residential electricity use increased by an average of 3% per year. However, that trend reversed over the past decade because of warmer weather and energy efficiency improvements, EIA noted. Per capita residential electricity use has fallen 5% in the United States since 2010.

EIA said that per capita U.S. residential electricity use varied widely across the states in 2020, from 2,018 kWh per person in Hawaii to 6,663 kWh per person in Louisiana. Nearly all of the states with the highest residential electricity sales per capita, such as Louisiana, Alabama, and Mississippi, are in the South census region, where air conditioning and electric space heating are most prevalent. About 64% of southern homes heat primarily with electricity, compared with about 25% of homes outside of the South.

The only state with relatively high per capita residential electricity use outside of the South is North Dakota, which has the coldest average annual temperature in the Lower 48 states. About 41% of homes in North Dakota heat with electricity, EIA said.

“In 2020, per capita residential electricity use decreased in many of the states where electricity is widely used for home heating, including many states in the South. In 2020, the District of Columbia’s per capita residential electricity use fell 4% compared with 2019, a larger decrease than for any of the states, followed by Arkansas (-4%) and North Dakota, Indiana, North Carolina, South Dakota, and Missouri (-3% each),” EIA reported.

But per capita residential electricity use rose significantly in the West census region. According to EIA, many states in this region experienced their warmest summers on record in 2020. Arizona’s per capita residential electricity use increased 10% compared with 2019, the largest increase of any state, followed by Nevada, Alaska, and California (9% each).

NYPA Launches Study to Assess Potential Impact Of Climate Change On Its Operations

August 17, 2021

by Paul Ciampoli

APPA News Director

August 17, 2021

The New York Power Authority (NYPA) will study the long-term effects of climate change on its physical power generation and transmission assets and system operations, NYPA said on Aug. 5.

The research, in collaboration with Argonne National Laboratory, a U.S. Department of Energy science and engineering research center, the Electric Power Research Institute (EPRI) and Columbia University’s Center on Global Energy Policy (CGEP), aims to inform NYPA’s risk and expenditure planning and strengthen its resilience against all hazards, including major weather events.

The study will be conducted by Argonne. NYPA noted that Argonne is known as a world leader in creating hyperlocal climate model simulation datasets and as having the most detailed climate projections available in the U.S.

For the study, an interdisciplinary team of scientists and engineers will use state-of-the-art climate and infrastructure system modeling techniques, and one of the world’s fastest supercomputers, to determine the risks an ever-changing climate may pose to NYPA’s infrastructure and operating systems.

Researchers will identify and quantify the potential impacts of climate change on NYPA’s critical facilities, assets and equipment, and produce a system-wide assessment of location-specific climate risks overlaid onto NYPA’s energy system infrastructure. Argonne’s experts will also develop a climate resiliency plan that will inform how NYPA mitigates any climate-related potential risks. The study’s planned simulations will use three different global climate models and two different greenhouse gas emission scenarios which are designed to capture much of the modeling and planning uncertainties associated with climate change projections.

Study results are expected in the spring.

The analysis is part of a multi-year sustainability plan outlining steps NYPA needs to take to enhance its long-term environmental, social and governance performance across the authority. The study is the first phase of a four-year climate adaptation and resilience assessment.

A second phase in 2023 will assess the social and economic impacts of climate change on NYPA’s customers, communities and other stakeholders, and identify strategies to support regional and community adaptation and resilience planning efforts.

NYPA as a power system infrastructure owner and operator will conduct quantitative climate-informed risk assessments to identify vulnerabilities. The study will also inform the appropriate design and operational standards and specifications of NYPA’s customer solutions projects such as energy efficiency, solar, storage and electric vehicle charging stations.

In the early stages of the project, CGEP will provide input on the proposed approach from Argonne for applying climate and energy infrastructure models in the research. In this part of the process, CGEP will contribute its expertise in integrating global energy systems and climate models. CGEP will also contribute expertise in scenario design for energy systems analysis under uncertainty during the modeling planning phase. After the initial analysis is complete, CGEP will serve on the results review panel, providing feedback on the outputs, insights, and any corresponding recommendations.

U.S. Large-Scale Battery Storage Power Capacity Increased 35% In 2020

August 17, 2021

by Paul Ciampoli

APPA News Director

August 17, 2021

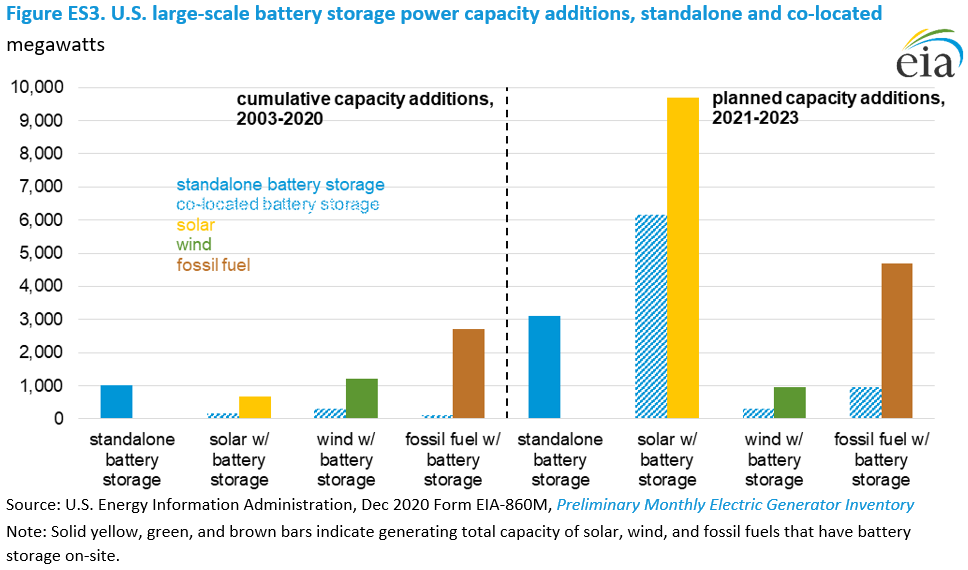

The U.S. continued a trend of significant growth in large-scale battery capacity, with U.S. battery power capacity reaching 1,650 megawatts (MW) by the end of 2020, the U.S. Energy Information Administration (EIA) reported on Aug. 16.

According to EIA’s report, Battery Storage in the United States: An Update on Market Trends, U.S. battery power capacity grew by 35% in 2020 and has tripled in the last five years.

EIA expects that most large-scale battery energy storage systems to come online over the next three years will be built at power plants that also produce electricity from solar photovoltaics, a change in trend from recent years.

As of December 2020, the majority of U.S. large-scale battery storage systems were built as standalone facilities. Only 38% of the total capacity to generate power from large-scale battery storage sites was co-located with other generators: 30% was co-located specifically with generation from renewable resources, such as wind or solar PV, and 8% was co-located with fossil fuel generators.

“We expect the relationship between solar energy and battery storage to change in the United States over the next three years because most planned upcoming projects will be co-located with generation, in particular with solar facilities,” EIA said in the report.

If all currently announced projects from 2021 to 2023 become operational, then the share of U.S. battery storage that is co-located with generation would increase from 30% to 60%.

Based on planning data collected by EIA, an additional 10,000 MW of large-scale battery storage’s ability to contribute electricity to the grid is likely to be installed between 2021 and 2023 in the United States, which is10 times the total amount of maximum generation capacity by all systems in 2019.

Almost one-third of U.S. large-scale battery storage additions will come from states outside of the PJM Interconnection and the California ISO, which led in initial development of large-scale battery capacity.

Five states account for more than 70% of U.S. battery storage power capacity as of December 2020, with California alone accounting for 31% of the U.S. total (506 MW). Texas, Illinois, Massachusetts, and Hawaii each have more than 50 MW of power capacity.

More than 400 MW of small-scale total battery storage power capacity also existed in the United States as of 2019, with California accounting for 83% of the capacity. Small-scale batteries have a nameplate power capacity of 1 MW or less.

U.S. battery system energy capacity also continued to increase, reaching 1,688 megawatt hours at the end of 2019, a 30% increase from 2018.

The entire report is available on the EIA website.

DEMEC Establishing First In-State Training Yard For Apprentice Lineworkers

August 17, 2021

by Paul Ciampoli

APPA News Director

August 17, 2021

The Delaware Municipal Electric Corporation (DEMEC) is establishing its first in-state training yard for eight municipalities to train apprentice lineworkers in best practices and servicing unique systems, DEMEC reported on August 10.

DEMEC bought five acres of land next to ShureLine Electrical in Delaware’s Smyrna Industrial Park in April. With a target opening of spring 2022, the wholesale power supplier is planning to install a series of utility poles, transformers and substation infrastructure on site to host classes for its membership.

DEMEC is a joint action agency that represents eight power-producing Delaware towns and cities that serve 99,200 people. Members include Clayton, Dover, Lewes, Middletown, Newark, New Castle, Seaford and Smyrna.

DEMEC noted in a news release that lineworkers are typically sent to out-of-state programs that may last up to two weeks for training that is required for the field. Delaware has no facility of its own to send lineworkers, and DEMEC has three utility poles behind its Smyrna headquarters for small training sessions.

The new facility will open up more possibilities for larger classes.

“In-state training will allow for greater member participation and cost savings. Additionally, it keeps lineworkers closer to home should services be required at a moment’s notice,” DEMEC Chief Operating Officer Kimberly Schlichting said in a statement. “Best practices and safety training for lineworkers is never-ending and is paramount for this line of work.”

Site improvements will include utility poles for climbing and bucket truck use, shorter poles for group demonstrations, meter panels, an underground training area, a substation training area as well as a sidewalk and a parking lot.

The training yard and program will be open to DEMEC members’ apprentice lineworker (levels 1 to 4), journey lineworkers, foremen and others. Outdoor hands-on training may range between 10 to 20 students, but apprentice training classes are expected to be small for a stronger instructor-to-student ratio, DEMEC said.

“It really comes down to the needs of our members at any point in time,” said Schlichting, who will become DEMEC CEO in October.

DEMEC’s training yard will give lineworkers more hands-on exercises, specifically in each Delaware town’s own distribution systems. Utility managers from DEMEC-associated towns each weighed in on the future training yard to ensure the tools available will help meet town-specific standards.

DEMEC officials see the training yard as a long-term investment, and if the program grows larger, then the hope would be to relocate to another site but keep the property for other uses.

“It’s conveniently located and provides convenient access to our members which span from the northern to southern municipalities in Delaware,” Schlichting said. “As technology continues to advance and change, so will best practices change. This program will allow our members to stay on top of those changes and even ahead of anticipated innovative practices.”

In a recent episode of the American Public Power Association’s Public Power Now podcast, Schlichting, Gary Johnston of the Lewes Board of Public Works in Delaware and Joshua Little of the Town of Smyrna, Delaware, discussed the Light Up Navajo project, an initiative to connect Navajo homes to the grid.

Click here for access to that episode as well as other Public Power Now podcast episodes.