Bonneville Power Administration To Decrease Power Rates By An Average Of 2.5 percent

August 4, 2021

by Paul Ciampoli

APPA News Director

August 4, 2021

The Bonneville Power Administration (BPA) will decrease power rates by an average of 2.5% and slashed its proposed transmission rate increase in half to an average of 6.1%, the federal power marketing administration (PMA) said in late July.

The new rates were announced as BPA released the final record of decision for its BP-22 power and transmission rate case as well as a tariff proceeding (TC-22).

The tariff proceeding adopted new language in BPA’s open access transmission tariff that will enable the power marketer to participate in the Western Energy Imbalance Market (EIM) if BPA chooses to do so. The decision of whether to join the Western EIM is a separate process outside of the tariff proceeding and is anticipated to be made by the end of the fiscal year.

In 2019, BPA issued a record of decision that addresses numerous policy issues and topics related to its participation in the EIM. BPA also signed a Western EIM Implementation Agreement with the California Independent System Operator that signaled the beginning of work on projects that need to be completed before BPA could start EIM operations.

Under a settlement adopted by the BP-22 record of decision, firm power tier 1 rates will decrease by 2.5% for fiscal years 2022 and 2023. Looking back over the previous decade, BP-22 will cap a 10-year period during which BPA’s power rate trajectory increased by less than 2% annually, which is in line with historical inflation rates.

“Rates that have matched inflation – not just in a single rate case, but over a sustained period – is proof of BPA’s commitment to bending the cost curve and driving down rate pressures on our power rates,” said BPA Administrator John Hairston in a statement. BPA’s announcement “demonstrates we are financially strong, competitive and responsive to our customers’ needs,” he said.

With respect to transmission, the settlement provided for a 6.1% average effective rate increase across the rate period, a number roughly half of what was proposed in an initial proposal.

“We’ve landed in a spot where BPA will be able to continue to keep its transmission commitments and re-invest in the value of BPA’s transmission infrastructure in a fiscally sound and responsible manner,” Hairston said.

Beyond rates, the BP-22 record of decision also establishes revenue financing for up to $40 million for both the power and transmission business lines. This financing will allow BPA to issue less debt and decrease upward rate pressures in subsequent rate cases.

As part of the settlement, BPA has committed to holding workshops on various topics of interest to customers, including revenue financing, EIM costs and benefits, balancing services, the Eastern Intertie, and transmission losses.

The tariff proceeding updated language in BPA’s tariff, including addressing the terms and conditions that will apply to transmission service if BPA decides to participate in the Western EIM. The adoption of this language enables the potential participation of BPA in the Western EIM without committing BPA to that path.

This proceeding also addressed Southern Intertie studies, transmission planning process, real power loss return, the removal of an exception for designation of Seller’s Choice agreements, ministerial edits to service agreement templates, generator interconnection procedures and requirements, and credit standards.

The changes captured by the final records of decision for BP-22 and TC-22 will be effective October 1. Specific to rates, BPA will file the case with the Federal Energy Regulatory Commission, requesting interim approval to start on that date while awaiting final FERC approval.

The Public Power Council (PPC) said that BPA’s final record of decision in the BP-22 rate proceeding largely advances the proposed approach from members of the PPC.

“The Northwest public power community came together with a unified voice to focus on a core set of high-impact issues with BPA on its upcoming power and transmission rates,” said Scott Simms, PPC’s Executive Director. “To come to agreement in the BPA rate case, we knew we needed a strategy that delivered meaningful savings to public power and was reasonable for BPA to run its operations.”

The PPC, established in 1966, is an association that represents over 100 consumer-owned electric utilities in the Pacific Northwest. PPC’s mission is to preserve and protect the benefits of the Federal Columbia River Power System for consumer-owned utilities. PPC is a key forum to identify, discuss and build consensus around energy and utility issues.

Shrewsbury Electric & Cable Operations Adopts Accelerated CO2 Reduction Goals

August 4, 2021

by Peter Maloney

APPA News

August 4, 2021

Shrewsbury Electric & Cable Operations (SELCO) in Massachusetts has adopted a plan with even more aggressive carbon dioxide (CO2) emission reductions than those set by the state.

Earlier this year, Massachusetts established guidelines for all utilities to reach net-zero emissions by 2050. At its July 26 meeting, the SELCO Commission, which approves budgets and sets rates for the public power utility, voted unanimously to adopt a power supply policy that provides a roadmap to 100 percent CO2 free power by 2032.

SELCO provides electric, cable, telephone, and internet services to residential and commercial customers in the Town of Shrewsbury.

The policy establishes a greenhouse gas emission standard for the utility and provides a framework for future power supply contracts, as well as acquisition and retirement of Renewable Energy Certificates (RECs) in pursuit of net-zero emissions.

“We believe this accelerated schedule is in alignment with customer priorities, meets or exceeds community goals for net-zero emissions, and helps establish SELCO as an industry leader,” Christopher Roy, SELCO’s general manager, said in a statement.

The accelerated emissions reduction timeline positions SELCO to serve as the bedrock for a clean energy transition across all other sectors within the town of Shrewsbury and “balances both fiscal and environmental responsibility, resulting in the average customer seeing a monthly bill impact of around $1 in 2021 and increasing to about $5.60 in 2032,” Roy said.

SELCO’s power supply policy will be reviewed annually by the SELCO Commission to confirm the utility is meeting benchmarks in alignment with established goals. The annual review also aims to ensure market fluctuations, industry trends, changes in regulatory requirements and/or public policy are reflected in the utility’s roadmap to net-zero carbon emissions.

After vetoing climate change legislation in January, Charlie Baker, Massachusetts’ Republic governor, in late March signed comprehensive climate change legislation that commits to reaching net zero emissions in 2050.

The law, Senate Bill 9, An Act Creating a Next Generation Roadmap for Massachusetts Climate Policy, establishes interim goals for emissions reductions, significantly increases protections for environmental justice communities across Massachusetts, authorizes the governor to implement a new, voluntary energy efficient building code for municipalities, and allows the commonwealth to procure an additional 2,400 megawatts of offshore wind energy by 2027.

NREL Helps GSA Make Its Buildings More Grid Interactive And Efficient

August 4, 2021

by Peter Maloney

APPA News

August 4, 2021

The National Renewable Energy Laboratory (NREL) has created a plan to help the General Services Administration (GSA) transition its huge real estate portfolio to a more grid interactive and efficient operation.

The GSA, which procures and manages office space for federal buildings, has an annual budget of a nearly $21 billion. The agency owns and leases over 376.9 million square feet of space in 9,600 buildings in more than 2,200 communities nationwide.

The Blueprint for Integrating Grid-Interactive Efficient Building Technologies into U.S. General Services Administration Performance Contracts developed by a team of NREL researchers provides the GSA with a guide to using federal energy performance contracting to transform GSA properties into grid-interactive efficient buildings (GEBs) that can interact with the electric grid, using smart technologies to reduce, shed, shift, modulate, or generate electricity load as needed.

A grid-interactive efficient building is able to optimize its energy use in a continuous and integrated way for demand flexibility, grid services, occupant needs and preferences, cost reductions, and increased resilience, NREL says.

The NREL blueprint seeks to expand the GSA’s deployment of its National Deep Energy Retrofit program, by incorporating demand flexibility and grid integration strategies that can lead to additional energy and cost savings, increased resilience, and leading to deeper greenhouse gas reductions.

The blueprint offers guidance in using energy performance contracts, such as energy savings performance contracts and utility energy service contracts that provide a means of financing projects for government customers who do not benefit from the energy efficiency and renewable energy tax incentives available to private sector customers. Instead, some or all of the energy upgrades are paid for by contractors or the utility, with the costs recouped through energy savings over the life of the project.

The GSA is putting performance contracting to work implementing GEB at multiple sites. For instance, the agency won multiple Department of Energy grants to help co-fund solar-plus-battery-storage projects at six Land Port of Entry facilities in Texas and New Mexico, and at four courthouses and a parking garage in Oklahoma. Through its Green Proving Ground program, GSA is also preparing to test the effectiveness of various grid-interactive efficient buildings technologies at other facilities in its portfolio.

APPA, NRECA Urge FERC Not To Revoke Demand Response Opt-Out Mechanism

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

The Federal Energy Regulatory Commission (FERC) should not revoke a demand response opt-out mechanism because such a move would intensify concerns of state and local regulators that the Commission does not sufficiently accommodate their policy decisions, the American Public Power Association (APPA) and the National Rural Electric Cooperative Association (APPA) said in response to a notice of inquiry (NOI) issued by FERC earlier this year.

In their July 23, 2021, comments, APPA and NRECA urged the Commission not to rescind its regulations that require a regional transmission organization (RTO) or independent system operator (ISO) not to accept bids from an aggregator of retail customers (ARC) that aggregates the demand response of the customers of utilities that distributed more than four million megawatt-hours (MWh) in the previous fiscal year, in instances where the relevant retail regulatory authority (RERRA) prohibits such customers’ demand response to be bid into organized markets by an ARC (Docket No. RM21-14). RERRAs include public power regulators.

APPA and NRECA said that the regulation, referred to as the Demand Response Opt-Out, remains valid and necessary for all of the reasons that it was initially adopted. “Moreover, elimination of the Demand Response Opt-Out at this time will likely cause adverse consequences and impose undue burdens on individual states and other RERRAs, as well as exacerbate the concerns of state and local regulators that the Commission does not sufficiently accommodate their policy decisions,” the trade groups argued.

Therefore, the Demand Response Opt-Out should continue to apply as adopted in FERC’s Order No. 719, issued in 2008. APPA and NRECA also argued that the Demand Response Opt-Out should apply to demand response resources included in “heterogenous” aggregations, i.e., distributed energy resource (DER) aggregations that are made up of different types of resources including demand response.

FERC Issued Order No. 2222-A, NOI in March

At its monthly open meeting in March 2021, FERC issued an order (Order No. 2222-A) that responded to requests for rehearing and clarification of FERC Order No. 2222, which addresses the participation of DER aggregations in markets administered by RTOs and ISOs. FERC approved Order 2222 in September 2020. Among the important features of Order No. 2222, FERC provided an “opt-in” mechanism for small distribution utilities — including most public power utilities. This opt-in mechanism is not at issue in the NOI on the Demand Response Opt-Out.

At the meeting, FERC also issued the notice of inquiry on the potential impacts of eliminating the ability of states to choose whether demand response resources should participate in RTO/ISO wholesale markets.

FERC asked whether the circumstances relevant to this demand response opt-out have changed since the opt-out was established in Order Nos. 719 and 719-A, and what are the potential benefits or burdens of removing it.

The NOI sought comment on the following three general areas:

- Whether and how circumstances have changed since the Commission established the Demand Response Opt-Out in Order Nos. 719 and 719-A;

- Potential benefits of removing the Demand Response Opt-Out and “reasons why the balance between the Commission’s goal of removing barriers to the development of demand response resources in RTO/ISO markets and the interests and concerns of state and local regulatory authorities may have shifted such that the market rules reflecting the Demand Response Opt-Out may no longer be just and reasonable;” and

- Potential burdens from removing the Demand Response Opt-Out

In Order No. 2222-A, FERC also found that demand response resources included in heterogenous aggregations would not be subject to the Demand Response Opt-Out. FERC later retreated from this finding, saying it would consider the comments in the NOI proceeding before deciding the issue.

As a number of parties pointed out in response to Order No. 2222-A, failing to apply the opt-out any time demand response resources are included in an aggregation with even one other type of DER would effectively negate the Demand Response Opt-Out and result in adverse consequences, NRECA and APPA told FERC in their NOI comments.

APPA, NRECA Warn of Adverse Consequences

In their comments, APPA and NRECA said that revoking the Demand Response Opt-Out will lead to the adverse consequences that Order No. 719 sought to avoid.

The trade groups said that the rationales for the Demand Response Opt-Out remain applicable today and should continue to be recognized by the Commission.

In Order No. 719, the Commission adopted the Demand Response Opt-Out in order to avoid interference with successful retail demand response programs, APPA and NRECA pointed out.

“The removal of the Demand Response Opt-Out at this time would likely threaten or upend existing demand response programs, in violation of the Commission’s assurance in Order No. 719 that its intent ‘was not to interfere with the operation of successful demand response programs,’” they went on to say.

“Notably, in the years since Order No. 719 was adopted, there has been growth in retail demand response programs, and participation in those programs,” APPA and NRECA said.

According to the Commission’s annual Assessments of Demand Response and Advanced Metering, retail demand response programs and/or customer enrollment in retail demand response programs has increased in the years since Order No. 719 was issued.

“These programs stand to be adversely impacted if the Commission removes the Demand Response Opt-Out at this time. This is a particular concern if demand response ARCs can ‘cherry-pick’ the loads or customers that will best advance their aggregation goals, such as industrial customers. Successful retail programs that are providing benefits to all end-use customers might be relegated to residual programs, with larger loads opting for the wholesale demand response programs through an ARC. Such an outcome would be an unjustified departure from the Commission’s stated intent not to interfere with successful demand response programs,” the trade groups told FERC.

APPA and NRECA said that these existing programs should be accommodated and respected in the Commission’s policies.

Impact On RERRAs

APPA and NRECA said that FERC’s rationale for the Demand Response Opt-Out, to avoid placing an undue burden upon state and local regulatory entities, also remains a valid concern. “The removal of the Demand Response Opt-Out at this time would reintroduce the concerns over displacing state and local authority and imposing undue burdens on retail regulators. With demand response as the most prevalent form of distributed energy resource, managing the impact of demand response aggregators could impose a significant burden on state and local regulatory authorities, after the Commission expressly stated it would not do so.”

If the Demand Response Opt-Out is abandoned now, the burden will be placed on state and local authorities and other RERRAs to take affirmative action to address the myriad regulatory issues that may be raised by ARCs, the groups said.

FERC has previously determined that RERRAs should have the authority if they so choose, to decide whether existing retail aggregation programs provide benefits and whether retail customer participation in wholesale demand response programs, individually or through an ARC, would adversely affect those programs and, if so, whether and how to permit such participation. “APPA and NRECA submit that there are no changed circumstances that justify depriving state and local regulators of this authority by eliminating the Demand Response Opt-Out.”

Costs For End-Use Consumers

APPA and NRECA said that as they “have often reminded the Commission, the focus in all of these efforts must remain reasonable costs to end-use consumers.”

FERC determined in Order No. 719 that RERRAs are in the best position to make determinations whether retail versus wholesale demand response programs are effective, and the role aggregation should play.

“APPA and NRECA submit that the RERRAs remain in that position. The fact that the Commission has in the interim determined in other instances not to abide by this policy of cooperative federalism does not render it inapplicable or not useful in ensuring just and reasonable rates for end-use customers.”

The Commission “should not yet again seize from RERRAs their authority to balance new technologies, maintain grid reliability, and protect consumers from unaffordable costs, particularly since the Commission specifically preserved that authority with the Demand Response Opt-Out.”

EPA Plans to Revise Power Plant Wastewater Limits

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

The U.S. Environmental Protection Agency (EPA) formally unveiled its plans to initiate a new rulemaking to revise the 2020 Steam Electric Effluent Limitation Guidelines (ELG) for certain wastewater discharge limits for coal power plants.

EPA on July 26 noted that it undertook a science-based review of the 2020 Steam Electric Reconsideration Rule under Executive Order (E.O.) 13990, finding that there are opportunities to strengthen certain wastewater pollution discharge limits.

For example, treatment systems using membranes continue to advance as an effective option for treating a wide variety of industrial pollution, including from steam electric power plants rapidly, it said. EPA expects this technology to continue advancing, and the agency will evaluate its availability as part of the new rulemaking.

However, during the 2020 ELG rulemaking process, EPA specifically rejected membranes as the “best available technology economically achievable” for flue gas desulfurization (FGD) wastewater because not a single facility in the United States had adopted the technology for anything beyond small-scale pilots. As of October 2020, some information in the rulemaking record suggests that coal-fired facilities in China may have installed membranes to treat FGD wastewater, but there was no actual data on the short- or long-term performance of these particular systems.

While the agency pursues this new rulemaking process, current regulations will be implemented and enforced.

The 2020 rule modified only certain aspects of the 2015 Steam Electric Effluent Limitation Guidelines (ELGs) rule, such that requirements promulgated in 2015 and 2020 are currently in effect.

EPA said that the current requirements provide significant environmental protections relative to a 1982 rule that would otherwise be in effect.

EPA, on July 26, signed a Federal Register notice to announce its intent to initiate this rulemaking process. Because this rulemaking could result in more stringent ELGs that are the subject of petitioners’ claims in litigation pending in the Fourth Circuit Court of Appeals, the Department of Justice, in coordination with EPA, is filing a request with the court to hold the litigation in abeyance. The court is expected to grant EPA’s recommendation.

The agency intends to issue a proposed rule for public comment in the fall of 2022.

The American Public Power Association filed comments supporting the proposed 2020 ELG Reconsideration rule and creating the low utilization boiler subcategory.

To read EPA’s notice and learn more about Steam Electric ELGs, click here.

On September 30, 2015, EPA finalized a rule revising the regulations for the Steam Electric Power Generating category. The rule set the first federal limits on the levels of toxic metals in wastewater that can be discharged from power plants.

On August 31, 2020, the agency finalized a rule revising the 2015 requirements for two specific waste streams produced by steam electric power plants — flue gas desulfurization wastewater and bottom ash transport water.

On January 20, 2021, President Joe Biden signed E.O. 13990, which directed the EPA to review all regulations and policies undertaken by the Trump Administration and rescind or revise any that do not protect public health and the environment. Accordingly, the EPA conducted a review of the 2020 Steam Electric Reconsideration Rule.

Installed Power Capacity Of Large-Scale Battery Storage In U.S. Continued To Grow: EIA

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

Installed nameplate power capacity of U.S. large-scale battery storage reached 1,650 megawatts (MW) by the end of 2020, the U.S. Energy Information Administration (EIA) reported on July 26.

The 2020 figure represents a 35% (or 428 MW) increase compared with installed battery storage capacity at the end of 2019 (1,222 MW), EIA said in its Electricity Monthly Update.

EIA defines large-scale capacity as those systems with a nameplate capacity of 1 MW or greater. Although the first battery storage system reported to us as of December 2020 began operation in 2003, cumulative battery storage did not surpass 100 MW until 2012, it said.

The federal agency noted that significant battery storage growth began in 2015 when 153 MW of annual operational capacity were added, a 90% increase relative to 2014 levels. Following that growth, battery storage surpassed the 1 gigawatt (GW) mark in 2018.

“As currently reported to us, cumulative planned battery storage power capacity additions for 2021 through 2024 equal 10,904 MW (or 10.9 GW). If all of these projects come online and if no current operating capacity is retired, battery storage power capacity could exceed 12 GW by 2024,” EIA said.

EIA said that battery storage systems are being installed tor a number of reasons including:

- Balancing grid supply and demand

- Reserving energy for times of high demand (referred to as peak shaving)

- Storing energy from intermittent renewable sources, such as wind and solar, to dispatch at a later time

- Providing fast response ancillary services, such as frequency regulation

- Creating opportunities to take advantage of price arbitrage

According to EIA, the most recent increase in new storage capacity is mainly due to the installation of battery energy systems connected to solar projects.

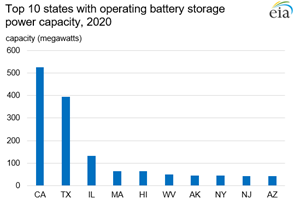

The federal agency reported that the 1,650 MW of operating battery storage power capacity at the end of 2020 were spread out across 33 states, although more than 70% were in 5 states: California, Texas, Illinois, Massachusetts, and Hawaii. Each of these states have over 50 MW of battery storage power capacity. California has the most with 506 MW of battery storage power capacity. Each of these five states have passed legislation in recent years, either to establish requirements for energy storage or to provide financial incentives for new projects, EIA noted.

The 10,904 MW of planned battery storage power capacity additions through the end of 2024 are spread out across 22 states, although over 70% were in 4 states: California, Texas, New York, and Arizona.

California has more than 4 GW of battery storage power capacity planned by 2024, Texas and New York are planning to install over 1 GW each, and Arizona plans to install just under 1 GW.

EIA said that the top 10 states for planned battery storage capacity additions (including Nevada, Florida, New Mexico, Hawaii, Colorado, and Massachusetts) account for 94% of planned additions, or 10.5 GW, by 2024.

EIA said that the concentration of new battery storage capacity additions in the top 10 states may be partly due to one or more of the following factors:

- A high renewable resource base where storage can partner with, or be situated near, projects to take advantage of that resource (for example, very windy or sunny locations)

- State policies that encourage renewable and battery systems

- The presence of local, real-time, capacity-constrained markets that may present economic opportunities for battery storage systems

EIA noted that it will soon publish an update to the report U.S. Battery Storage Market Trends. This report provides further information about battery storage projects including geographic representation, ownership, chemistry, applications, costs, and future trends.

The American Public Power Association’s Public Power Energy Storage Tracker is a resource for association members that summarizes energy storage projects undertaken by members that are currently online.

Infrastructure Bill Excludes Provisions Encouraging Sale Of Public Utilities

August 3, 2021

by Paul Ciampoli

APPA News Director

August 3, 2021

The Infrastructure Investment and Jobs Act includes a number of provisions of importance to public power utilities including in areas related to cybersecurity and electric vehicle infrastructure. At the same time, it does not incorporate provisions encouraging the sale of public utilities and other revenue generating assets as a way to fund additional infrastructure investments.

The Senate on Aug. 1 began debate on the legislative text, called the Infrastructure Investment and Jobs Act, of an infrastructure framework negotiated over the last several weeks between 22 Democratic and Republican senators.

An initial draft of the senators’ Bipartisan Infrastructure Framework had listed so-called asset recycling as an area of agreement, and opposition to this proposal was a top priority for the American Public Power Association (APPA). Joy Ditto, President and CEO of APPA, on July 14 wrote to President Joseph Biden in opposition to using infrastructure funding legislation to encourage the privatization of public facilities.

The text of the agreement does not incorporate provisions encouraging the sale of public utilities and other revenue generating assets as a way to fund additional infrastructure investments.

Details On Infrastructure Investment and Jobs Act

A section of the bill establishes a grant program at the Department of Transportation to provide grants to eligible entities, including public power, for the deployment of electric, hydrogen, propane, or natural gas vehicle infrastructure along designated Alternative Fuel Corridors. Entities are required to contract with a private entity for the acquisition and installation of fueling infrastructure and may use a portion of grant funds to pay a private entity to operate and maintain the infrastructure for up to five years and/or to enter into a cost-sharing agreement with the private entity.

Fifty percent of the overall funding is set aside for “Community Grants” for which public power would also be eligible. These grants do not require, but allow for, partnerships with private entities and can be used to deploy fueling infrastructure in public locations, including parking facilities, public buildings, public schools, and parks. This section is based on the Clean Corridors Act, which APPA supports.

Another section of the legislation would require the Secretary of Energy, in consultation with state regulatory authorities, industry, the Electric Reliability Organization, and other relevant federal agencies, to carry out a program to promote and advance the physical security and cybersecurity of electric utilities, with priority provided to utilities with fewer resources. This section of the bill also requires a report to Congress on improving the cybersecurity of electricity distribution systems.

APPA is supportive of this provision. It is modeled upon an existing, successful public-private partnership funded by DOE’s Office of Cybersecurity, Energy Security, and Emergency Response Cybersecurity for Energy Delivery Systems program between the department and APPA to bring greater resources, training, and tools for cyber and physical security to small- and medium-sized electric utilities.

The bill would also authorize $500 million for the period of fiscal years 2022 through 2026 for a state energy program for state, local, and Tribal governments to support transmission and distribution planning, including feasibility studies of line routes and alternatives, preparation of necessary project designs and permits, and outreach to affected stakeholders.

The legislation would also increase the borrowing authority made available to the Bonneville Power Administration under the Federal Columbia River Transmission System Act by an additional $10 billion.

In addition, the bill calls for the establishment of a new Treasury account for the purposes of making expenditures to increase bilateral transfers of renewable electric generation between the United States and Canada — $100 million is authorized to be appropriated to carry out the relevant subsection of the bill, which is specified as non-reimbursable.

The bill also directs a study of the potential hydroelectric power value to the Pacific Northwest of increasing the coordination of the operations of hydroelectric and water storage facilities on American and Canadian rivers.

Also, the bill would appropriate $500 million to the Western Area Power Administration for the purchase of power and transmission services.

APPA Weighs In On Interim Final Rule For Coronavirus Relief Funds

July 29, 2021

by Paul Ciampoli

APPA News Director

July 29, 2021

The American Public Power Association (APPA) recently weighed in on an interim final rule (IFR) for coronavirus state and local fiscal relief recovery funds in comments submitted to the U.S. Department of Treasury.

In its July 16 comments, APPA said it strongly supports Treasury’s decision in the IFR to allow coronavirus state and local fiscal relief recovery funds to be used for purposes similar to those of coronavirus relief funds previously authorized.

At the same time, APPA said it disagrees with Treasury’s decision to exclude electric power utilities from the definition of general revenue.

“Historically, public power utilities nationwide on average contribute 5.4 percent of their operating revenues back to the communities they serve. However, the inability of some customers to pay their utility bills due to the COVID-19 pandemic has significantly affected many public power utilities,” APPA said. Treating lost utility revenue as lost general revenue, would allow these communities to use coronavirus state and local fiscal relief recovery funds to offset these losses, the public power group said.

The IFR states that assistance, including utility assistance, to households or populations facing negative economic impacts due to COVID-19 is an eligible use of coronavirus state and local fiscal relief recovery funds. The IRF also allows such assistance to be predicated on the assumption that households or populations experiencing economic harm during the pandemic experienced that harm due to the pandemic, and thus qualify for assistance.

“APPA believes this flexibility is appropriate and will help reduce barriers to relief to those who need it most,” it said.

APPA also strongly supported Treasury’s guidance in the form of Frequently Asked Questions relating to the use of CRF funds Office of the Undersecretary for Domestic Finance and the prohibition of CRF to replace lost revenues.

Specifically, that guidance clarified the parameters under which CRF lost revenue prohibitions would not be violated by a utility payment assistance program benefiting customers of public power utilities. We believe that guidance continues to help communities draft programs of benefit to public power utility customers.

“However, as we understand the rules, households must still attest to their need before relief can be provided,” APPA said. “Because many households are being shielded from the effects of the pandemic by utility shutoff moratoria, there is growing evidence that these households are not seeking relief. In fact, while electric utility customer arrearages are soaring in many communities, we have heard anecdotally that the number of applications for Low Income Home Energy Assistance Program benefits are down.”

Allowing programs supported by coronavirus state and local fiscal relief recovery funds to provide relief directly to customers in arrears without such an attestation would get around this hurdle, APPA said.

Meanwhile, APPA noted in its comments that the statute allows the use of coronavirus state and local fiscal relief recovery funds for the provision of government services to the extent of reduction in revenues.

“As we read the IRF, that includes the provision of electric utility services. However, the IRF specifically excludes utility revenues from the definition of lost general revenue,” APPA said.

As a result, the “pool” of coronavirus state and local fiscal relief recovery funds that could be spent as “lost revenue” funds will be smaller than the actual amount of lost revenue. “While we understand the need for a simple clear methodology for defining this term, it simply does not reflect reality for communities that own or operate their own electric utility. More importantly, it puts at a disadvantage those communities that have suffered significant electric utility arrearages due to the pandemic.”

APPA conducts annually a survey of its members, including an in-depth study of their finances. Consistently these surveys show public power utilities contributing to their communities. For example, the 2020 survey on 2018 financials, showed that, on average nationwide, public power utilities contributed roughly 5.4 percent of operating revenues back to their communities.

However, in February 2021, APPA surveyed its members about the dollar amount of residential arrearages for their electric power utility for January 2020 and then January 2021. Overall, surveyed utilities reported arrearages totaling $375 million as of January 2020 and arrearages totaling $778 million as of January 2021. This is a net increase of $402 million. Measured against residential revenue, arrearages as of January 2021 totaled 5.1 percent of residential income.

Responses to the survey were also quite varied. “Some communities have done relatively well during the pandemic, and so customer payment of bills has not fallen – in fact, in a handful of communities, arrearages have declined. In most communities, however, there has been an increase in arrearages as a result, and in roughly one third of communities, these increases have been quite substantial (with the definition of ‘substantial’ being admittedly subjective),” APPA said.

Many of those communities seeing the highest arrearages are in areas hit particularly hard by the pandemic and where the community has chosen to suspend utility shutoffs or are required to suspend shutoffs by the state.

While coronavirus state and local fiscal relief recovery funds can be used for utility assistance payment relief, that is only helpful if customers are seeking relief and willing to attest to their need for relief, the public power trade group pointed out.

Allowing utility lost revenue to be treated as lost general revenue would ensure that the pool of coronavirus state and local fiscal relief recovery funds that could be spent as “lost revenue” funds is closer to the actual amount of lost revenue. In turn, that would allow public power utilities to seek the use of coronavirus state and local fiscal relief recovery funds for use “for the provision of government services,” APPA said.

“If allowed, our members have indicated that they would most likely seek to use these funds to establish customer assistance programs in which they credit customer accounts for arrearages. Again, as a replacement of lost revenues, this relief could be provided without the heavy hand of the threat of a utility shut off.“

Bipartisan Bills In Congress Allow For Energy Tax Credit Transfer To Public Power Owners

July 29, 2021

by Paul Ciampoli

APPA News Director

July 29, 2021

Bipartisan legislation in Congress calls for a technology-inclusive, flexible investment tax credit (ITC) or production tax credit (PTC) designed to promote innovation across a range of clean energy technologies, including generation, storage, carbon capture, and hydrogen production. The American Public Power Association (APPA) supports the legislation.

The Energy Sector Innovation Credit Act was reintroduced on July 27 by Senate Finance Committee Ranking Member Mike Crapo (R-ID) and Finance Committee member Sheldon Whitehouse (D-RI), along with House Ways and Means Committee members Tom Reed (R-NY) and Jimmy Panetta (D-CA).

The legislation would allow qualifying facility owners to transfer any credits that accrue to project partners, including someone who has an ownership interest in the property, provided equipment for or services in the construction of the property, provides electric transmission or distribution services for such property, purchases electricity from the property pursuant to a contract, or provides financing for the property.

While APPA is primarily pursuing the direct payment of energy tax credits, Crapo and Reed have been leaders in the efforts to obtain comparable incentives for public power and APPA is supportive of their efforts.

In a letter to Crapo and Reed, APPA President and CEO Joy Ditto noted that allowing the transfer of energy-related tax credits to other project partners “would be an important step to removing the financial disincentive for public power utilities to own such facilities, which are needed to transition to cleaner generating technologies.”

Along with APPA, the legislation is supported by a number of other groups and entities including Utah Associated Municipal Power Systems (UAMPS).

Established in 1980, UAMPS is an energy services interlocal agency of the state of Utah. As a project-based consortium, UAMPS provides a variety of power supply, transmission and other services to its 47 members, which include public power utilities in six western states: Utah, California, Idaho, Nevada, New Mexico, and Wyoming.

Schuetz Selected As Energy Northwest’s New CEO

July 29, 2021

by Paul Ciampoli

APPA News Director

July 29, 2021

Richland, Wash.-based Energy Northwest’s Executive Board on July 29 named Robert Schuetz as the agency’s CEO, effective Aug. 7.

Schuetz joined Energy Northwest in 2013. He was promoted to plant general manager for the Columbia Generating Station in 2014 and became site vice president in 2018.

Before joining Energy Northwest, he served as a plant evaluation team leader for the Institute of Nuclear Power Operations (INPO), concluding his INPO tenure on a reverse-loan assignment to Energy Northwest.

Hettel To Continue as chief nuclear officer

Grover Hettel will remain Energy Northwest’s chief nuclear officer with responsibility for the overall performance of the Northwest region’s only nuclear power plant, Columbia Generating Station, which provides approximately 10% of Washington State’s electricity.

During the last decade, Energy Northwest’s Columbia Generating Station set numerous generation records and received industry recognition for performance. The agency has earned multiple safety awards, reduced costs and was named as a utility partner for two Department of Energy’s Advanced Reactor Demonstration Program awards.